views

Union Budget 2021 announced setting up a new ‘bad bank‘ to manage one of the world’s largest piles of stressed loans that may actually end up inflating prices.

According to a report by Bloomberg, experts say they’ll be closely watching whether it could wind up inflating the price of distressed assets. That could happen if the creation of the bad bank reduces pressure on loan owners to price such debt at discounts attractive enough to draw other buyers, the argument goes.

The report further adds that if the firm is owned by lenders including ones that originated soured assets bought at lower prices, that could force those banks to mark down the value of the securities they receive in exchange.

While the plan provides a new path to resolve soured loans, key issues including the capitalisation of the bank, its ownership structure, and the limited secondary market for stressed assets still need to be addressed, Nitesh Jain, a director at CRISIL Ratings, the local arm of S&P Global Ratings, told Bloomberg.

Also read: Union Budget 2021 Announces Bad Bank to Purge Balance Sheets and NPA Worry

Any such issues with the transparency of bad loan pricing could crimp interest in Indian distressed credit that’s been growing in recent years and drawing investors from Oaktree to Apollo.

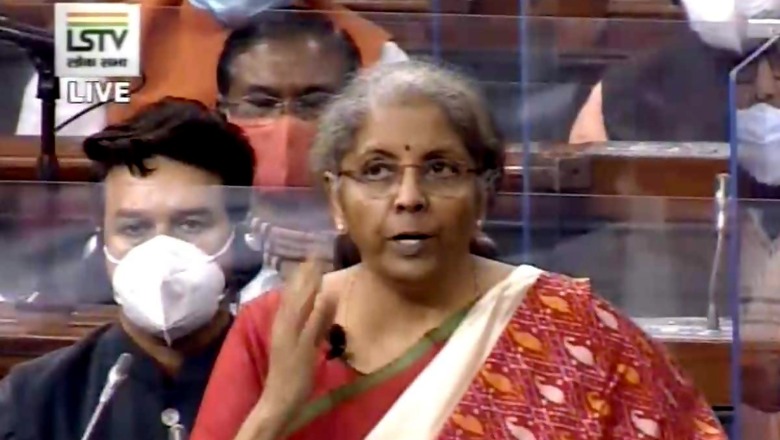

The organization will be set up through an Asset Reconstruction Company (ARC) model, Finance Minister Nirmala Sitharaman had said in her Budget speech on Monday.

It will be a major boost for bad asset resolution in the financial system and has been in discussions for long. Banks can transfer bad assets to this entity at a discount. Experts will then attempt for a resolution through a professional approach, while originating banks can focus on new business.

Also read: What is ‘Bad Bank’ And Why Centre May Use it as Policy Option in Budget 2021 to Revive Banking Sector

The idea of a bad bank itself is not new. In 2018, the government announced a plan for PSBs called ‘Project Sashakt’, which had a five-point plan for bad loan resolution in public sector banks. The government then spoke of a model, with the guiding principles of an Asset Management Company (AMC) resolution approach, under which an independent AMC would be set up to focus on asset turnaround, job creation and protection. The functions of this new company will be aligned with the Insolvency and Bankruptcy Code (IBC) process and IBC laws, the government had said.

The existing stock of bad loans is a big worry for banks. At the end of September 2020 year, the total gross NPAs of the banking system was 7.5 percent of the overall industry loan book. This is expected to shoot up to 13.5 percent by March-September this year, according to the Reserve Bank of India’s (RBI) projection.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment