views

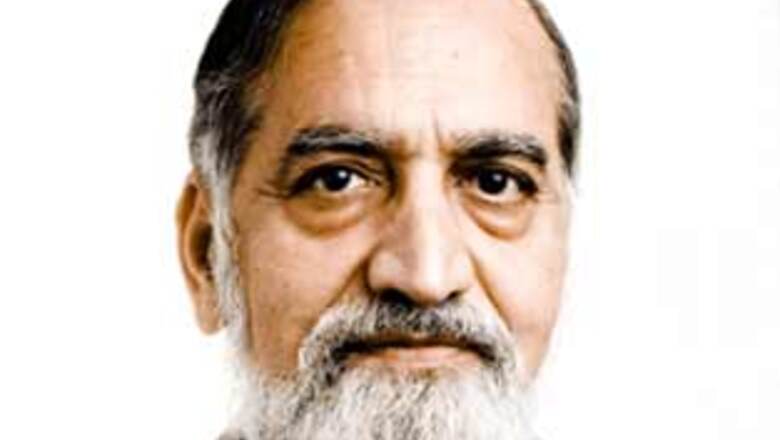

Kiran Karnik was called to head Satyam in its most difficult time after the big scandal. Having led the company out of the crisis, Karnik is ready to take a bow and leave. Forbes India asks him about the very unusual stint

Name: Kiran Karnik

Age: 62

Last Stint: Satyam’s chairman during the crisis.

Career: Worked at Indian Space Research Organisation. Was MD at Discovery Networks before becoming Nasscom president in 2001.

Education: A post-graduate from IIM-Ahmedabad; also holds an Honours degree in Physics from Bombay University.

Interests: Education, reading.

What was the most difficult moment?

We visited the company for the first time on January 12, 2009 and we were absolutely shocked to find out there was no money to pay the salaries. Satyam’s US employees had to be paid on January 15. We knew that if we didn’t pay salaries on time, then it would be the worst thing for the company. Employees would leave and so would customers.

Was there ever a moment when you thought that Satyam won’t survive?

At no stage did I think that Satyam would not recover. Once the government had appointed the board, I and other board members were full of hope and optimism. All of us felt that we had to ensure the company’s survival. One of the reasons was that the government had taken an unprecedented step. In normal course, after an accounting scandal, the company usually implodes. In this case, the government had acted quickly and we had got it right because the world was watching. I have always believed that Indians are a resilient lot. We wanted to show exactly this with Satyam.

How hard was it selling to customers when you hardly had any good news to share with them?

Not hardly — there was no good news at all! Customers stayed because of two reasons. The first reason was Satyam’s superb quality of service. I figured this out in the first few days.

The second reason was that we ourselves offered a transition plan to all the customers who were iffy. This we did after the government board came in. To all customers who were jittery we said, ‘Look, we are willing to work on a transition plan of transferring your business to one of Satyam’s peers but we must decide on parameters that will trigger a transition.’ We took attrition and service levels as a trigger points. If the attrition increased from X to Y and if service levels fell from B to A then we would extend all possible help to the customer to transition the business.

The Satyam affair has called into question the role of independent directors and auditors. Is there any solution?

In this case, independent directors have been blamed and yes, may be they should have been more sceptical, especially for the Maytas deal. I doubt, though, whether they could have done more. Auditors are another thing. I think PricewaterhouseCoopers messed up big time. Taking the bank statement certificate from the company rather than the bank is Audit 101 error. After Enron, Arthur Anderson ceased to exist. At least, PwC should take a bigger ownership of their role in this issue.

What next for you? Public office?

No. I am going to take a bit more time out for myself. I am finally catching up on some reading. I am reading Umberto Eco’s Mystery Flame of Queen Loana and I really like it. But after some time, I would be working with some NGOs in the education sector, a cause that is dear to my heart.

Comments

0 comment