views

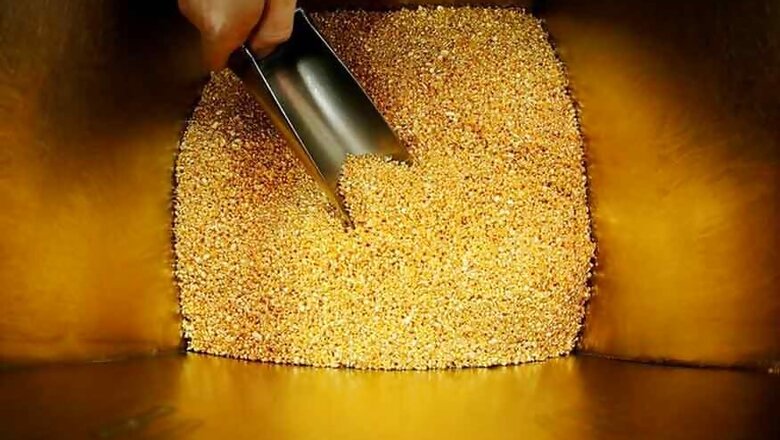

New York: Gold touched a more than eight-month high on Tuesday as the dollar eased before a U.S. Federal Reserve meeting, with investors cautious about an escalation in US-China trade tensions.

Spot gold was up 0.4 percent to $1,309.11 per ounce as of 1306 GMT, having hit its highest since May 15 at $1,310 in the session.

US gold futures were up 0.4 percent at $1,308.70 per ounce.

"There's plenty of reason to still look at gold as a means to have some protection" given expectations that other markets will continue to struggle, especially stocks, and with the dollar a tad weaker, Saxo Bank analyst Ole Hansen said.

"The momentum in gold has been established now. We just need to work out how strongly the momentum has been backed by speculative interest."

The United States on Monday charged Chinese telecommunications equipment maker Huawei, its chief financial officer and two affiliates with bank and wire fraud in a case that has escalated tensions with Beijing.

Investors fear the charges could complicate high-level U.S.-China trade talks set to begin on Wednesday.

The dollar index, a gauge of the US currency's value versus six major peers, held close to a two-week low.

Meanwhile, the Fed's two-day policy meeting begins later in the day. The US central bank is expected to leave interest rates unchanged.

Some officials have said the Fed will be patient in raising rates given the stalemate over global trade, the federal government shutdown, and waning business and consumer confidence.

Gold tends to rise on expectations of lower interest rates, which reduce the opportunity cost of holding non-yielding bullion.

The metal has risen over 12 percent from a more than 1-1/2-year low touched in August mostly due to volatile stock markets and a softer dollar.

"From a technical point of view, its price is now entering in a 'new area', with the return in the $1,300-1,350 range, which was the lateral range where we have seen gold moving in the first semester of 2018," ActivTrades chief analyst Carlo Alberto De Casa said in a note.

Holdings of SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, rose 0.73 percent to 815.64 tonnes on Monday, their highest since June 2018.

Silver rose 0.7 percent to $15.85 per ounce, having hit its highest since July 2018 at $15.9.

Comments

0 comment