views

54th GST Council Meeting 2024: The GST Council in its latest meeting on Monday reviewed the GST rates for online gaming, casinos, and race courses. However, no decision was taken to alter the rates.

The GST Council reviewed GST rates on online gaming, casinos and race courses. The council has decided to maintain the status quo, according to a report by CNBC-TV18.

From October 1, 2023, entry-level bets placed on online gaming platforms and casinos were subject to 28% GST.

Before that, many online gaming companies were not paying 28% GST, arguing that there were differential tax rates for games of skill and games of chance.

The GST Council in its meeting in August 2023 had clarified that online gaming platforms were required to pay 28% tax and subsequently, Central GST law was amended to make the taxation provision clear.

Offshore gaming platforms were also mandated to register with GST authorities and pay taxes, failing which the government would block those sites.

The council had then decided that the taxation on the online gaming sector would be reviewed after six months of its implementation.

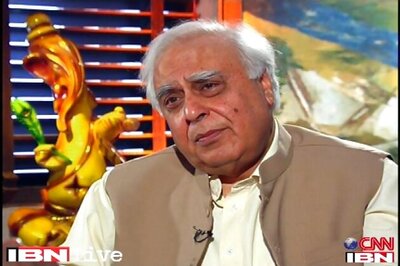

The GST Council, chaired by Finance Minister Nirmala Sitharaman, met on September 9 and was attended by several state finance ministers and senior officials.

Comments

0 comment