views

Your condition is recognized as a disability.

To qualify for SSI or SSDI, your condition must meet disability criteria. Social Security doesn't label every health condition as disabling. The government states that if you can perform Substantial Gainful Activity (SGA), you’re ineligible for benefits. However, if you have a listed condition that hinders your everyday life, you’ll likely get approved. Check if your condition is listed as an approved disability in the SSA’s Blue Book.

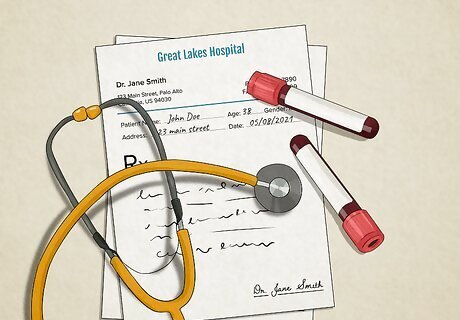

You presented adequate medical evidence.

Disability applications must include convincing health history. Even if you have an approved medical condition, you must prove that your condition affects your everyday life and ability to work. For each diagnosis, provide sufficient medical evidence of your symptoms and care to improve your chances of approval. Attach the following items to your claim as evidence: Medical report Diagnostic reports X-rays, CT scans, and MRIs Description of treatments Prescription drug receipts Ask your doctor to write a letter listing your conditions, confirming your medical diagnosis and report, and explaining your symptoms to boost your credibility. The state may schedule an interview, appointment, or examination to help determine your eligibility.

You proved you haven’t worked for at least 12 months.

The SSA requires applicants to prove they haven’t worked for a year. For your disability application to be approved, you must show that you’re unemployed because of your medical condition. Ask a past employer or your doctor(s) to write a letter about your inability to work. As part of your assessment, the SSA will look at your Residual Functional Capacity (RFC), which tests your ability to physically and mentally work with your medical condition. If you cannot perform basic tasks, such as walking, standing, or lifting, you have a greater chance of getting approved. As a general rule, the more work tasks you can complete, the less likely you are to be approved. Keep in mind that to qualify for benefits, your disability needs to last longer than 12 months; otherwise, you’ll need to apply for partial or short-term disability (which has no payable benefits).

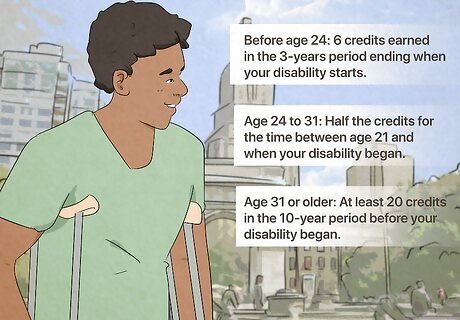

You meet the work credit requirements.

To qualify for disability, you need 6 to 20 work credits. If your previous job paid Social Security taxes, you’ve earned work credits. You can earn up to 4 credits per year, depending on your total wages. In 2023, you earn 1 Social Security credit for every $1,640 and must earn $6,560 a year to get 4 credits. The number of credits needed for disability benefits depends on your age: Before age 24: 6 credits earned in the 3-years period ending when your disability starts. Age 24 to 31: Half the credits for the time between age 21 and when your disability began. For example, if you are disabled at 27, you need 3 years of work (12 credits) from the past 6 years (between ages 21 and 27). Age 31 or older: At least 20 credits in the 10-year period before your disability began.

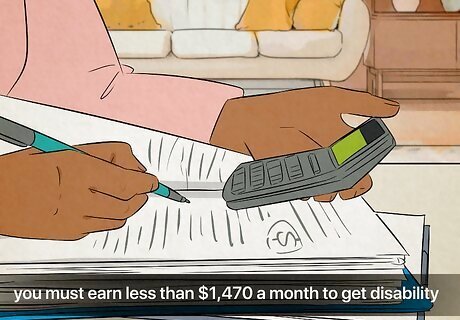

You earn less than the monthly SGA.

In 2023, you must earn less than $1,470 a month to get disability. The SGA or Substantial Gainful Activity determines how much work you’re able to do. If you make more than the monthly amount, your likelihood of getting approved drops. If you make below the amount, your chances increase. This amount only applies to non-blind disabled applications. If you’re blind, the SGA does not apply for SSI benefits.

You’re 50 years old or older.

The SSA believes that older individuals are entitled to benefits. Social Security follows “grid rules,” which implies that the older someone gets, the less likely they can work. If you’re 50 or older, these rules work in your favor because your disability application may be flagged for approval. Keep in mind that being 50 years old or older isn’t an automatic “yes” for disability. Other factors, such as your medical report, still play an important role—age simply increases your chances.

Comments

0 comment