views

Beginning the Agreement

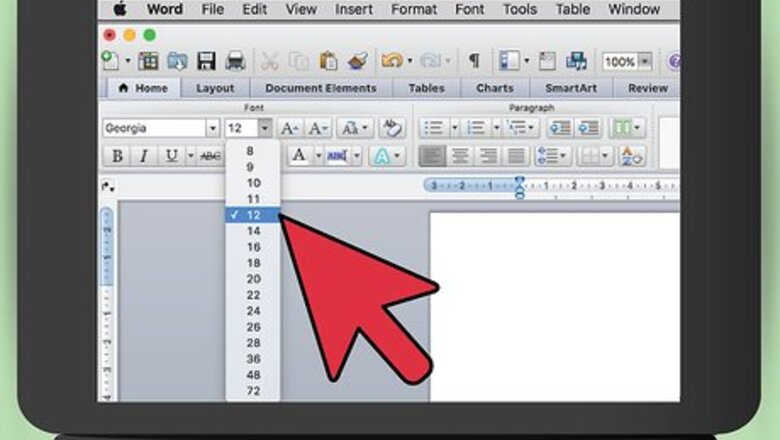

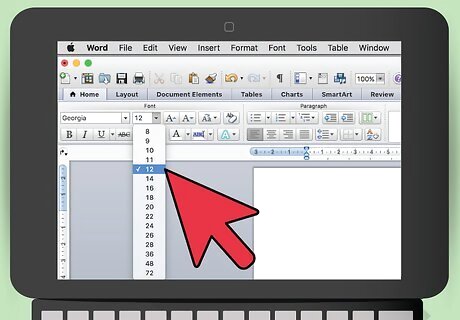

Format your document. Open a blank word processing document. You should set the font size and style to something most people can read. Times New Roman 12 point works for most people, but feel free to choose anything legible. You might be making multiple stock sales to many different buyers. If so, you can set up your document as a template. Include blank lines for any information that might change between sales, such as the name of the buyer and the purchase price.

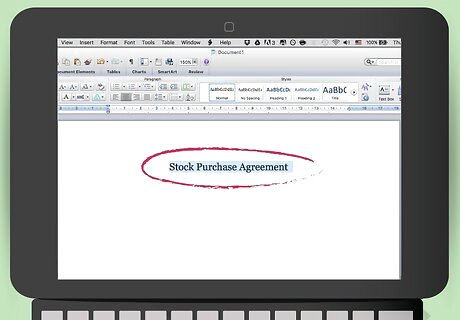

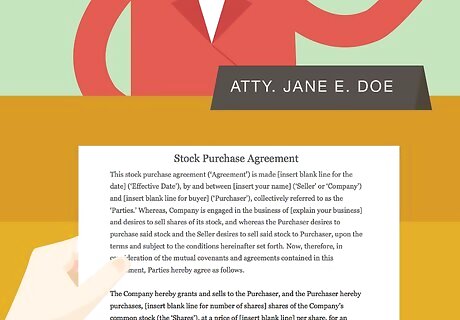

Add a title at the top. You should identify the document by inserting “Stock Purchase Agreement” at the top of the page. Center the title between the left- and right-hand margins. You can make the title stand out by putting it in all caps.

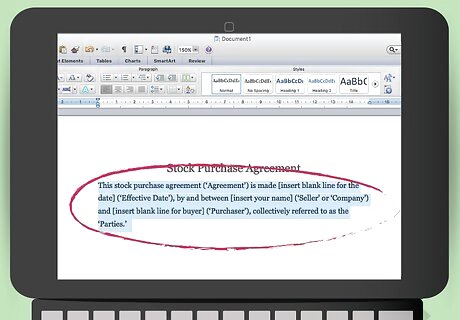

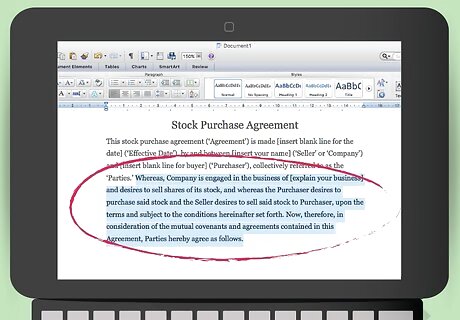

Identify the parties. In your first paragraph, you need to identify yourself as the seller and the identity of the buyer. Also be sure to include the date. Sample language could read, “This stock purchase agreement (‘Agreement’) is made [insert blank line for the date] (‘Effective Date’), by and between [insert your name] (‘Seller’ or ‘Company’) and [insert blank line for buyer] (‘Purchaser’), collectively referred to as the ‘Parties.’”

Include your recitals. Recitals summarize why each party entered into the agreement. Accordingly, they can help clarify the purpose of the purchase agreement in case any dispute arises later. Recitals often begin with “whereas” and may be sentence fragments. When a company is selling its own stock to a buyer, then the recitals might read: “Whereas, Company is engaged in the business of [explain your business] and desires to sell shares of its stock, and whereas the Purchaser desires to purchase said stock and the Seller desires to sell said stock to Purchaser, upon the terms and subject to the conditions hereinafter set forth. Now, therefore, in consideration of the mutual covenants and agreements contained in this Agreement, Parties hereby agree as follows.”

Explaining the Terms of the Sale

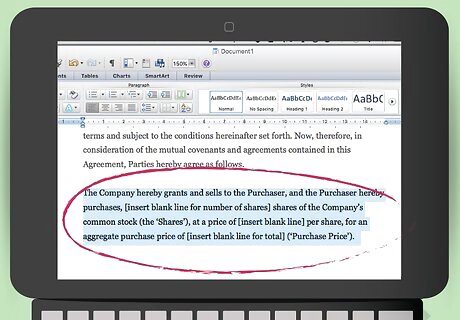

Grant shares to the purchaser. You should start off the purchase agreement by stating that you are granting shares to the purchaser. You can also list the price per share as well as the aggregate amount paid for the total amount of shares. Sample language could read: “The Company hereby grants and sells to the Purchaser, and the Purchaser hereby purchases, [insert blank line for number of shares] shares of the Company’s common stock (the ‘Shares’), at a price of [insert blank line] per share, for an aggregate purchase price of [insert blank line for total] (‘Purchase Price’).”

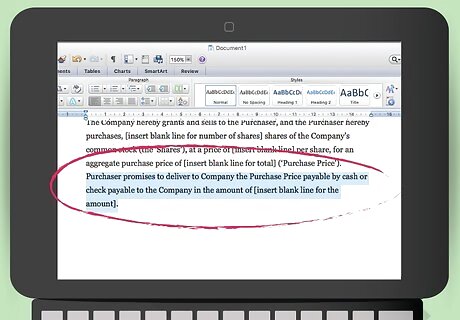

Require the purchaser to deliver payment. You should next include a specific provision where the buyer agrees to deliver the purchase price. You may also want the purchaser to sign other documents, such as a spouse consent form. You should talk with a lawyer about what documents you want signed. Sample language could read: “Purchaser promises to deliver to Company the Purchase Price payable by cash or check payable to the Company in the amount of [insert blank line for the amount].”

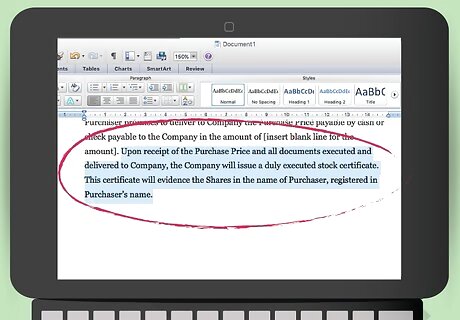

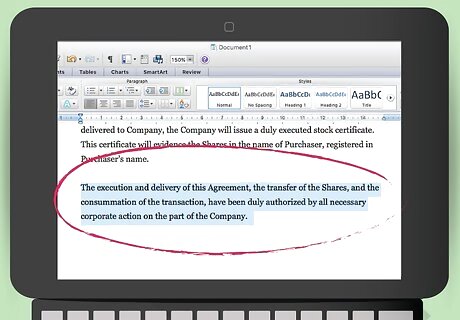

Explain the delivery of the shares to the purchaser. As the seller, you also have a duty to deliver the shares to the buyer. You should include a provision to this effect in your stock purchase agreement. For example, you could write: “Upon receipt of the Purchase Price and all documents executed and delivered to Company, the Company will issue a duly executed stock certificate. This certificate will evidence the Shares in the name of Purchaser, registered in Purchaser’s name.”

Including Warranties

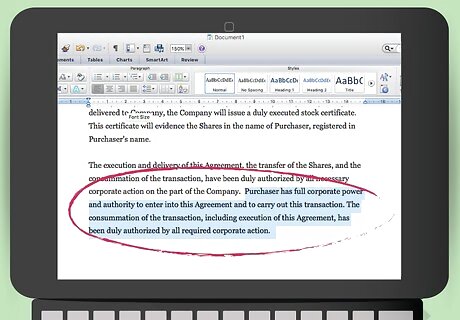

Warrant that you are authorized to sell the shares. A warranty is a statement of fact that you guarantee at the time of contracting. If the fact turns out to be false, then the purchaser could sue you. One warranty you should make is that you are authorized to sell the shares of stock. Sample language could read: “The execution and delivery of this Agreement, the transfer of the Shares, and the consummation of the transaction, have been duly authorized by all necessary corporate action on the part of the Company.”

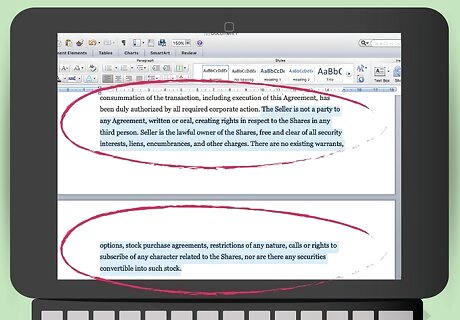

Have the buyer warrant that they are authorized to buy the shares. Just as the seller warrants that they can sell the shares, the buyer should also warrant that they can purchase the shares. A sample provision might read: “Purchaser has full corporate power and authority to enter into this Agreement and to carry out this transaction. The consummation of the transaction, including execution of this Agreement, has been duly authorized by all required corporate action.”

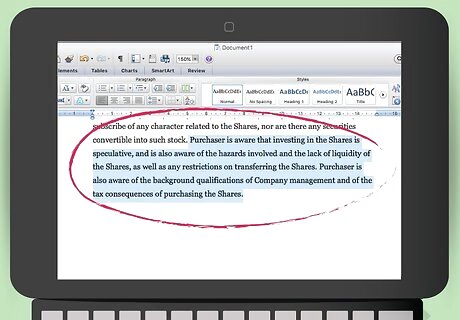

Warrant that the stock is free of all liens. The buyer will probably want assurances that it is getting good title to the stock and that there aren’t any liens clouding title. You can include a provision stating that the stock is free and clear. For example, you might write, “The Seller is not a party to any Agreement, written or oral, creating rights in respect to the Shares in any third person. Seller is the lawful owner of the Shares, free and clear of all security interests, liens, encumbrances, and other charges. There are no existing warrants, options, stock purchase agreements, restrictions of any nature, calls or rights to subscribe of any character related to the Shares, nor are there any securities convertible into such stock.”

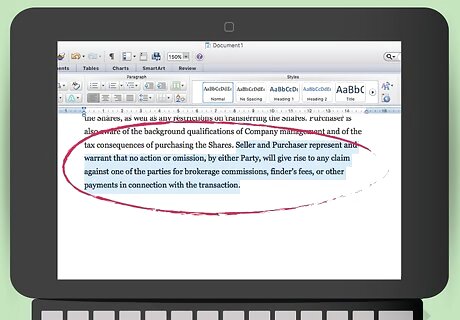

Include a provision about investment risk. You can also protect yourself by getting the buyer to warrant that they understand the risks involved with investing. A sample provision could state: “Purchaser is aware that investing in the Shares is speculative, and is also aware of the hazards involved and the lack of liquidity of the Shares, as well as any restrictions on transferring the Shares. Purchaser is also aware of the background qualifications of Company management and of the tax consequences of purchasing the Shares.”

Warrant that the transaction will not expose the parties to a lawsuit. You can include a provision where both buyer and seller warrant that they have not done anything that would give rise to a legal claim against either, e.g., claims for a brokerage commission or finder’s fee. You could write, “Seller and Purchaser represent and warrant that no action or omission, by either Party, will give rise to any claim against one of the parties for brokerage commissions, finder’s fees, or other payments in connection with the transaction.”

Finalizing the Document

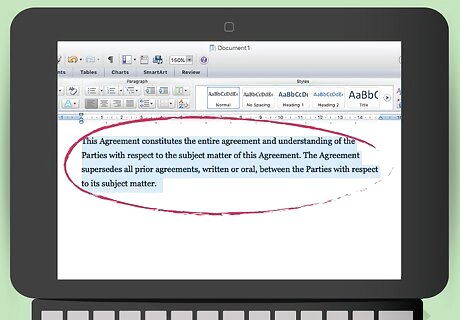

Include a merger clause. With this clause, you state that the written stock purchase agreement contains all promises made between you and the buyer. This clause helps prevent one party from claiming that there were prior oral agreements that should trump the written purchase agreement. You could write, “This Agreement constitutes the entire agreement and understanding of the Parties with respect to the subject matter of this Agreement. The Agreement supersedes all prior agreements, written or oral, between the Parties with respect to its subject matter.”

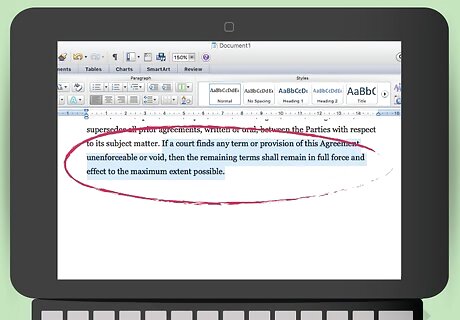

Add a severability clause. A judge might find that some provision of your stock purchase agreement is illegal. If so, then the judge might void the entire contract. To prevent it from being voided, add a severability clause. A severability clause might read: “If a court finds any term or provision of this Agreement unenforceable or void, then the remaining terms shall remain in full force and effect to the maximum extent possible.”

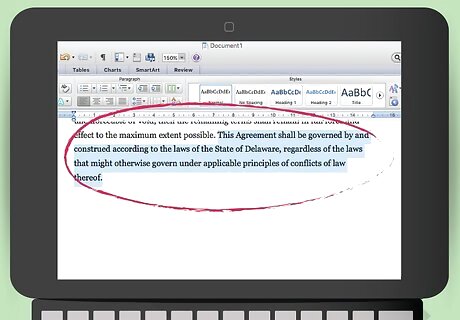

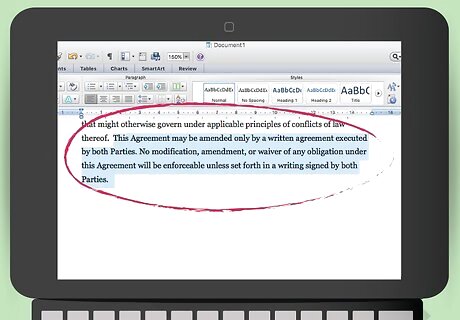

Identify the governing law of the agreement. If there is a dispute, then a judge needs to apply some state’s law to the dispute. You can pick which state law to apply. Generally, companies choose the law of the state where they are incorporated. Your clause might read: “This Agreement shall be governed by and construed according to the laws of the State of Delaware, regardless of the laws that might otherwise govern under applicable principles of conflicts of law thereof.”

Require that all amendments be in writing. You might find that you need to change the agreement. If so, then require that the changes be written and signed by both parties. Like the merger clause, this clause prevents the buyer from claiming you made an oral side agreement to change the written stock purchase agreement. A sample provision might read, “This Agreement may be amended only by a written agreement executed by both Parties. No modification, amendment, or waiver of any obligation under this Agreement will be enforceable unless set forth in a writing signed by both Parties.”

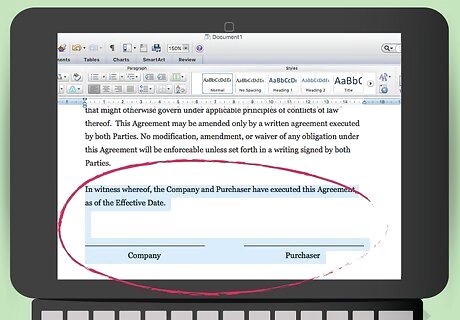

Insert signature blocks. You should include signature lines for the buyer and the seller. Just above the lines, include the following: “In witness whereof, the Company and Purchaser have executed this Agreement, as of the Effective Date.” If you included any exhibits, then list them below the signature blocks.

Show the draft to a lawyer. This article describes a basic stock purchase agreement. Your needs may vary. In order to check if anything is missing, you should meet with a lawyer. A more expansive stock purchase agreement could include the following, which you would want to discuss with the lawyer: restrictions on transferring the stock right to repurchase the stock back from the buyer provisions if you are selling physical assets along with the stock

Comments

0 comment