views

Requesting Forms from a Current or Past Employer

Call the payroll department of your current or former employer. This is the easiest way to get an old W-2 form. Employers are required to save important tax information such as your current and prior-year W-2s. Employers are required to provide employees with a W-2 for the current tax season by January 31. If you have not received your W-2 by this date, or if you have lost or misplaced it, you can contact your employer.

Call your company’s payroll provider. If your employer contracts out payroll duties, ask your boss for the phone number of the company that handles your company’s payroll. You can call this provider and request to have your W-2 mailed to you. Be prepared to provide your Social Security number or employee number. Make sure to specify the year of the W-2 form that you want to have sent to you. Make sure the provider has your correct address on file. While you are speaking to the payroll provider, you may also want to ask how long it will take for your W-2 to arrive.

Call your tax preparer. Another way to get a copy of an old W-2 is to contact your tax preparer (if you have one). Be prepared to provide your Social Security number. Make sure to specify the year of the W-2 form that you want to have sent to you. Make sure the tax preparer has your correct address on file. While you are speaking to the tax preparer, you may also want to ask how long it will take for your W-2 to arrive.

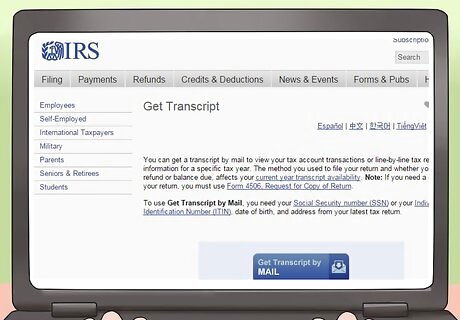

Requesting Information from the IRS

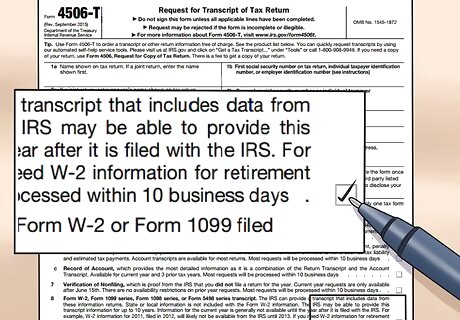

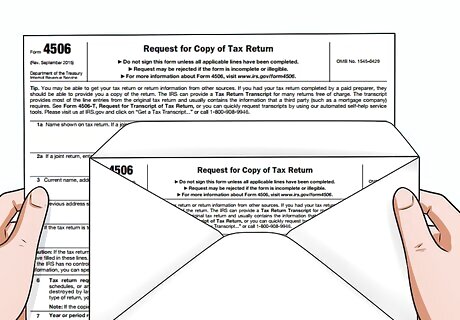

Request a copy of your W-2 from the IRS. If you cannot obtain your W-2 from your employer or their payroll provider, you can order a copy from the IRS by using the IRS’s “Get Transcript” tool, form 4506 “Request for Copy of Tax Return,” or form 4506-T “Request for Transcript of Tax Return.” Use the IRS’s “Get Transcript” tool if you only need the information contained in the W-2 and the W-2 you need is less than 10 years old. This service is free of charge. Use form 4506 if you need your W-2 form and you need other information from that year’s completed taxes. However, you will only receive a copy of your actual W-2 if you paper-filed your taxes that year and submitted a copy of your W-2 at filing. Each copy that you request costs $50.00 with this option. Use form 4506-T if you only need the information that was on the W-2 and not the actual completed W-2. This option is free of charge. For additional assistance, call the IRS at 1-800-908-0046.

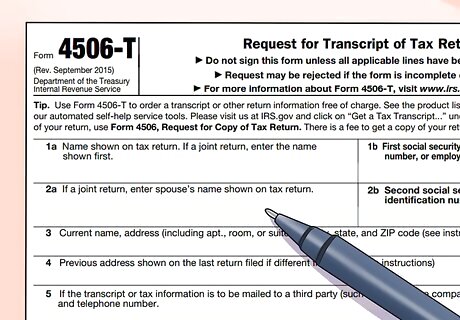

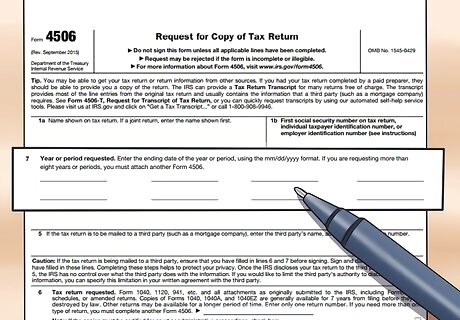

Complete boxes 1-5 of the 4506 or 4506-T. If you have chosen to fill out a 4506 or 4506-T, lines 1-5 of forms are the same, so the following guidelines apply to both. For line 1a, enter your name the same way that you did on the tax return for that year. If you filed a joint return, enter the name that was listed first on the return. For line 1b, enter the Social Security number of the person named in line 1a. If the first filer on the tax return used an individual taxpayer identification number (ITIN) or an employer identification number (EIN), enter that number. Only fill in lines 2a and 2b if you filed a joint return for the year you are requesting. For lines 2a and 2b, enter the second name and Social Security (or other tax ID) number listed on the tax return for that year. For line 3, enter your current name and mailing address. Make sure to include the city, state, ZIP code, and country (if you are living outside of the US). For line 4, enter the address that was listed on the tax return for the year you are requesting only if it is different than the address listed on line 3. Only complete line 5 if you want the tax return copy or transcript sent to someone other than you. If you do, you will need to enter the name, address, and telephone number (with area code) of the person or business to whom you want it sent. Be aware that the IRS has no control over how this third party will use your information. You may want to consider having a written agreement regarding use and disclosure of your information with this person or entity.

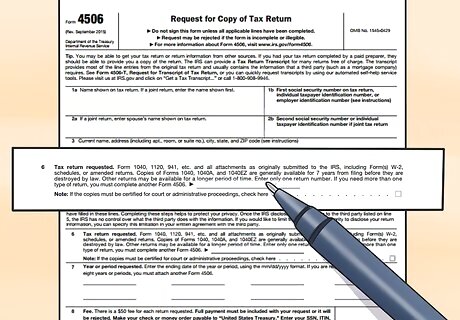

Complete line 6 of your 4506 or 4506-T. Whether you are using 4506 or 4506-T, you will need to enter the form you filed for your taxes in the year requested (most commonly 1040, 1040A, or 1040EZ) on line 6. Form 4506 has a small box in the corner of line 6 that you can check if you will be using these copies in court, administrative hearings, or for some other reason that requires the copies to be certified. Check the box at the bottom right of line 6 if you need your tax return copy to be certified. Keep in mind that you do not have the option to certify your transcript if you use form 4506-T. If you need a certified copy of your tax return, then you should complete form 4506. For form 4506-T, you can select the type of return transcript that you are requesting by selecting one of the options below line 6. Read through the options to see which one best suits your needs.

Complete line 7 of the 4506. Enter the year or period you are requesting on line 7. This must be in MM/DD/YYYY format (example 04/15/2013 for April 15, 2013). You can request up to 8 W-2 forms on each form 4506. If you need to request more, you must attach another Form 4506. Keep in mind that each copy that you request costs $50.00.

Check the box next to line 8 if you are completing the 4506-T. By checking this box, you are indicating that you want a transcript of the information included in the W-2s. This information will be included with the tax return transcript you are requesting. Keep in mind that these transcripts are only summaries of the earnings information, not actual copies of your W-2s.

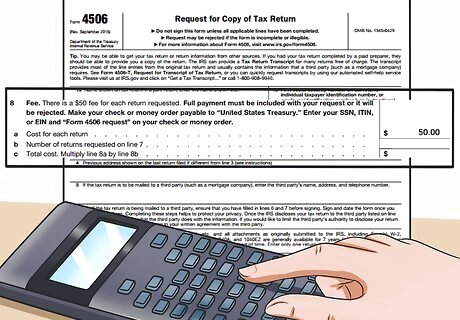

Calculate the fee in line 8 for form 4506. Enter the number of returns you are ordering in line 8b. Multiply line 8b by 50, and enter the result in line 8c. This is the total cost of ordering copies of your tax returns with all attachments, including W-2s.

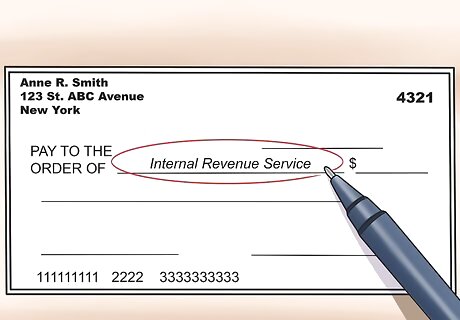

Prepare a check or money order for your form 4506. Make the check payable to the Internal Revenue Service for the amount you entered on line 8c. The IRS will refund your money if they cannot locate your return. Check the box on line 9 if you want that refund to be sent to the other person or entity you entered in line 5.

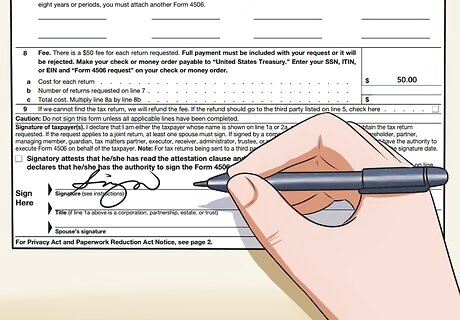

Sign and date your form 4506 or 4506-T. You should sign the form using the name or names in lines 1 and 2. If line 1a is an entity instead of an individual, you must enter your title in the line below your signature. If this is a joint return, you must get your spouse’s signature. Make sure that you provide a phone number so that the IRS can reach you if necessary.

Copy and mail your form. Make a copy of the application and check for your records. Mail the original application and check to the IRS at the address indicated for your state. This address is listed in the instructions that are attached to the form. Keep in mind that it can take two months or longer to process your request. If you have not received a response and it has been more than 2 months, you can call the IRS at 1-800-908-0046.

Filing Taxes Without a W-2

Estimate the wages you earned. In order to file your tax return without your W-2, you will need to provide an estimate of the income and taxes that would be listed on your W-2. You can do this by reviewing the year-to-date amounts on your final paycheck.

Contact the IRS if it is past February 14th and you need your W-2s to file taxes for the current year. If you are attempting to obtain your current tax year W-2 in order to file your current tax returns, and it is past February 14, call 800-829-1040 for assistance. Make sure that you are prepares to provide the following information before you call: name address Social Security number phone number employer’s name employer’s address employer’s phone number dates of employment estimated earnings for the year of the W-2 you are requesting

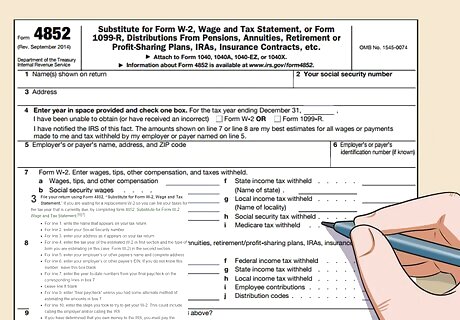

File your return using Form 4852, “Substitute for Form W-2, Wage and Tax Statement.” If you are waiting for a replacement W-2 so you can file your taxes for the tax year that is currently due, by completing form 4852, Substitute for Form W-2, Wage and Tax Statement. For line 1, write the name that appears on your tax return. For line 2, enter your Social Security number. For line 3, enter your address as it appears on your tax return. For line 4, enter the tax year of the estimated W-2 in first section and the type of form you are estimating (in this case, Form W-2) in the second section. For line 5, enter your employer’s or other payee’s name and complete address. For line 6, enter your employer’s or other payee’s EIN. If you do not know this number, leave this box blank. For line 7, enter the year-to-date numbers from your final paycheck on the corresponding lines in box 7. Leave line 8 blank. For line 9, enter “final paycheck” unless you had some alternate method of estimating the amounts in box 7. For line 10, enter the steps you took to try to get your W-2. This could include calling the employer and/or calling the IRS. If you have determined that you own money to the IRS, you must pay the amount that you have estimated you owe by April 15.

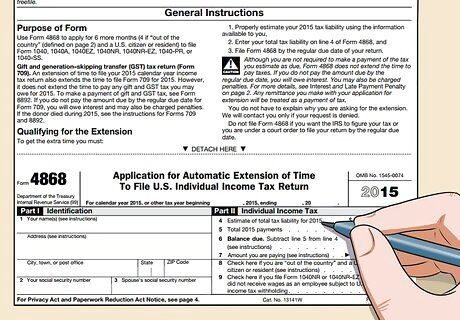

Consider filing an extension. If you want to wait to file a return until you get your W-2, you can submit form 4868 before or on April 15 to get an extension. Doing so gives you 6 extra months to file your income taxes if you are inside the US and 4 extra months if you check box 8. Keep in mind that even if you file an extension, you must pay any amount you believe you owe by April 15.

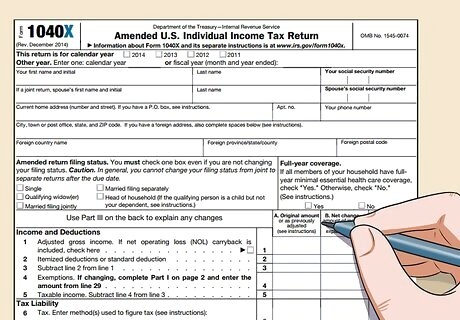

File a correction if necessary. If you receive your W-2 and it shows that your actual income is different from your estimate, you must file an amended return using Form 1040X.

Comments

0 comment