views

Planning Before Signing

Consider your options. Because of increasing banking and identification security regulations in the United States, you will likely have difficulty finding a bank that will accept a third-party check. If you have a banking account and can deposit or cash the check written to you, it is almost certainly going to be easier for you to do that, then write your own check (or hand the cash) to the third party. Signing over a check may seem like it would be more convenient (by cutting out the middleman, so to speak), but is unlikely to be so anymore. Look into electronic transfers of funds to your third party, either through your existing bank accounts or a service such as PayPal, if you are seeking another convenient option. If you: 1) have a check written to you; 2) don't have a bank account; and 3) need to pay a third party the amount of the check written to you, this is the only real scenario in which you might want to try to sign over a check. See Part III of this article for other options in this scenario.

Confirm that the person you want to endorse the check to, the third party, will accept a signed-over check. Ask the person if they have used a third-party check at their bank before. This will improve your chances of success since there are no laws requiring banks to accept third-party checks.

Confirm that the third party's bank accepts such checks and know the bank's particular procedures. If you cannot contact the person immediately but know their bank branch, you can call the bank's customer service number to inquire about special endorsements of this kind. Ask if any special procedures are required by the bank to accept the third-party check. Some banks have enacted their own rules governing these procedures, such as requiring that both parties have accounts at the bank to ensure the funds can be transferred.

Be prepared to go in person with the third party to their bank. Completing the signing process in person may be required by the bank and will almost certainly improve your chances of success regardless. Bring proper identification, especially if it is not also your bank.

Signing Over the Check

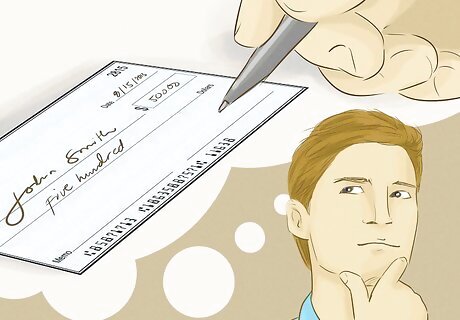

Sign the back of the check as usual, except keep your signature in the top section of the endorsement area. If there are three lines, sign the top line. This is not the time for a flamboyant "John Hancock" signature, because you will need the entire space to complete the process.

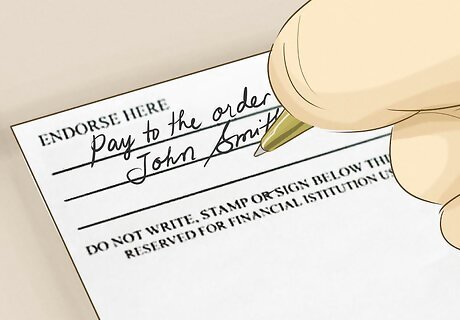

Print "Pay to the Order of" and the third party's name in the middle section (or second line) of the endorsement area. If you are pressed for space, you can try using "FBO" (For the Benefit of), but you may want to check with the bank first. Write neatly, especially the third party's name. Check for spelling.

Do not have the third party sign the check until it is deposited or cashed. Have the third party (the endorsee) sign the check in the bottom section (or third line) of the endorsement area. If they are not present, place an "X" to indicate where they should sign, and/or attach a friendly reminder note to the check.

Give the check to the endorsee to deposit in their bank as usual. So long as the bank accepts the third party check, the deposit process should be exactly the same as for a check written directly to the person

Looking into Alternatives

Open a bank account, deposit the check, then pay the third party. As noted, you're likely only considering signing over a check because you don't have a bank account. If it is possible for you to open an account, do so, because it will make this situation (and likely others) simpler. To open a checking account at a U.S. bank, you generally need to be 18 or older; provide basic information such as full name, address, contact information (phone / email), and Social Security number; and show a government-issued photo ID. You should be able to find a no-fee checking account at one of your local banks. Also look into online banks, where free checking accounts are more typical.

Ask the original check writer to void the check and write a new one to the third party. This is more likely to work with your Aunt Edna than a mega-corporation that sent you a rebate check, of course.

Ask the original check writer to add "or bearer" after your name on the check (and future checks written to you). Checks with "or bearer" written following the name of the payee can be deposited or cashed (typically, depending on bank policies) by whoever presents the check. The third party should be prepared to present identification when depositing or cashing the check, depending on the policies of the financial institution, especially if the check is for a larger amount. Checks written out to "cash or bearer" or just "bearer" will work similarly.

Use a check-cashing service. You will pay a fee in return for this service, but you will walk out with cash that you can use to pay your third party. Check-cashing charges generally range somewhere between 1% and 12% of the check amount, so shopping around for the best deal can pay off. Some national retailers, including Walmart, provide this service. You will need a photo ID to cash the check.

Comments

0 comment