views

Underwriting an Initial Public Offering (IPO)

Hire an investment bank. If you decide that you want to go public, the first step is hiring an investment bank, or a syndicate (group) of investment banks, as underwriters. The investment bank vets you by analyzing your financial performance. It works with you to register your IPO with the Securities and Exchange Commission (SEC) and to determine a price for your IPO. Then, on the day of the IPO, the investment bank purchases all of the shares you are offering. This guarantees that all of your shares get purchased, and you are not left undersold. There are two syndicates: the underwriting syndicate, which are the investment bankers guaranteeing the sale of the offering and getting an underwriting fee (even when they have to buy it themselves), and a selling syndicate, which markets the shares to the public which collects a sales commission. Some firms can act as both syndicates. Investment banks specialize in large-scale, complicated financial transactions. Some of the most well-known investment banks are Barclays, Bank of America, Merrill Lynch, Warburgs, Goldman Sachs, Deutsche Bank, JP Morgan, Morgan Stanley, Salomon Brothers, UBS, Credit Suisse, Citibank and Lazard.

Evaluate offers from different investment banks. Invite three to five institutions to make bids. They will present their valuation of your company and how they expect your stock to perform in the market. Assess the accuracy and thoroughness of their research and business analysis. The bank will evaluate your company to assess the risk. If they don’t want to bear all of the risk alone, they may opt to work with a syndicate of banks to share the risk. Look for a bank that is familiar with your industry and has brought other businesses in your sector public. An investment bank will only want to work with you if you meet certain financial criteria. For example, they typically look for revenues of approximately $10 to $20 million and profits of at least $1 million. Also, they want projected annual growth to be relatively high for the next five to seven years.

Structure a deal. Discuss how much capital you want to raise. Arrive at an agreement for the type of guarantee the bank will offer you. A firm commitment means that they guarantee to raise a specific amount of capital by purchasing all of the shares and reselling them to the public. A best effort agreement means the bank does not guarantee that all of the shares will be sold. This usually happens with high-risk securities or when the market is unstable.

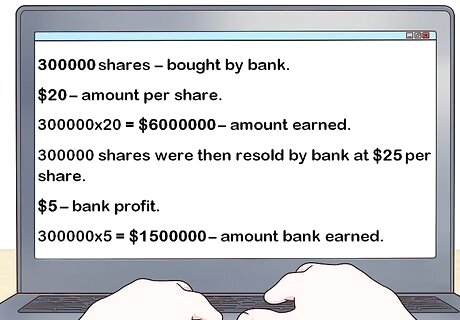

Understand how the bank makes money. The bank makes money by getting a commission on the selling price of your shares. Typically, banks earn anywhere from 1 percent to 7 percent commission. Also, they get to keep the difference between the price for which they purchased the shares and the selling price. This is known as the underwriting fee. There may be other expenses charged by the underwriting syndicate, including the costs to print and distribute investment prospectuses. This commission pays the investment bank for assuming all of the risk. They are investing their own capital when they purchase your shares. They risk losing money on that investment if they cannot sell the shares to the public. For example, suppose you are offering 300,000 shares for $20 per share. You negotiated a firm commitment with an investment bank to purchase all of your shares for a 5 percent commission. On the day of your IPO, the bank purchases all 300,000 shares for $20 per share, which means that you made $6 million. But, the bank keeps 5 percent, or $300,000 in commission. Then, the bank turns around and sells the shares for $25 per share. They make a profit of $5 per share, or $1.5 million. The total amount the bank earned in commissions and profits was $1.8 million.

Filing a Registration Statement with the Securities Exchange Commission (SEC)

Perform due diligence. The bankers, lawyers and accountants involved with the IPO need to verify all of the information that will be put into the registration document. This includes researching the industry and the market to predict the company’s financial performance. Accountants audit historical financial statements and tax records to look for any inaccuracies. Customers are even contacted to learn as much as possible about their relationship with the company, key risks they perceive and how they view the company compared to its competition.

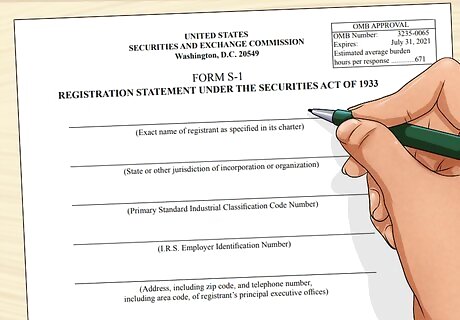

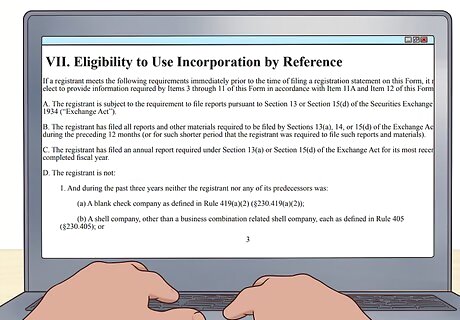

File form S-1 with the SEC. This form is also known as the "Registration Statement Under the Securities Exchange Act of 1933.” It is the initial registration form that is required by the SEC for new companies who are going public. This form must be on file and the company approved for sale with the SEC before any shares can be sold to the public. Required information includes how you plan to use capital you raise, information about your business model and your competition in the industry, a prospectus that details information investors should know, how you plan to price your shares and finally, disclosure of any potential conflicts of interest.

Arrange to sell some of your shares in the IPO. If you or any of your private stock holders want to include any shares in the offering, this must be disclosed to the SEC in form S-1. This also has to be negotiated with the bank. The proceeds from this sale would go to you and the other individuals selling securities, not to the company. Specific requirements must be followed in order to avoid any hint of insider trading. This information would be provided in Part 1, Section 7 of form S-1. The Code of Federal Regulations (CFR) requires the following information to be disclosed: the name of each security holder; the nature of any relationship or position the security holder has had with the company or any of its affiliates within the last three years; the amount of securities owned prior to the offering; the amount of securities to be offered; and the amount the security holder will still hold after the offering. While not required by the SEC, many investment banks will impose a lock-up period. This prevents you and others who hold private stock in the company from selling the stock for 90 to 180 days after the IPO. The purpose is to avoid depressing the value of the stock by flooding the market with shares. Any shares that are sold into the general market must be registered or in a private sale to someone who will be restricted by the same non-pubic sale rules. Note that shares sold by insiders do not benefit the company, but increase the float (number of shares outstanding).

Wait for approval. Once the SEC receives the registration document, it imposes a cooling off period of approximately two weeks. During this time, the SEC verifies the information provided in the registration documents. Once the information has been authenticated, the SEC issues an effective date. This is the date on which the stock will be offered to the public.

Courting Institutional Investors

Prepare a red herring. This is a brief prospectus that details your company’s business operations and projected financial performance. It does not include the expected price of your shares nor the number of shares you will be offering. It is used to communicate with prospective investors. It gives them information they need to decide whether to purchase shares in your company from the investment bank on the day of the IPO.

Meet with prospective institutional investors. Institutional investors are companies that trade securities in such large quantities that they receive preferential treatment. Pension funds and life insurance companies are examples of institutional investors. Along with your underwriter, travel around the country to meet with institutional investors to pitch why they should invest in your company. This process is known as the “road show” or the “dog and pony show.”

Accept subscription requests. If the pitch is successful, investors subscribe to the offering. This means they make a commitment to purchase a certain number of shares from the bank on the day of the IPO. The exact price of the shares is not known at this point, so the commitment is non-binding. This means the investors are free to back out if they so choose. Underwriters usually limit the number of shares that can be purchased on the offering to maximize liquidity and encourage after-market purchases to supplement holdings. This is because It is normally not in the best interest of the company to have a few dominant shareholders.

Selling the Stock to the Public

Negotiate a price for the IPO. Work with your underwriter to set an initial selling price for your shares. The nature of your company, the success of the road show and current market conditions will all impact the price. Quantitative and qualitative factors are evaluated when determining the price. Quantitative elements that affect price include demand, industry comparables and growth projections. Strong demand for your company’s product may lead to a higher IPO price or increased after-issue demands, protecting the offering price or causing it to go higher. Industry comparables, or the IPO price of other companies in the same industry, also factor into the price. Your future growth projections also significantly impact the valuation of your IPO. Qualitative factors include innovation, such as a new way of doing business or a product that will change the way things are done.

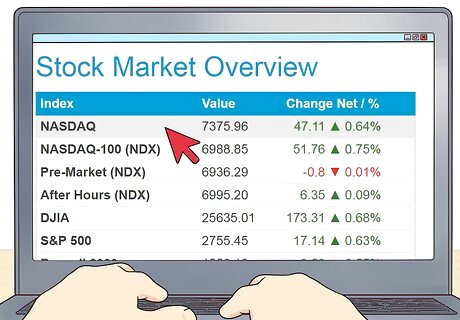

Choose a stock exchange. Stock exchanges, such as the Nasdaq and the New York Stock Exchange (NYSE) will make bids for your business. Having your business could lead to increased trading and future relationships with other IPO’s. Also, if your company is well-known, the exchange will want the prestige of being associated with you. Expect to receive pitches from the different stock exchanges. There are listing requirements for each exchange. Most companies begin on the NASDAQ and may go on to a listing on the NYSE. Many companies' stocks trade on multiple exchanges simultaneously.

Collect money from investors. On the day of your IPO, the bank will purchase all of the shares that you are making available. Then, they will attempt to sell them to the public. Realistically, the only investors who will be able to get in on the IPO are the most favored customers of firms in the selling syndicate. The average investor won’t be able to purchase your stock until a later date. By then, if the investment bank has done a good job of valuing your company and promoting the sale of your stocks, the value of your stocks will be higher than the initial offering price. Don’t be concerned if the price of your stock doesn’t skyrocket on the day of your IPO. Analysts find that the most profitable companies start out slow but continue to build value over time. The offering price is set by the underwriters who want to ensure an active after-market for the shares. However, the company does not receive any proceeds for shares traded in the after-market whether they are above or below the offering price. If you have included any of your privately-held shares in the offering, the proceeds from the sale will go to you, not to the company. This deal can only happen if disclosed to the SEC in the S-1 form and if the SEC approved the sale.

Making Your IPO Successful

Establish processes for financial communication. In the months and weeks leading up to the IPO, the investment bank does most of the financial communicating for you. Once the IPO is over, the bank moves on and you are left to on your own to communicate financial information to a new set of stakeholders, like analysts, investors and employee-owners. Prior to the IPO, create a 12-month plan to publicly communicate company information. For example, design a reporting cycle that defines when financial reports will be published. Public companies have a legal requirement to report financial data regularly to the SEC (4Ks, 10Ks, etc.). By law, communications with the public and potential investors are severely limited before the offering and for a period thereafter. Use press releases to publicize key events, product development schedules and conference attendance. Good communication with shareholders will lay the foundation for a positive relationship. This will help with conflict resolution and facilitate future communication.

Build relationships with underwriters and institutional investors well before your IPO. Ideally, you should be fostering these relationships as much as two years ahead of your anticipated IPO. Get to know investment banks so you can choose the best one to underwrite your deal. Allow potential investors to become familiar with your company so they will be likely to commit to the purchase of shares during your road show. Begin by getting to know analysts who cover your industry or business sector. Meet with them regularly and have them write reports about your company. However, analysts cannot write or publicize reports to the public until after the stock has bee traded for a certain period. Once you have a relationship with the analysts, meet with the bankers at their firms. Get to know institutional investors by attending conferences and other events.

Keep your financial projections realistic. Don’t get caught up in the excitement of the IPO and create financial projections that you can’t meet. Perform a stress test on your financial projections, and have them reviewed by a neutral third party. Providing realistic financial projections protects your credibility. If you miss your expectations for two or more quarters, you run the risk of losing the trust of your investors.

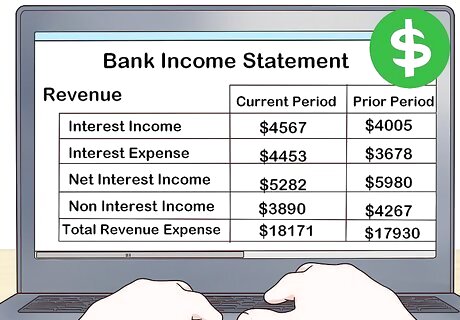

Factor the impact of the IPO into your financial projections. Anticipate how the IPO will affect your financial statements. Include these impacts when preparing financial projections. For example, the IPO will increase your public company costs and your non-cash, share-based compensation. Also, account for the change in shares outstanding. Finally, consider how you will use the proceeds from the IPO. If, for example, you are repaying debt, factor in any discounts and account for the impact to interest expense.

Allocate enough time for the road show presentations. Give yourself enough time to prepare and rehearse your presentations. Plan to work around the schedule of the institutional investors. Earnings seasons, conference weeks and other IPO meetings may make them unavailable on certain dates. Plan to take at least one week for each presentation. Allow time for traveling and for adjusting times and dates for scheduling conflicts.

Comments

0 comment