views

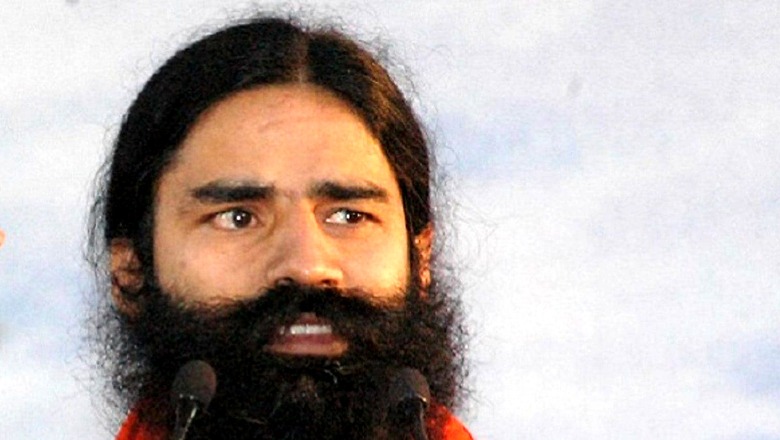

Ruchi Soya FPO: Ruchi Soya, backed by yoga guru Baba Ramdev, follow-on public offering (FPO) will run from today, March 24 to March 28, 2022. At the upper end of the price band of Rs 650 per share, the Rs 4,300 crore FPO is available at a 40 per cent discount to the company’s current market price of Rs 913. The company is planning to raise as much as Rs 4,300 crore through its FPO. The net FPO proceeds will be utilised for repaying debts, working capital requirements and other general corporate purposes.

Ruchi Soya Industries mobilised Rs 1,290 crore from 46 anchor investors on March 23, ahead of its follow-on public offering (FPO). The FPO is going to be only a fresh issuance of equity shares to public investors without any offer for sale component.

Investors who participated in the offer included Aditya Birla Sun Life Trustee, AG Dynamics Funds, Alchemy India, ASK MF, Authum Investment, Belgrave Investment Fund, BNP Paribas Arbitrage, Cohesion MK Best Ideas, HDFC Life Insurance, Kotak MF, NPS Trust, Quant MF, SBI Life Insurance, Societe Generale, UPS Group TRUST, UTI MF, Volrado Venture Partners, and Winro Commercial.

About Ruchi Soya

Ruchi Soya is among the largest branded oil packaged food company with a strong portfolio of brands of cooking oils under categories such as palm, soybean, mustard, sunflower, cottonseed etc. Its ‘Ruchi Gold’ brand has a market leadership position.

It is also one of the largest manufacturers of soya foods in India under the brand name of ‘Nutrela’. It has expanded its packaged food portfolio by acquiring the ‘Patanjali’ product portfolio of biscuits, cookies, rusks, noodles, and breakfast cereals.

Should You Invest in Ruchi Soya at a Deep Discount?

Analysts said the reason behind deep discount could also be because Patanjali wants the issue to succeed given the volatile market condition. Moreover, there will be more FPOs in the coming year as Patanjali will still own more than 75 per cent following this round of share sales. So, it needs the investor appetite to remain strong.

“Patanjali Group wants to make sure this FPO is successful so that they can come out with more FPOs, however, aggressive investors can apply for long-term,” said Aayush Agrawal, Senior Analyst, Swastika Investmart.

Amarjeet Maurya, AVP – Mid Caps, Angel One Ltd., said: “In terms of valuations, the post-issue FPO TTM P/E works out to 26.6x (at the upper end of the issue price band), which is low compared to its peers Adani Wilmar (TTM PE -57.8x). Further, RSIL has a strong brand recall, wide distribution, healthy ROE (FY21). Considering all the positive factors, we believe this valuation is at reasonable levels. Thus, we recommend a subscribe rating on the issue.”

Ravi Singh-Vice President and Head of Research ShareIndia, said: “Ruchi Soya FPO looks good for long term perspective. In past years, the stock has shown very high volatility and the valuations are a bit weak also. However, the new management is settling down and the results in the coming year could be the key driver of the stock.”

Read all the Latest Business News and Breaking News here

Comments

0 comment