views

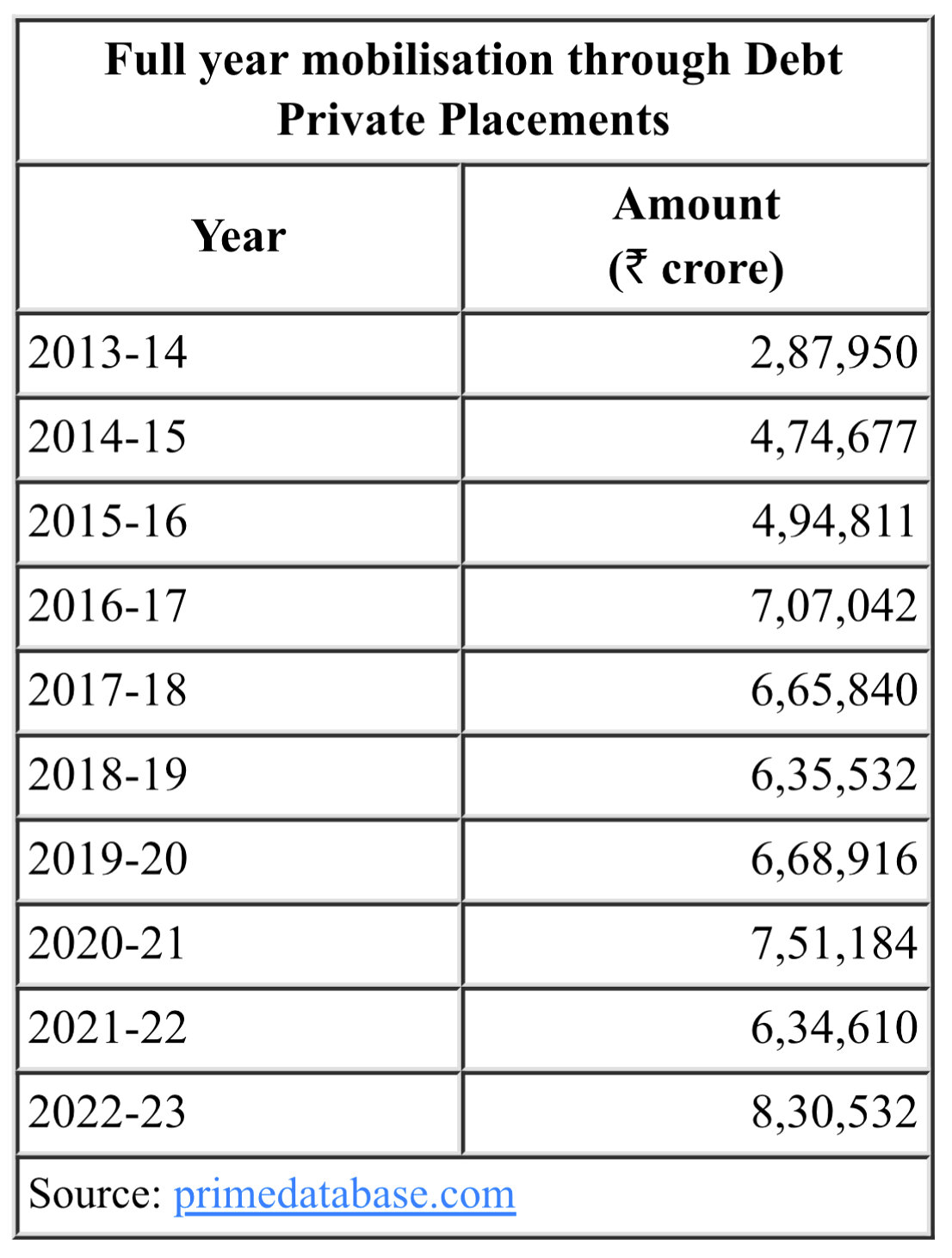

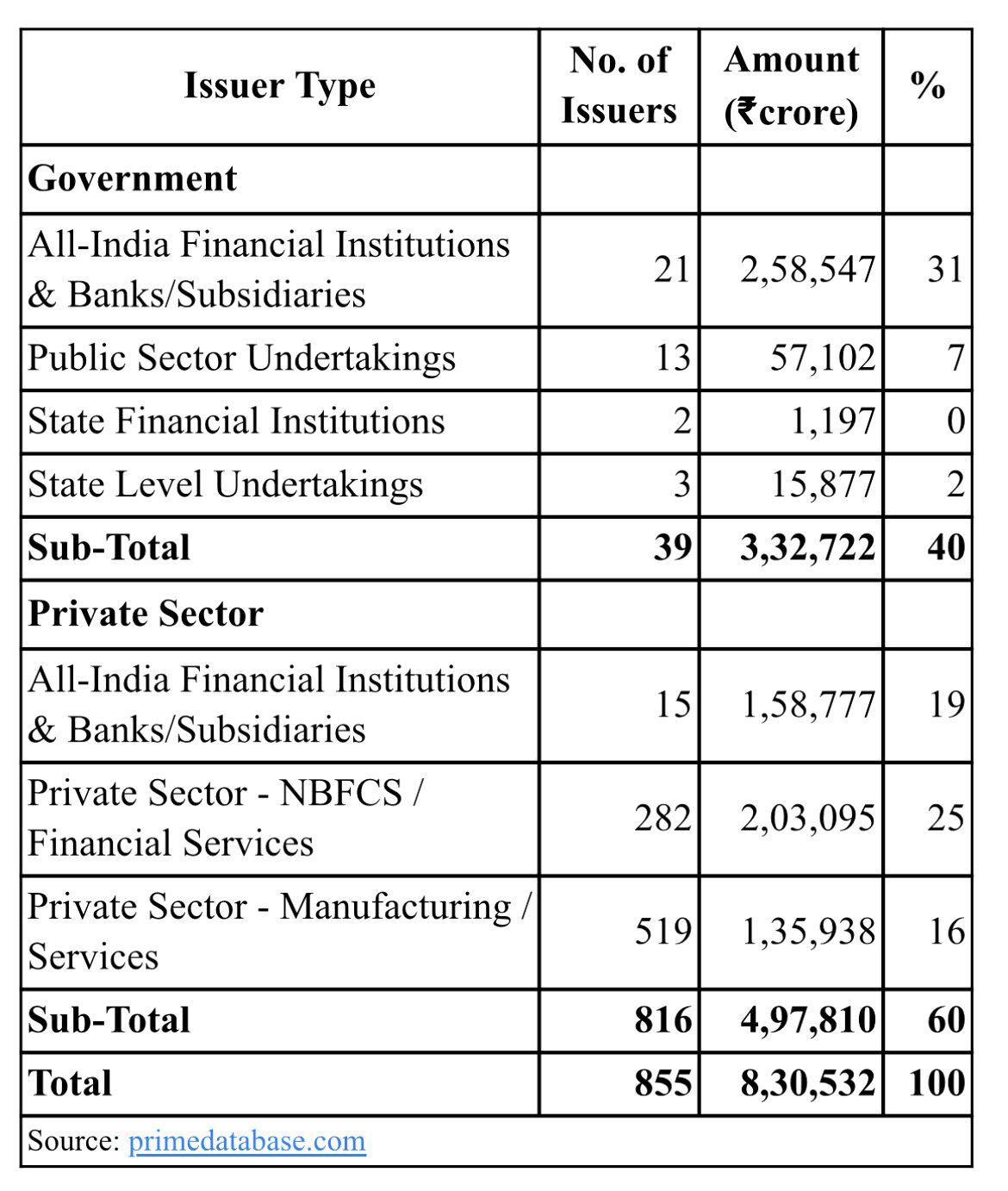

Fundraising through corporate bonds on a private placement basis in India jumped 31 per cent to its all-time high of Rs 8,30,532 crore during the last financial year 2022-23, according to the latest data from Prime Database. The funds were mobilised by 855 institutions and corporates during the year.

Deals, listed and unlisted, that have a tenor and put/call option of above 365 days have been considered, said Prime Database, a leading database on the primary capital market, in a statement.

Pranav Haldea, managing director of PRIME Database Group, said a combination of factors such as overseas borrowing turning pricier, a surge in credit demand, higher bank loan rates, and also large issuances by some issuers led to this.

According to the data, the highest fundraising was done by the all-India financial institutions and banks category at Rs 4,17,323 crore during 2022-23, compared with Rs 2,68,413 crore in the year-ago period, representing an increase of 55 per cent.

An increase in mobilisation was also witnessed by the private sector (excluding banks/FIs), up by 12 per cent to Rs 3,39,033 crore, compared with Rs 3,02,985 crore in 2021-22.

“Government entities, put together, mobilised 40 per cent of the total amount, higher than 34 per cent in 2021-22. Among government entities, all-India financial institutions/ banks led with a 78 per cent share followed by a 17 per cent share by PSUs,” Prime Database said in the statement.

Company-wise, the highest mobilisation through debt private placements during the year was by HDFC (Rs 78,415 crore), followed by NABARD (Rs 49,510 crore), PFC (Rs 42,097 crore), SBI (Rs 38,851 crore) and SIDBI (Rs 35,405 crore). The top-5 issuers of 2022-23 raised Rs 2,44,277 crore in comparison with Rs 1,61,895 crore raised by the top-5 issuers of 2021-22.

“Maximum amount of monies was raised in the above 10-year maturity bucket (Rs 2.92 lakh crore or 35 per cent of the total amount) followed by 3-5 years bucket (Rs 2.62 lakh crore or 32 per cent of the total amount),” the statement said.

Issues of as much as Rs 5.58 lakh crore or 67 per cent of the overall amount were AAA rated, it said.

Industry-wise, the banking/ financial services sector continued to dominate the market, collectively raising Rs 6,17,534 crore or 74 per cent of the total amount. The housing, civil construction and real estate category ranked second with a 5 per cent share (Rs 38,152 crore).

“The month of December 2022 saw the highest issuance at Rs 1,24,073 crore (14.9 per cent) followed by March 2023 at Rs 1,16,364 crore (14 per cent),” the statement said.

As many as 393 first-time issuers hit the market in 2022-23 in comparison to 381 last year.

The public bonds market saw a near 30 per cent decrease with 32 issues raising Rs 7,444 crore in comparison to 27 issues raising Rs 10,710 crore last year. The largest issue was from Creditaccess Grameen raising Rs 500 crore.

In addition, Indian companies also raised Rs 2.22 lakh crore through overseas borrowing (including ECBs), down 42 percent from Rs 3.86 lakh crore in 2021-22.

Outlook for 2023-24

Haldea said corporate bond issuances are likely to slow down given the recent taxation changes in debt mutual funds which are big investors in this space.

Jyoti Prakash Gadia, managing director of Resurgent India, said, “The investment cycle is looking up with potential emerging in infrastructure development and climate change green financing. The procurement of resources for on lending by banks/financial institutions specifically for identified emerging sectors is a prerequisite at this stage to tap the opportunities in these sectors .”

He added that the recent modification in tax rules relating to debt funds may dampen the sentiments in the short run.

Read all the Latest Business News, Tax News and Stock Market Updates here

Comments

0 comment