views

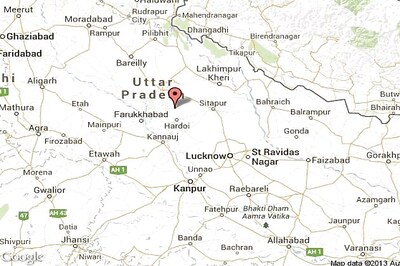

As investment options continue to evolve, savvy investors are always on the lookout for opportunities that provide both stability and attractive returns. In recent years, the Indian real estate market has emerged as a promising option for HNI’s seeking to diversify their portfolio and generate attractive returns. Real estate AIFs, emerging as an excellent investment option, offer unique opportunities to invest in different asset classes across residential, commercial and industrial segments.

Also Read: Residential Real Estate Trends: Expert Tips In Navigating A Shifting Landscape

Transparent and Regulated Investment Process

The Indian real estate market has always been a favoured investment option for HNI’s, and real estate AIFs streamline the traditionally complex investment landscape by offering investors a structured and professionally managed platform to access the real estate market. By pooling funds from multiple investors, AIFs provide portfolio diversification, mitigating individual risk while offering potentially higher returns.

Furthermore, AIFs are managed by experienced fund managers and industry experts who conduct thorough due diligence of opportunities, negotiate deals, manage regulatory compliances, and oversee the entire investment lifecycle. This provides a transparent and regulated platform for investors to capitalise on the sector’s sustained long term growth.

Access to Unique Investment Opportunities

Diversification is the cornerstone of successful investing, and real estate AIFs play a crucial role in achieving a balanced portfolio. Real estate AIFs offer access to a diverse range of real estate asset classes, including residential, commercial, and warehousing projects.

Investors can gain exposure to a broader real estate portfolio, reducing the risk associated with investing in a single project or asset class. Certain asset classes such as industrial and commercial are not easily accessible to retail investors in an individual capacity, and are primarily accessed through a fund’s investment program. The ability to invest across different asset classes, through regulated AIF platforms, provides risk-mitigation and opportunities for attractive returns to investors.

Benefit from Both Residential Sales and Commercial Rent Yields

An attractive aspect of real estate AIFs is their potential to generate regular income through both residential sales revenues and commercial rental yields.

Residential AIFs offer investors an attractive blend of both unit sales revenues and capital appreciation over project life spans. At the same time, investors can access steady commercial rental yields via AIFs. A report by Knight Frank indicates that India offers amongst the highest global yields in commercial real estate, with rental yields between ~8-11% per annum. Whether a fund invests in commercial properties, such as office spaces and shopping complexes, or industrial assets such as warehouses, rental income serves as a stable source of cash flow for investors to supplement residential sales-based strategies.

Fueling the Growth of the Indian Real Estate Sector

The robust growth of India’s real estate sector has been significantly bolstered by the emergence of Real Estate Alternative Investment Funds (AIFs). These funds have injected renewed dynamism into the sector by attracting both domestic and foreign investment. AIFs, with their structured approach and focus on transparency and professional management, have not only simplified the investment process but have also catalysed the development of diverse real estate projects, ranging from residential and commercial spaces to industrial projects.

The infusion of capital through AIFs has expedited project execution, stimulated economic activity, and contributed to job creation, thereby propelling the growth trajectory of the real estate sector.

Real estate AIFs – A Complementary Addition to Investment Portfolios

The key to a robust and balanced investment portfolio lies in diversification across various asset classes. Real estate AIFs offer an attractive proposition for investors looking to diversify beyond traditional investment options like equities and gold. By adding real estate to their investment mix, investors can create a more robust portfolio that is less susceptible to the inherent volatility of the stock market.

Additionally, real estate investments often exhibit low correlation with other asset classes, thereby acting as a hedge against market downturns.

Investing in real estate AIFs in India can help diversify HNI portfolios. These fund platforms provide SEBI-approved access to diverse and lucrative asset classes within the real estate sector.

The potential for rental yields, whether through commercial or industrial investments, helps by adding steady rental income for investors to complement sales-oriented residential strategies. Moreover, real estate AIFs complement traditional investment portfolios, offering the much-needed diversification required for long-term wealth creation.

-The author is Partner, TriVeda Capital. Views expressed are personal.

Comments

0 comment