views

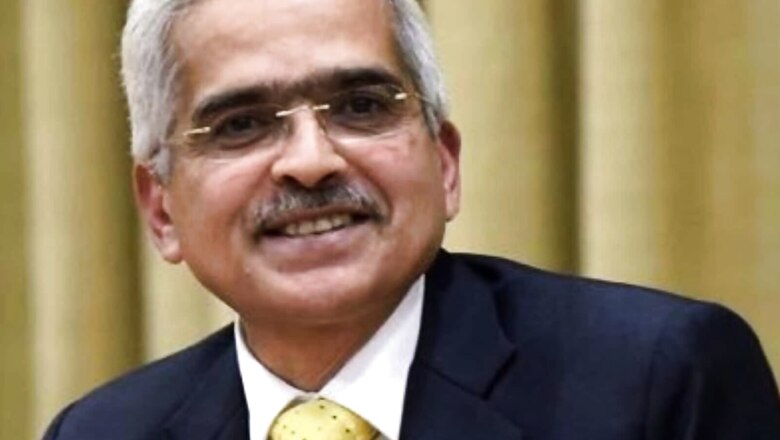

Reserve Bank of India Governor Shaktikanta Das on Friday said tackling inflation is the central bank’s top priority and the RBI will try to minimise its impact on growth. He added that global factors are impacting inflation and growth in India.

In an interview with a media company, the RBI governor said the domestic economic activities, including high-frequency indicators, are resilient. He said the central bank is also studying why the GDP growth in April-June 2022 quarter was lower than what the RBI had projected.

India’s GDP rose 13.5 per cent in the June 2022 quarter (Q1FY23). It is the fastest growth in a year, as the country’s GDP had grown at 4.1 per cent in the previous quarter (Q4FY22), 5.4 per cent in the December 2021 quarter of FY22, and 8.4 per cent in September 2021 quarter. However, the Q1FY23 growth fell short of the RBI’s projection of 16.2 per cent.

The country’s inflation in April had stood at 7.79 per cent, which eased to 7.04 per cent in May and fell further to 7.01 per cent in June. The consumer inflation further declined to 6.71 per cent in July. However, it’s still above the RBI’s target of 2-6 per cent.

The RBI governor said he will discuss the Q1 GDP growth at the next Monetary Policy Committee’s (MPC) meeting. He also said the global slowdown and global inflation are impacting India.

Das also said the RBI constantly monitors the credit growth of all banks. The RBI cautions banks when they see excessive credit growth in an area. “Our digital rules are well received by all segments of lenders. The RBI’s new digital rules are consumer-centric, focus is on transparency.”

The RBI’s digital rules focus on risk assessment, management and mitigation.

He said India’s high foreign exchange (forex) reserves are a strong buffer for the Indian economy. Das also said forex reserves are keeping the rupee stable.

The RBI’s Monetary Policy Committee hiked the key repo rate by 50 basis points to 5.4 per cent in early August. It was the third straight hike after a 50 per cent raise in June and a 40 per cent hike in May.

Read all the Latest Business News and Breaking News here

Comments

0 comment