views

Even as technology opens up opportunities for more people to become digital nomads, and people start to move across the globe again, findings from an HSBC study revealed that the financial experience of international citizens may not be all plain sailing.

HSBC Bank commissioned a multi-market study to understand the evolution of the financial lives of international citizens, their motivations for relocating to a new country, and the issues they face as they settle abroad. The study also highlighted the financial challenges they face, the pressures of relocating, and the impact it can have on their lives.

The findings, based on the responses shared by international citizens in India – that is, people who have either relocated to India, or are planning to do so – are as follows;

Finding suitable financial services is a common concern among those who are planning to move to India. Nearly 62% of the respondents, who are considering moving to the country, agree that finding the right financial services to suit their specific needs is a matter of worry.

Difficulty in setting up essential services can lead to feeling unsettled. As per the survey, three-quarters (75%) of the respondents who have relocated agreed that they felt unsettled when they first arrived because they struggled to set-up important things like a bank account, utilities, and the internet. This highlights how complex financial administration can have a negative impact on their new experience. Without a bank account, they struggle to secure a home – and without a fixed address, they struggle to get children in schools.

The findings said the inability to transfer credit history is a major obstacle for those moving overseas. Almost four in every five (78%) international citizens in India have struggled to set up essential services such as credit cards, mobile phones, and utilities due to this reason. Moreover, almost 61% of the respondents who are planning to move to India are concerned by the fact that they cannot transfer their credit history.

Cash flow planning is one of the most integral aspects to consider while moving abroad. The survey reveals that more than half (53%) of the respondents who are planning to move to India (to live, work or study) expect a cash flow crisis upon arrival.

Furthermore, half (50%) of those who plan to relocate to India have no idea how they’ll manage their finances between locations when they move. Of those who have already relocated, 67% respondents said they got no help in financial management.

Whereas, for those who are still planning to live, work, or study in India, one in every two (50%) international citizens have said that nobody helped them feel financially prepared to relocate.

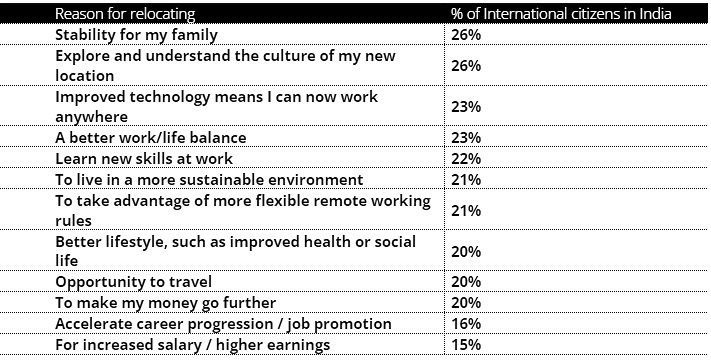

Motivation for relocation

Amidst inflationary pressures and rising cost of living, the study found that 26% of international citizens are motivated to relocate to India for stability for their family, 23% move due to improved technology which means they can work from anywhere, and 20% relocate or are planning to relocate for a better lifestyle.

Top reasons for relocating to work or study in India

Taylan Turan, group head of retail banking and strategy, wealth and personal banking, HSBC, said, “Moving abroad is exciting and daunting, but managing your finances internationally shouldn’t be a struggle. It’s clear from our research that some people get caught out on the financial front, which can really impact their ability to settle in their new home.”

“Banking across multiple locations can make it tricky to stay on top of your finances; there’s a lot to think about. To be set for success, people need to be able to open a bank account before they move overseas and see their bank accounts in one global view. Beyond banking, the tax implications of relocating abroad can also play heavily on people’s minds, so help from tax planning advisors is crucial. The right financial support can help reduce the time people spend worrying about money matters, and instead make more time for them to enjoy their new life,” Turan added.

The study was conducted by Ipsos UK, surveyed over 7,000 adults across nine international markets, including India. It investigated the experiences of those currently living, working and studying abroad, as well as those who are planning to do so and those who have returned within the last five years.

It explored the experience of a range of different international citizens, including expat families, digital nomads and overseas students.

Read all the Latest Business News here

Comments

0 comment