views

General insurance company Digit has rolled out a health policy that is totally in tune with the times. The new Digital Health Care Plus policy covers the medical costs in case you are hospitalized or under quarantine for the Coronavirus, or COVID-19 illness. Since Digit is a digital-only insurance company, you can now sign up for this insurance policy on their website or using the app that is available for Android phones and the Apple iPhone. At this time, the insurance policy offers sum insured options of Rs 25k, Rs 50k, Rs 75k, Rs 1 lakh, Rs 1.25 lakh, Rs 1.5 lakhs, Rs 1.75 lakh and Rs 2 lakh and is available to anyone less than 60 years of age.

Digit says the insurance cover will trigger under two conditions. First, if you are quarantined for investigation in a government or military hospital of Coronavirus Disease (COVID-2019) for at least 14 consecutive days during the Policy Period and receive a certificate from a Government Medical Officer to start the treatment for Coronavirus Disease (COVID-2019). Secondly, if you received a positive Virology report from ICMR - National Institute of Virology in Pune. In case of the latter condition, Digit says that they will disburse the full sum assured without having to wait for the completion of the treatment.

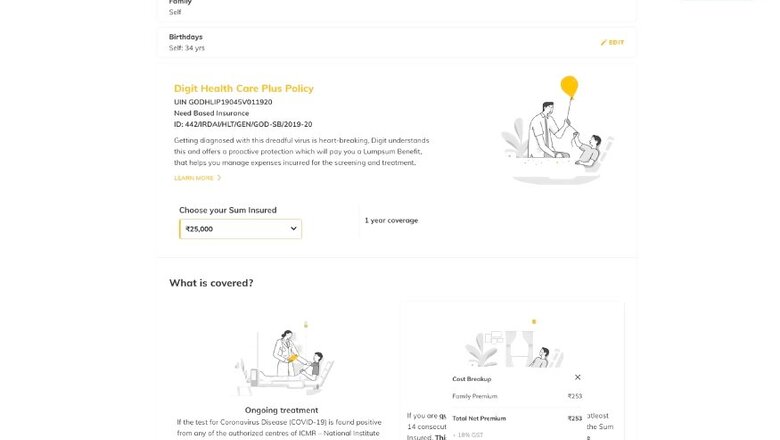

As far as what you pay for the one-year cover insurance, we did a simple check based on this writer’s age, which is 34 years. The Rs 25,000 sum insurance costs just Rs 253. The Rs 50,000 cover costs Rs 507. The Rs 75,000 cover is priced at Rs 760. If you want to get Coronavirus insurance worth Rs 1 lakh, you pay Rs 1,014 premium. The Rs 1.25 lakh cover costs Rs 1,267 while the Rs 1.5 lakh cover costs Rs 1,520. The Rs 1.75 lakh option is priced at Rs 1,774 while the highest spec coverage option of Rs 2 lakh costs Rs 2,027.

However, there are conditions that you need to keep an eye out for before attempting to sign up for the Go Digit Digital Health Plus. First, this policy is not available to anyone who is 60 years of age or above. Also, the policy will not be applicable if the testing done in a center other than the ICMR - National Institute of Virology in Pune, which is the authorized testing center in India. Also, Digit’s Coronavirus policy doesn’t apply if you have taken treatment outside India or already have a pre-existing condition whether declared or undeclared.

Digit also says that any additional cost of multiple testing or expenses of medications is not covered by the insurance. If you are under investigation and your Coronavirus tests are negative, the policy will not cover any hospitalization or medical expenses.

Your travel history also plays a big role in whether you are eligible for this policy or not. Digit says this insurance will not be applicable if you have traveled to China, Japan, Singapore, South Korea, Thailand, Malaysia, Hong Kong, Macau, Taiwan, Italy, Iran, Kuwait and Bahrain after December 1, 2019. Safe to say, a lot of potential customers would get filtered by these conditions, which seem to be a wide generalization if we are to keep in mind the spread of the Coronavirus to these countries—for example, Italy and Iran came much later compared with China and Hong Kong.

Digit says this policy is as per the IRDAI Regulatory Sandbox Regulations 2019 which allows insurance companies to offer need-based insurance products to customers. The policy will be terminated after the 100% sum insured is paid out.

Comments

0 comment