views

The government should remove the need for any in-person meeting of customers during the video-KYC (Know Your Customer) process for all regulated non-banking financial services, industry body Internet and Mobile Association of India (IAMAI) demanded amid Covid-19 lockdown. To avoid physical interaction between the customer and the employees of the entities like Prepaid Instruments (PPI), Non-Banking Financial Companies (NBFCs), lenders and others, the government should enable digital onboarding of customers, the industry body said.

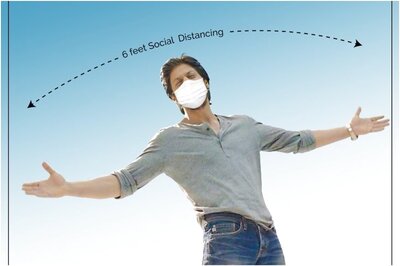

In its appeal to the government on Monday, the association stated that at times of social isolation and ongoing lockdown all critical transactions are being conducted via digital means. Users require digital payment instruments for paying for utilities like electricity and water, all e-commerce transactions for essential items, etc.

While it has become imperative that the industry offers end-to-end remote digital KYC solution, eliminating the need for any in-person verification, the current video-KYC regulations are prescriptive which require the officer to be on the other side during the video verification and mandate meeting customers in-person as part of due diligence, IAMAI said.

The association reiterated that the financial services and payments sector has for long been asking for complete remote /e-KYC norms as the only requirement for this sector and now the time is right, where this should be enabled by the government. The industry should be allowed to use Aadhaar-based authentication with immediate effect and the need for in-person verification as part of video KYC be removed entirely and companies be allowed to leverage technology solutions to replace in-person verification, said IAMAI.

The association highlighted that physical KYC is not feasible under the present circumstances and the same will continue until the coronavirus is completely under control. This, in turn, means that many customers will be unable to utilise the full range of financial services offered by the entities at times of the present crisis, due to the KYC restriction, it said.

Comments

0 comment