views

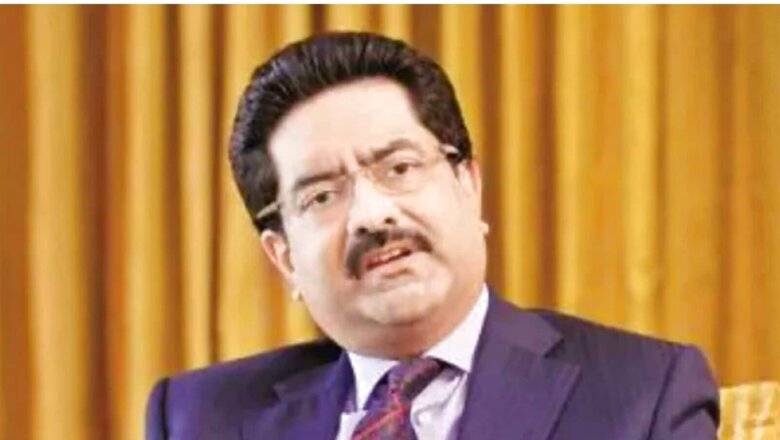

Kumar Mangalam Birla stepped down as the non-executive director and non-executive chairman of Vodafone Idea (Vi). This move comes at a time when Vi is struggling to keep afloat due to its enormous amounts of debt. Birla offered to give up his stakes in the company upon stepping down as well. This request was put in after the close of business hours on Wednesday. Following Birla’s move to step down, the company’s shares plummeted over 20 per cent to Rs 5.94 – a 52-week fresh low on the BSE. This trend ended with a lower 18.5 per cent dive at Rs 6.03 as investors took an exit out of fear that the company was headed for bankruptcy. With the fall on Thursday, Vodacom Idea’s stock tanked 42.69 per cent in the span of four days. The market capitalisation of the telco fell to Rs 14,741 crore. This downward trend emerged when Birla had announced that he was willing to give up his promoter stake in the company, after which Vodafone Group Plc ruled out any further injection of equity into the debt-ridden company.

As Birla steps down, a new nominee of the Aditya Birla Group on the board, Himanshu Kapania, will be taking his place. With that, the board had also accepted Birla’s move to step down from his post in the company after the close of business hours on Wednesday. Kapania, who is taking Birla’s place is an industry veteran with over two decades of experience and was previously a member on the board of GSMA for two years. He was also the chairman of the Cellular Operators Association of India. In addition to this, another industry veteran, Birla Group’s chief financial officer, Sushil Agarwal was appointed the additional director on the Vi board.

Birla, who owned a 27 per cent stake in the company offered to give it up to keep the company afloat. He had put forth the offer to any government or domestic financial entity in the hope to keep the company above water. Earlier in a letter to Cabinet Secretary Rajiv Gauba, Birla said that, with a ?sense of duty? towards 27 crore Indians connected with Vodafone Idea, he is ?willing to hand over his stake to public Sector Unit (PSU), a government entity or any domestic financial entity, or any other entity that the government may consider worthy of keeping the company as a going concern.? VIL has been trying to raise Rs 25,000 crore to sustain operations and pay regulatory and governmental dues.

Birla stepping down from the company comes after his attempts to keep it afloat, while the Vodafone Group has not taken any steps to infuse any more money into the company. The company has Rs 1.8 lakh crore debt on its books. Vodafone Plc announced that it is ready to offer up its 45 per cent stake in Vi to Indian banks, financial institutions or to Bharat Sanchar Nigam (BSNL), for free, according to reports. The caveat of this deal is that Vodafone Plc expects the acquiring party to take over the telecom company. In light of this lack of confidence, lenders and investors are hesitant at best with the future outlook of this company.

Over the last two years, Vi has lost both subscribers and revenue to rivals in the industry such as Reliance JIO and Bharati Airtel. In a letter, Birla had stated that the company had taken every possible measure to improve the operational efficiency via capital expenditure, manpower restructuring and other cost-cutting steps. Despite that, however, the financial condition of the telecom company deteriorated. Birla has also long since sought clarity and action on the AGR liability, adequate moratorium on spectrum payments, and a floor price regime so as to try and restore investor confidence in the company.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment