views

Know where you have your accounts. Keep a simple list. You may wish to list the banks' contact information on the same list.

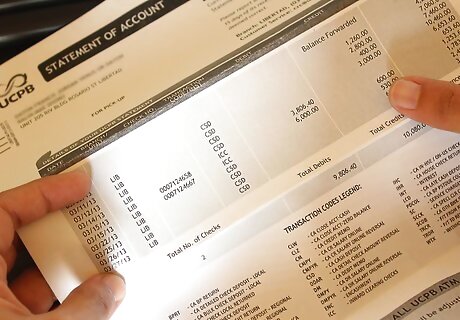

Read your statements each month, even of accounts you don't use frequently. Be on the lookout for fees and any other unexpected activities.

Read the fine print. Find out what the rules are about inactive accounts at your bank. Most banks can provide you with a copy of your account agreement and rules if you request one.

Choose accounts without inactivity fees, especially for longer-term accounts, such as retirement accounts. For tax-deferred accounts, remember that fees may come out of the same money that has a special tax status, and that that money is often subject to annual contribution limits.

Make a small transaction regularly. Even if you keep an account for the purpose of long-term storage, do something with it every now and then, such as depositing or transferring a little money. The frequency (and in some cases, the amount) will depend on the terms of your account. If you keep a calendar, write your next transaction on it when you make the previous one. If you keep an electronic calendar, make it a recurring appointment with a reminder in advance of when you need to act. Find out whether checking your balance counts as an activity. If the bank only needs to know that you still exist, logging in now and then or making a phone call might be enough. Find out whether automatic transactions count to avoid inactivity fees. Make sure the transaction you make won't put your accounts below any minimum balances or trigger other fees. Find out whether transactions in linked accounts count. If you have multiple accounts at the same institution, they may all count as one.

Keep your address current. Depending on your bank and how it handles your inactivity, you may be notified of inactivity before your account is charged a fee—or declared abandoned. That notice will probably arrive at whatever address is on file for you, so be sure to update your address each time you move.

Know the rules. In some places, inactivity fees are forbidden.

Question the fee. If you do get charged an inactivity fee, call your bank and object. Not all banks will refund a fee, but many will—once—if you ask. If a bank gets enough complaints, it could even change the policy and fee schedule. If you do get a fee refunded, take steps to make sure the problem doesn't happen again.

Keep your checkbook balanced and current. Don't compound the loss of an inactivity fee by accidentally incurring an overdraft or dropping below a minimum balance because of it.

Comments

0 comment