views

X

Research source

To begin, you’ll have to establish your business credit, which can take up to two years.

Establishing Your Business Credit

Obtain a tax ID number. You’ll need an (EIN) from the IRS to establish your business credit. You can get it at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online. Alternately, you can fill out IRS form SS-4, which is available at the IRS website. EXPERT TIP Bryan Hamby Bryan Hamby Professional Auto Broker Bryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service. Bryan Hamby Bryan Hamby Professional Auto Broker Talk to a CPA to decide whether buying a car under your LLC is the right decision. According to Bryan Hamby, the owner of Auto Broker Club: "If you buy a car under an LLC, you can help build your company's credit, but the LLC is responsible if anything happens with the car. However, depending on how your LLC is set up, it could provide a tax write-off benefit, so meet with your CPA to determine what fits your business best."

Create a credit profile. Contact Dun & Bradstreet, which is the major credit bureau for businesses. You can create a profile and upload company information, such as financial statements. Set up your Dun & Bradstreet profile at their website. You’ll need at least three trade lines to get a Dun & Bradstreet credit score (called a Paydex score). You can get trade lines with large retailers, such as FedEx, Home Depot, or Staples. Ask the vendor to report your payment information to Dun & Bradstreet if they aren’t doing it already.

Build your business credit. It can take up to two years to build up enough credit for your business to qualify for a car loan. To get the highest score, you should do the following: Pay your bills early. A history of timely payments will improve your business credit score. It’s also important to pay early, since that’s the only way you can qualify for the highest Paydex score. Avoid using too much credit. Limit your use to 20-30% of available credit. Clean up your public records. Bankruptcies, liens, and court judgments against your business will all lower your credit score. If a client has a lien, try to pay the debt and get the lien released. EXPERT TIP Bryan Hamby Bryan Hamby Professional Auto Broker Bryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service. Bryan Hamby Bryan Hamby Professional Auto Broker Consider whether having a guarantor could be a benefit. Bryan Hamby of Auto Broker Club says: "Some lenders will not finance an LLC without a guarantor. The financing will be based off of the guarantor's credit score. If that person has too many vehicles under their name or they have bad credit, the vehicle for your LLC may not be approved, it may only be approved at a higher rate, or it could affect your debt-to-income ratio, thereby affecting your LLC's credit."

Purchasing the Car

Check your business credit score. Before heading out to a dealership, you should pull your business credit score from each of the three main credit bureaus: Dun & Bradstreet, Equifax, and Experian. Business credit scores range from 0-100. You’ll need to pay to see your business credit score. Contact each bureau individually. You can get your Experian credit history for around $36.95, your Equifax score for $99.99, and your Dun & Bradstreet for $61.99. A credit score over 80 is generally good and should qualify you for loans. If your business credit is weak, consider leasing a car in your company name instead of buying one.

Find dealerships with commercial sale departments. These departments specially assist businesses buy and register their vehicles. Stop into a dealership and ask if they have a commercial sales department, which can make buying the car easier.

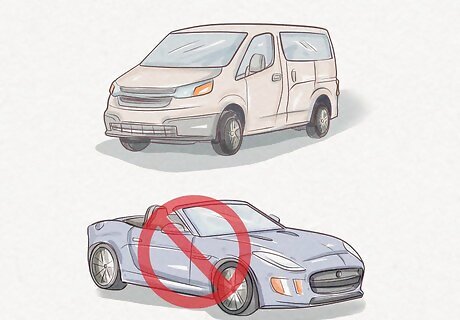

Choose an appropriate vehicle. For example, if you have a catering business, then buying a minivan might be appropriate. However, buying a sports car could raise red flags with the IRS. You should never buy a car for personal use through your business.

Provide financial information. Lenders will want to see a variety of financial information before extending a loan. For example, they might want to see financial records such as your business balance sheet. You can also expect the lender to pull your personal credit history as well. For this reason, you should get a free copy of your personal credit report and check it for errors. Dispute errors with the credit reporting agency that has the wrong information.

Finance in your company name. You can get a loan from the dealership, or you can shop around for a car loan from local banks and credit unions. Always remember to state that you are seeking a loan in your business name. Compare interest rates and other terms so that you find the most competitive loan. You shouldn’t assume that the dealership is giving you the best deal, though obtaining financing from them might be the most convenient.

Provide a guaranty for the loan. Your business credit might not be strong enough to get a loan only in your business name. Some lenders will ask you to sign a guaranty. This means you are personally responsible for the loan if your business stops making payments. Think carefully before doing this. The lender can sue you and come after other personal assets to satisfy the loan.

Make regular payments on the loan. Always remember to use your business bank accounts to make payments on the car. If you make payments using personal accounts, then it looks like your business is a sham.

Registering Your Car

Obtain insurance. If you use the car primarily for business, then you should look into commercial auto insurance. However, if you only use the car part-time for business, then personal auto insurance might be better. Consider how many employees will be driving the car as well. You can obtain insurance from large insurers such as Geico, Allstate, and Progressive. Also check for local insurers in your phone book, who might offer better deals. If you don’t know where to look, reach out to the insurance agent who sold you business liability insurance.

Register the car in your business name. Car registration differs depending on the state. You’ll probably need to show that your business has been properly organized by providing copies of your Articles of Organization or Articles of Incorporation. Contact the DMV for information about registration in your state. Send a member/manager of the business to register the car and not an employee. The member will need to show their driver’s license. Remember to pay all registration fees using your business bank account. Don’t cut a personal check.

Keep a mileage journal, if necessary. You might be using the car for both business and personal use. However, you can only get a tax deduction for the business portion. If necessary, keep a mileage journal in which you note how much you drove for business purposes.

Claim a tax deduction. The tax deduction rules are complicated and depend on whether you own the vehicle as an LLC, one-member LLC, corporation, or partnership. Consult with a tax professional for more information.

Comments

0 comment