views

Calculating Monthly Business Cash Flow

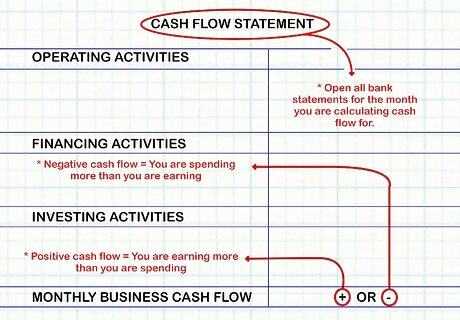

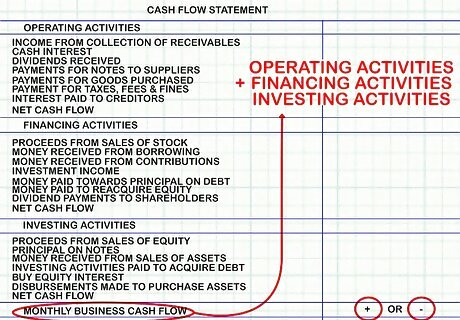

Create a spreadsheet. Create columns for operating activities, financing activities, and investing activities. Open all your bank statements for the month you are calculating cash flow for. Your objective is to determine whether you had a positive or negative cash flow for this month. A negative cash flow indicates that you are spending more than you are earning. A positive cash flow indicates that you are earning more than you are spending. You need to have a large enough positive cash flow that you can continue to invest in your company's growth.

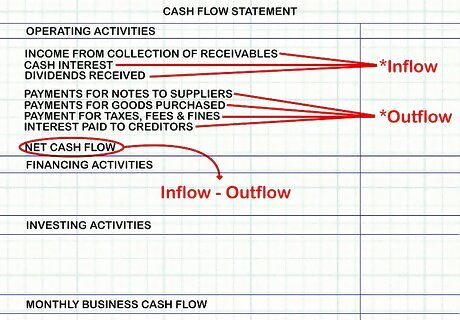

Calculate the net cash flow from operating activities. Add up the inflow, or money that came in, from daily operations and delivery of goods and services. Include income from collection of receivables from customers, and cash interest and dividends received. Next, calculate the outflow. Cash outflows from operations include cash payments for goods purchased, cash payments for notes to suppliers, cash payments to employees, cash paid for taxes, fees, and fines, and interest paid to creditors. Finally, subtract the outflow from the inflow. Write this number in the "Operating Activities " column. If the number is negative, indicate this with a – sign or sign of your choosing.

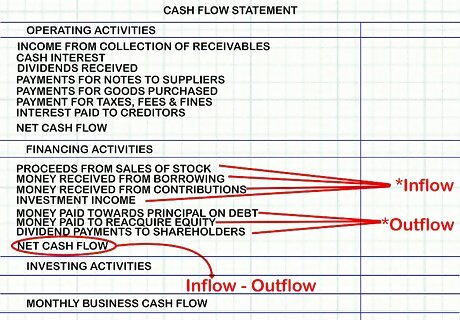

Determine net cash flow from financing activities. Add up all inflow you generated from debt or equity financing. This includes money spent or received from stocks, bonds and other securities. Include proceeds from sale of stock, money received from borrowing, and money received from contributions and investment income. Next, add up the financing outflow. Include money paid towards principal on debt, money paid to reacquire equity (buying back shares of stock), and dividend payments to shareholders. Subtract your outflow from your inflow, and write this number in the "Financing Activities" column of your spreadsheet."

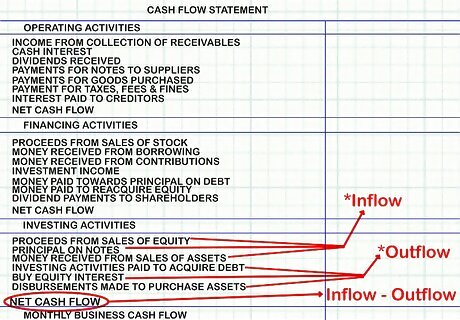

Figure out the net cash flow from investing activities. This section details how much cash your entity made from investments such as the purchase of stocks or bonds of another entity. Add up your inflow. This includes collected principal on notes, proceeds from sale of equity such as stocks or bonds, and money received from sale of assets or physical property such as plants and equipment. Add up your cash outflow, including money from investing activities paid to acquire debt, buy equity interest, and disbursements made to purchase assets or physical property such as plants and equipment. Subtract your outflow from your inflow, and put this number in the "Investing Activities" column.

Add all three columns together. Add the balance in your operating activities, financing activities, and investing activities columns together. This amount is your monthly business cash flow. If you have a positive number, you have a positive cash flow. If the number is negative, your business spent more than it earned that month.

Calculating Personal Average Monthly Cash Flow

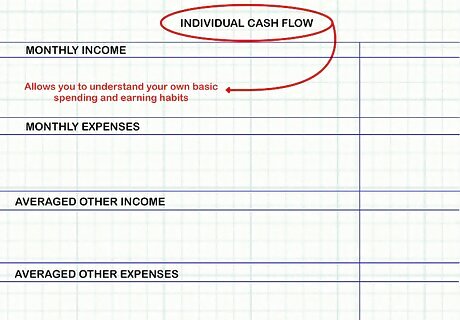

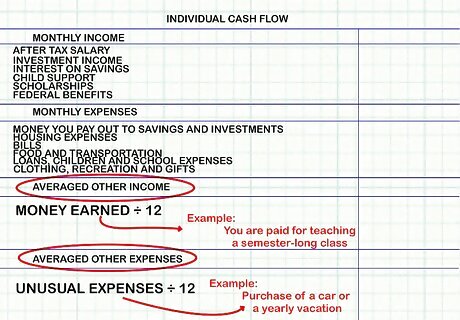

Look at your bank statement on a typical month. While businesses may need to review a statement of cash flow every month, you may wish to loosely calculate your individual cash flow in order to understand your own basic spending and earning habits. If you are thinking of investing, you may want to know what percentage of your income you can dedicate to investments. Create a spreadsheet with four columns: Monthly income, Monthly Expenses, Averaged Other Income, and Averaged Other Expenses.

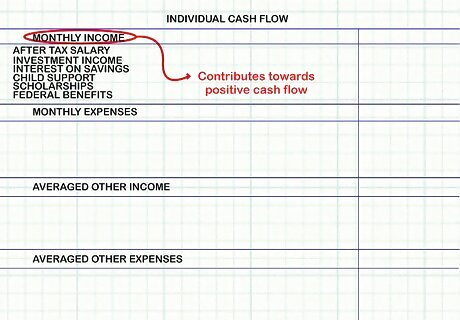

Start with your monthly income. Add up your after-tax salary, as well as any investment income, interest on savings, and income such as child support, scholarships, or federal benefits. This amount will contribute towards your positive cash flow. Any unusual income, that does not come in on a monthly basis, should be put aside for a separate column.

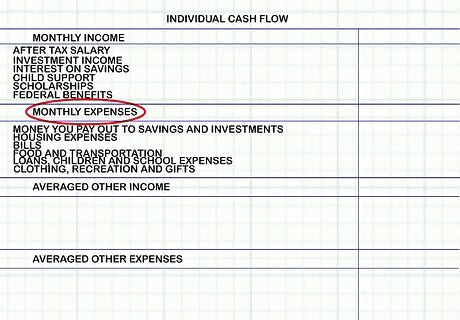

Add up your monthly expenses. Add together the money you pay out each month into savings and investments. Next, add your housing expenses, such as rent, mortgage, or property tax. Add your bills: electricity, gas, internet/telephone/cable, mobile phone bill, water or sewer, and any other bills you pay. Add the amount you spend on food, both groceries and food out. Calculate these separately if you eat out more than twice a week. Next, add the amount you spend on transportation: gas, tickets, taxis. Add the amount you pay in loans, the amount you pay for insurance and health care. If you have children, calculate what you pay in childcare, tuition, and extracurricular lessons and tutoring. If you are a student, add what you pay for your own school expenses. Finally, add the money you spend on clothing, recreation, and gifts. Include money spent on movie tickets, trips, and other typical monthly expenses. If an expense is large and unusual, put it in the "Averaged Other Expenses" column.

Average your unusual cash flow. Look over your accounts and determine any income you get on a non-monthly basis. For instance, if you are paid for teaching a semester-long class at the end of the semester, you may have a large influx of income that particular month. Take your non-monthly income and divide it by 12. Put that number in your "averaged other income" column. Take your unusual yearly expenses, such as a purchase of a car for your daughter's graduation, or a yearly vacation to see your relatives. Divide these expenses by 12, and put them in your "averaged other expenses" column.

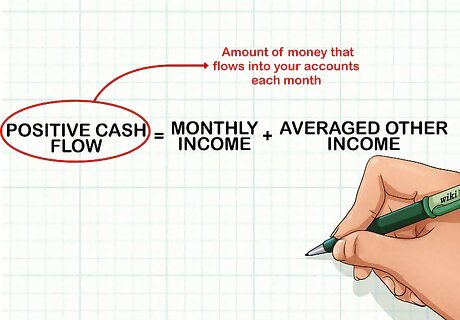

Add up your positive cash flow. Add your income and your averaged other income together. This is your positive cash flow: the amount of money that flows into your accounts each month. To verify, check your bank accounts to make sure that you start each month with roughly that amount coming in.

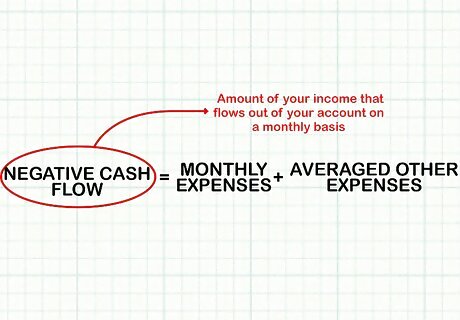

Calculate your negative cash flow. Add your expenses to your averaged other expenses. This is your negative cash flow: the amount of your income that flows out of your account on a monthly basis.

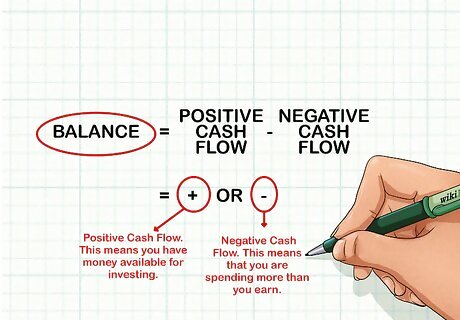

Subtract your negative cash flow from your positive cash flow. If the balance is a with a positive number, you have a positive cash flow. That means you have money available for investing. Think about investing some or all of your balance. If you end up with a negative number, you have a negative cash flow. That means you are spending more than you earn, and it's time to cut back on your expenses.

Managing Cash Flow

Monitor your cash flow. For a business, this means collecting inflow as near as possible to when it's recorded. Deposit checks daily, send invoices to customers, and collect receivables within a reasonable timeframe that will depend on your kind of business. Take advantage of any cash discounts available to you. Get ahead of yourself: use pre-numbered cash receipts, and account for them all. For disbursements, use pre-numbered checks. For the individual, keep close track of all your expenses. Save your receipts, and visit your bank account frequently. Depending on your business, you can try billing your customers at the end of the month, so everything's better organized. It's a good idea to work off retainers if you're dealing with an expensive service. This is a good way to protect yourself and keep your cash flow during the execution of the service.

Meeting unexpected expenses. Keep money set aside for unexpected emergency expenses, as well as unexpected opportunities for expansion. Anticipate shifts in payroll, debt payments, and the occasional large purchase. Put money aside every month to meet these expenses, as they will continue to arise. If most of your extra cash flow is tied up in investments, make sure there are ways to free some up in an emergency. Establish credit with your bank for moments of cash flow difficulty.

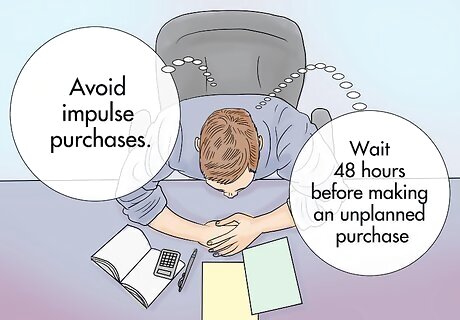

Manage your expenses. Review your outflow each month for any unnecessary or extravagant expense. In times of low inflow, review your discretionary spending, rent, capital costs, and payroll. Delay nonessential improvements and large equipment purchases until inflow has increased. Cut hours during non-crucial moments, and lay off anyone who is unnecessary or not pulling his or her weight. If you pay rent, negotiate with your landlord for a lease that will help you stay where you are. Individuals may want to follow simple cost-cutting practices, such as cooking at home rather than eating out. Plan your meals for the week over the weekend, and get all your groceries in one or two trips. Cook a large amount of two or three things you really like, and enjoy the leftovers. Businesses and individuals should avoid impulse purchases. Keep good stock of what you have and what you need. Wait 48 hours before making an unplanned purchase, and question any purchasing impulse that falls outside of your anticipated needs.

Comments

0 comment