views

X

Expert Source

John Gillingham, CPA, MACertified Public Accountant

Expert Interview. 3 March 2020.

It can also help you decide how to price your goods and services, how to pay your employees, and more.

Calculating a Business's Profit

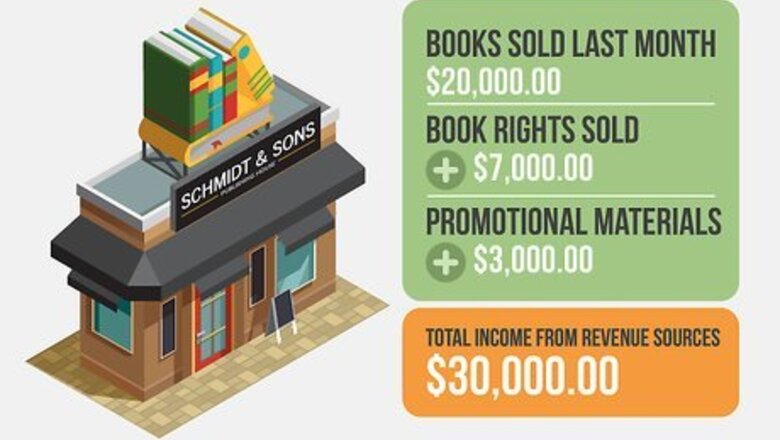

Start with a value for your business's total income. To find your business's profit, you'll want to begin by adding up all of the money your business has made in a set period of time (for instance, the quarter, year, month, etc.). Add up the total sales of goods or services by the business for the period in question. This can be from multiple sources, including products sold, services rendered, membership payments, or, in the case of government agencies, taxes, fees, the sales of resource rights, and so on. Note that you will need to subtract any amount of cash refunded to customers for returns or disputes in order to find an accurate figure for your total income. It's easier to understand the process of calculating a business's profit by following along with an example. Let's say that we own a small publishing business. In the last month, we sold $20,000 worth of books to retailers in the area. However, we also sold the rights to one of our intellectual properties for $7,000 and received $3,000 from book retailers for official promotional materials. If these represent all of our revenue sources, we can say that our total income is $20,000 + $7,000 + $3,000 = $30,000.

Calculate your business's total expenses for the accounting period. A business's expenses can be very diverse depending on the type of operations the business engages in. In general terms, a business's total expenses represent all of the money that the business spends in the accounting period being analyzed. See the section below for a detailed breakdown of the types of expenses that a business can incur as it operates. In our example, let's say that our business spent $13,000 total during the month that it made $30,000. In this case, we'll use $13,000 as our value for total income.

Subtract the total expenses from the total income. When you've found accurate values for your business's total income and expenses, calculating your profit is not difficult. Simply subtract your expenses from your income to find your profit. The value you get for your business's profit represents the amount of money it has earned in the period of time you are focusing on. This money is the business owners' to use as they please. They may want to re-invest the money in the business, use it to pay off a loan, pay a dividend to investors, or simply save it. In our example, since we have accurate, definitive figures for our income and expenses, calculating our business's profit is fairly simple. Subtracting our expenses from our income gives us $30,000 - $13,000 = $17,000 profit. Since we're the owners, we can use this money to buy a new printing press for our publishing company, increasing the number of books we can print and potentially earning us more profit in the long run.

Note that a negative value for profit is called a "net loss". Rather than saying that a business has turned a "negative profit", we usually say that a business has "run at a net loss" or has had a "net operating loss (NOL)". If your business generates a negative profit, this means that, for the time period you are focusing on, your business spent more money than it made. For nearly all businesses, this is something to be avoided, though, at the beginning of a business's life, this is sometimes unavoidable. In instances of NOL, a business may have to pay for its operating expenses with a loan or get additional capital from investors. A net loss doesn't necessarily mean that a business is in dire straits (though this certainly can be the case). It is not uncommon for businesses to run at a loss while they incur initial one-time expenses (buying offices, establishing a brand, etc.) until they become profitable. For instance, Amazon.com lost money for nine years (1994 - 2003) before it started turning a profit.

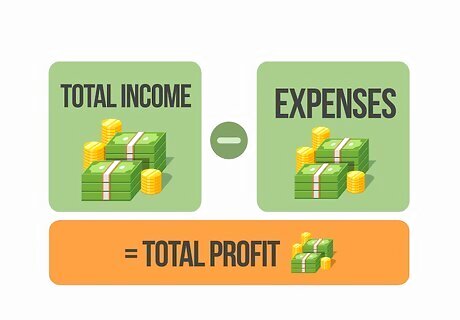

Consult a business's income statement for revenues and expenses. Since the actual calculation used to find a business's profit is fairly straightforward, the most difficult part of the process of finding a business's profit for a given accounting period is often finding accurate revenue and expense information. Luckily, most businesses are required to disclose accounting documents called income statements that list the company's sources of revenue and expenses in detail. Income statements usually contain detailed breakdowns of a company's sources of income and expenses as well as a "bottom line" value for the total profit during the accounting period (so called because it is usually found at the bottom of the income statement). Using the information on the income statement, it's possible to calculate a business's total profit with accuracy. In the next section, we'll explore a step-by-step breakdown of a business's sources of income and expenses much as an actual income statement would.

Breaking Down Revenues and Expenses

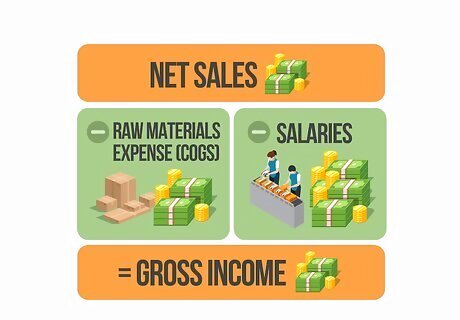

Start with the value of your business's net sales. While a company's profit is usually defined as its income minus its expenses, these two quantities are usually calculated from multiple sources of income and expenses themselves. Thus, if you're starting from scratch when calculating a business's profit, you may need to work with multiple values for sources of income and expenses, rather than single values for each. In this section, we'll break down a business's income and expenses to calculate profit in piecemeal fashion. Start with your net sales — the amount of money generated by the business from selling its goods and services, minus returns, discounts, and allowances for missing or damaged goods. To illustrate the process of breaking down a business's income and expenses, let's work through an example problem in this section. Let's say that we own a small company that makes high-end sneakers. For this quarter, let's say that we sold $350,000 worth of sneakers. However, due to a recall, we we had to pay out $10,000 in refunds. We also had to pay $2,000 for unrelated returns and discounts. In this case, our net sales are $350,000 - $10,000 - $2,000 = $338,000.

Subtract the cost of goods sold (COGS) to obtain gross income. Businesses have to spend money to make money. Products need to be assembled from raw materials, and, because neither the raw materials nor the labor needed to assemble them are free, this means that it costs businesses money to make the products that they sell. This cost is called the cost of goods sold, or COGS. COGS includes the material and labor costs directly tied to the creation of the product being sold, but not indirect expenses like distribution, shipping, and sales force pay. Subtracting COGS from net sales gives a value called gross income. In our sneaker company example, our company needs to buy fabric and rubber to make its sneakers and also needs to pay factory workers to assemble the raw materials into wearable products. If we say that we spent $30,000 on fabric and rubber and paid our factory workers $35,000 collectively this quarter, our business's gross income is $338,000 - $30,000 - $35,000 = $273,000. Note that in situations where the business in question doesn't sell any physical products (like, for instance, if the business is a consulting firm), a value similar to COGS called cost of revenue is used. Cost of revenue includes expenses directly related to your business making its sales, like direct labor costs and sales commissions, but excludes indirect expenses like employee salaries, rent, utilities, and so on.

Subtract all operating expenses. Companies don't just have to spend money to sell their products and/or services to consumers. They also have to pay their employees, fund marketing efforts, and keep the lights on at their offices. These expenses are collectively called operating expenses and are defined as the expenses needed to keep the business running that are not directly related to the manufacturing or implementation of the products or services being sold. For our sneaker company example, let's say that we paid our non-factory employees (sales force, managers, etc.) $120,000 collectively. We also paid $10,000 in rent and utilities and spent $5,000 running ads in trade magazines. If these are all of our operating expenses, we would subtract $273,000 - $120,000 - $10,000 - $5,000 = $138,000.

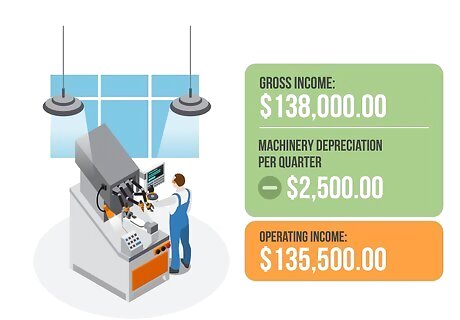

Subtract depreciation/amortization expenses. Once you've subtracted your business's operating expenses, you'll want to subtract expenses due to depreciation and amortization. Depreciation and amortization are related (but not identical) expenses. Depreciation represents the loss in value of tangible assets like equipment and tools due to wear and tear from normal operation over the lifespan of the asset, while amortization represents the loss in value of intangible assets like patents and copyrights over the life of the asset. Subtracting these expenses from your running total after subtracting operating expenses gives you your business's operating income. In our sneaker company example, let's say that the machinery used to manufacture our sneakers cost $100,000 and has a 10-year lifespan. Assuming straight-line depreciation, the machinery depreciates by $10,000 per year, or $2,500 per quarter. If this is our only depreciation/amortization expense, we can subtract $138,000 - $2,500 to get our operating income, $135,500.

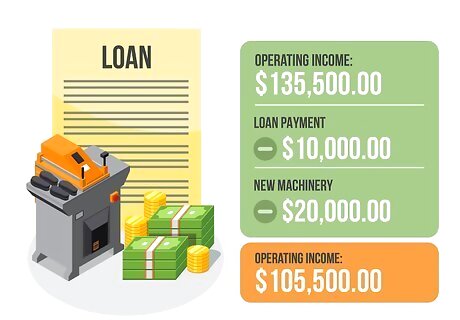

Subtract any other expenses. Next, you'll want to account for any extraordinary expenses that can't be attributed to normal business operations. These can include expenses due to loan interest, paying off debts, buying new assets, and more. These can vary from one accounting period to the next, especially if the company's business strategy changes. Let's say that our sneaker company is still paying off the initial loan we used to start the business. In the last quarter, we paid $10,000 towards our loan. We also bought a new shoe-making machine for $20,000. If these represent all of our extraordinary expenses for the quarter, we can subtract $135,500 - $10,000 - $20,000 = $105,500.

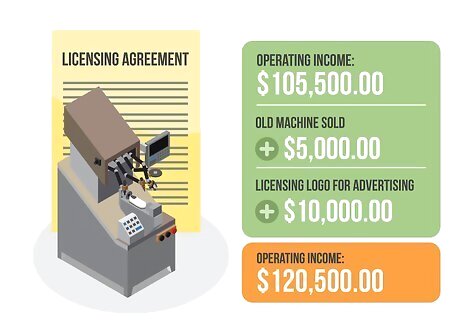

Add any one-time revenues. In addition to having extraordinary expenses, a business can also have one-time sources of income. These can include business deals with other companies, the sale of tangible assets like equipment, and the sale of intangible assets like copyrights and trademarks. Let's say that, in the last quarter, we sold an old shoe-making machine for $5,000 and we licensed our logo for use in another company's advertisements for $10,000. In this case, we would add our one-time revenues to our running total: $105,500 + $5,000 + $10,000 = $120,500.

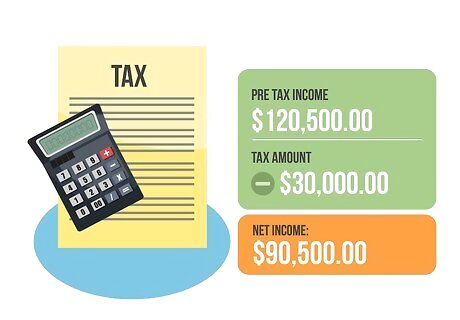

Subtract taxes to find your net income. Finally, when all other revenues and expenses have been accounted for, the last expense that is usually subtracted from a business's revenues on an income statement is its taxes. Note that taxes may be levied on a business by more than one government entity (for instance, a business may need to pay both state and federal taxes). Additionally, tax rates can change based on where the company does business and how much it makes in profits. Once you've subtracted your expenses due to taxes, the value you have left is your business's net income, which can be spent as the owners please. In our example, let's say that, based on our business's level of pre-tax income, we are taxed $30,000. Subtracting $120,500 - $30,000 = $90,500. This represents our business's net income, which means we profited $90,500 for the quarter. Not bad!

Comments

0 comment