views

Obtaining a Business Credit Report

Go to the credit bureau’s website. There are three different credit bureaus that compile data on business’ credit history: Dun & Bradstreet, Experian, and Equifax. All three companies have roots dating back to the 1800s, but Dun & Bradstreet has been active in the US for the longest. You can find the relevant part of Dun & Bradstreet’s website at http://www.dnb.com/duns-number/lookup.html. Experian’s website for checking business credit reports is http://www.experian.com/small-business/business-credit-scores.jsp. Equifax’s business credit reporting section is at http://www.equifax.com/business/business-credit-reports-small-business.

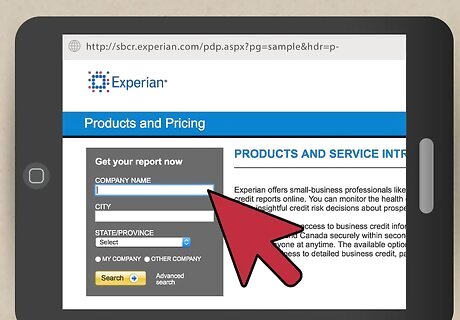

Conduct a search for the company you want to look up. Your next step is to find the company whose credit history you want to research. Do this before you make a purchase, because all of the bureaus might not collect data on your target company. Anyone who is willing to pay can look up a business' credit report, all you need to get started is the company’s name along with the state and country where they do business. Of course, more information makes for a quicker search. On the Dun & Bradstreet website, you’re going to do a search for a company’s D-U-N-S number, which is the identifying number they use to keep track of businesses. You can find the D-U-N-S number by looking up the business’ name and place of business. On the Equifax and Experian website, you’ll just look the business up by name and address.

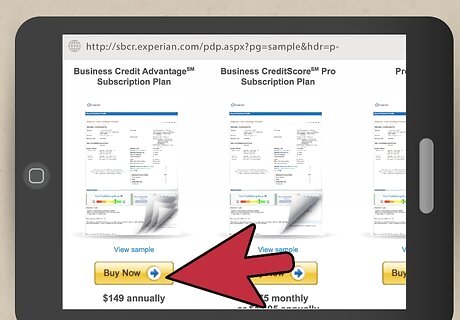

Make your purchase. Once you’ve determined that your target business has a history with the credit bureau in question, all you have left to do is purchase the report. You’ll just need payment and identifying information—name, address, and credit card number. While there are levels of detail with respect to the reports the credit bureaus offer, as of 8-2016, the prices for a basic business credit report for each of the reporting agencies are as follows: Experian’s basic report is $39.95. Equifax’s basic report is $99.99. Dun & Bradstreet’s basic report is $61.99. Sample credit reports are available for all three companies on their websites, usually in the section where you would select a credit report to purchase.

Understanding a Dun & Bradstreet Credit Report

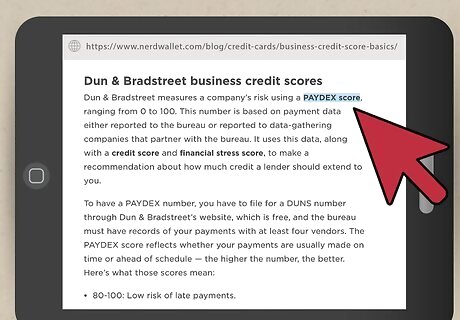

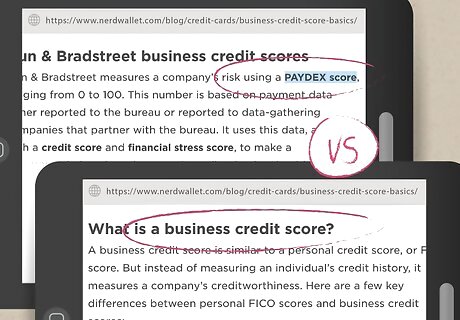

Make sure you understand the PAYDEX score. The PAYDEX score is Dun & Bradstreet’s summary of whether or not a business usually pays on time, based on the history of on-time payments. The PAYDEX number is scored from 100-1, with 100 being the best score and 1 being the worst. So if a company has a PAYDEX of 89, that means there is a very small likelihood of the company falling behind in payment. The PAYDEX score also shows the time that payments have been received versus when those payments were due.

Distinguish between credit score and PAYDEX. In a Dun & Bradstreet report, the credit score looks forward. It is a prediction of future payments. It is based on both payment history and comparisons to other companies of similar size with similar payment histories. Dun & Bradstreet credit scores are rated from 1-5, with 1 being the best and 5 being the worst.

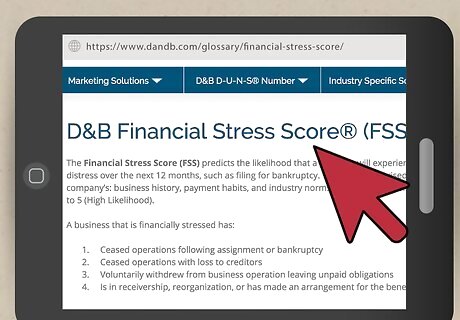

Interpret the financial stress score. The financial stress score is another forward-looking metric. It attempts to predict the likelihood of severe financial difficulty in the next year. The financial stress score is based on many factors, including: Changes in net worth, the proportion of on-time payments and delinquent accounts, legal action taken against the company, and the current level of debt. The financial stress score is also measure from 1-5, 1 being the best and 5 being the worst.

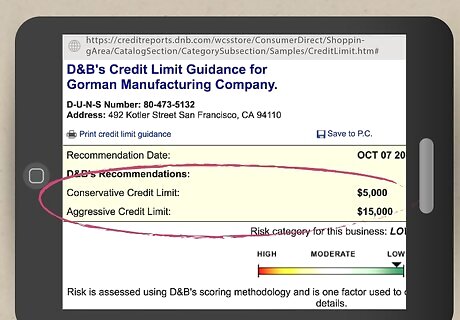

Consider the credit limit recommendations. Based on those three factors, Dun & Bradstreet will make a recommendation on whether any further credit should be extended to the business. Dun & Bradstreet also suggest how much credit should be extended, and how risky it would be. They will provide a conservative lending estimate and an aggressive estimate.

Understanding an Equifax Business Credit Report

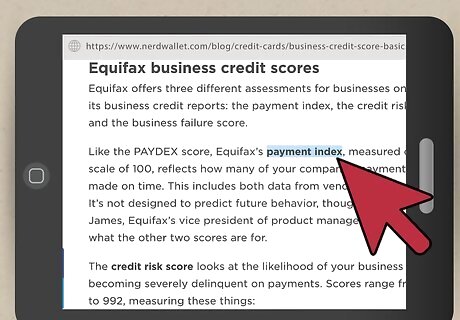

Examine the payment index. The payment index is similar to Dun & Bradstreet’s PAYDEX score. It serves as a measure of a business’ history of timely payments. The payment index is measured on a scale of 100-1, with 100 being the best and 1 being the worst.

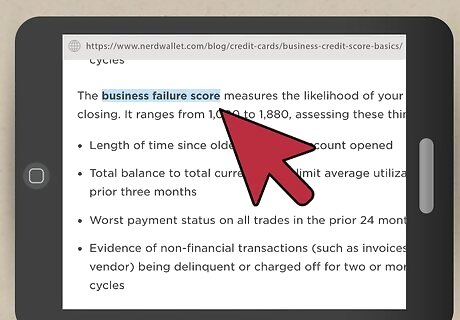

Take the business failure score into account. The business failure score is a measure of how likely Equifax thinks the target business would be to fail in the next year. The business failure score considers several factors, including: The proportion of credit utilized relative to the business’ credit limits. The number of delinquent and late non-financial accounts. The age of the oldest financial account. The score is calculated from 1880-1000, with 1880 being the best and 1000 being the worst.

Evaluate the overall credit risk score. The credit risk score is the predictive measure in the Equifax report. It estimates the risk that a business will become delinquent on an account should credit be extended. It is based on several factors, including: Company size Late payments and delinquent accounts. Age of accounts. The percentage of available credit that’s utilized. The score is calculated on a scale from 992-101, with 992 being the best.

Understanding an Experian Business Credit Report

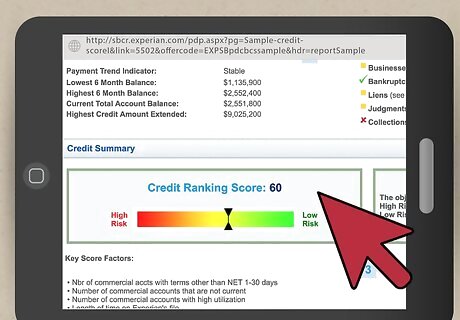

Learn what makes an Experian report unique. Unlike the reports for Dun & Bradstreet and Equifax, an Experian business credit report assigns one general risk level—and that’s it. Experian doesn’t index payment histories or attempt to score a business’ viability, and it doesn’t provide a suggested lending amount. The possible scores range from 100-1, with 100 being the best and 1 being the worst. Even though Experian doesn’t provide scores for payment history or financial stress, it does provide information describing payment history and financial health. This includes payment history, delinquent accounts, bankruptcies, judgements, and liens.

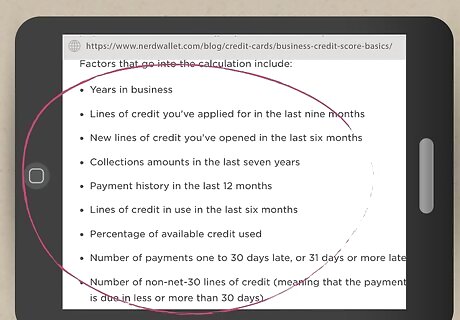

Understand the different factors that comprise the score. There are several factors that go into the creation of the score. Most of these factors show up in the more narrow metrics that the other credit rating companies provide in their reports. The factors include: Age and size of the company. Number of financial and commercial accounts which are late. Available credit vs. the percentage of credit which is utilized. New lines of credit and new credit applications.

Be aware of the bias. Experian weights age and size of the company more heavily than do the other ratings agencies. Therefore, smaller companies are assigned higher risk factors, even with histories of good payment, than are larger companies.

Comments

0 comment