views

- Request a rental history report from a consumer reporting company like Experian RentBureau or TransUnion SmartMove.

- Check to make sure the previous addresses, landlords’ names and contact information, rental rates, and occupancy dates on your rental history are correct.

- If any information is incorrect, write a letter describing the error and send the dispute to the consumer reporting company.

Checking Rental History as a Tenant or Landlord

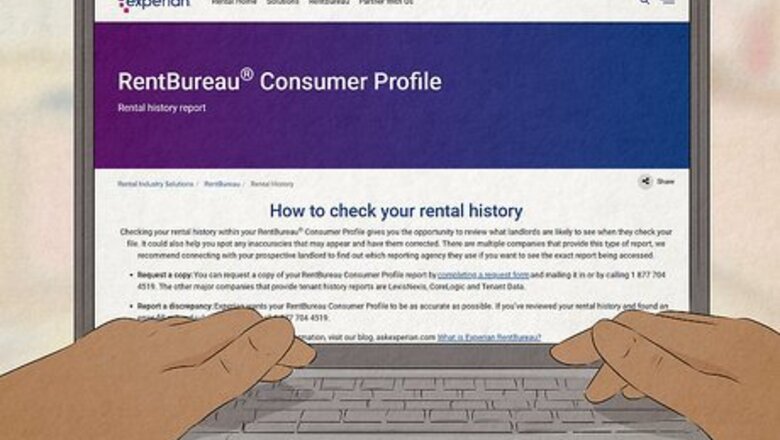

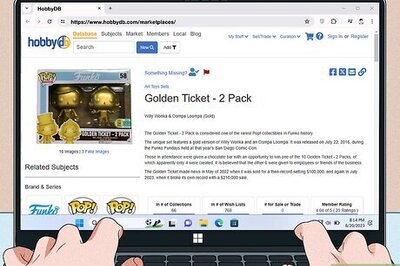

Request your rental history report from a third-party company. Third-party consumer reporting companies have to provide one free report every 12 months if you request it. If you’re applying to rent a property, ask the management for the name of the company they’ll use to screen your application. If you’re a landlord, register through one of these reputable tenant screening companies: Experian RentBureau TransUnion SmartMove AmRent Screening Reports, Inc. Real Page, Inc. SafeRent Solutions First Advantage Resident Solutions RentGrow, Inc. AppFolio, Inc. Contemporary Information Corp (CIC) This company will also provide you with a free eviction report every 12 months if you or your prospective tenant have one. Requesting a copy of your own credit/rental report will not hurt your credit score.

Alternatively, compile rental screening documents individually. Although most landlords request your rental history from a third-party consumer reporting company, you can compile the same documents that these companies receive yourself and review them. However, this method may not show whether your reported rental history is accurate. Compile a list of the locations you previously rented with the current landlords’ contact information, the rate you paid, and your dates of occupancy. Your potential landlord may reach out to a prior landlord to ask about your rental history. Note any evictions you’ve had or eviction cases you’ve won. If you’re a landlord, call the prospective tenant’s previous landlords and ask about their rental history or conduct a full tenant screening through one of the consumer reporting companies.

What does a rental history include?

A history includes rental payments and any issues caused by the tenant. Potential landlords request a tenant screening report to give them a clear picture of a tenant’s rental record and determine if they should accept them as a tenant at their property. A rental history typically includes: The amount the tenant paid each month at each property they rented The tenant’s dates of occupancy at each rental property Any concerns that may have been raised during their time as a tenant (such as damage to the unit, late rent payments, broken leases, neighbor complaints, or eviction notices) Any recommendations (positive or negative) a tenant has from past landlords A tenant screening report includes all of the above information plus their credit report, an employment verification, their criminal history, the sex offender registry, the national terrorist watchlist, and a risk score.

Disputing Errors on Your Own Rental History Report

Make sure your rental history report is accurate. Before any potential landlords see your rental history report, make sure all your previous addresses, landlords’ names and contact information, rental properties’ prices, and occupancy dates are correct.

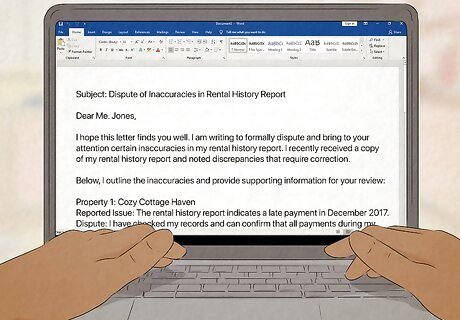

Write a dispute letter if you find an error in your report. Explain what is incorrect and why, and include copies of documents that support your dispute. You can use this dispute letter template as a guide. If you don’t want to file a dispute, some companies allow you to add a note about the error and any supporting documentation that will be available when others request your report. Your contact information, including your complete name, address, and telephone number. Your credit report confirmation number, if available. Every error you’d like fixed, including the account number for any account you may be disputing. A clear explanation of why you’re disputing the information. A written request that the information be removed or corrected. A copy of the portion of your credit report that contains the disputed items, with the disputed items circled or highlighted. Copies of the documents that support your dispute (such as past leases, credit reports, account numbers, or payment receipts).

Send any disputes to the appropriate consumer reporting company. Send your dispute letter and any relevant documentation to the consumer reporting company online, by mail, or by fax. The reporting company will investigate your dispute, forward your documentation to the bank, landlord, or credit card company that made the error, and report the results to you. If the dispute is approved, the company that made the error will notify you and all consumer reporting companies. The reporting companies will update their reports. If the consumer reporting company and the bank, landlord, or credit card company believe their information is accurate, they’ll notify you and leave your rental history report as-is.

Improving Your Rental History Report

Pay your rent and utility bills on time. Try to pay your rent in full on the day that it’s due. If you forgot to pay a late fee or made another payment error, talk to your landlord and ask them to expunge it from your rental report. Keep a receipt of any transactions to prove that you paid off your rent. If you owe money to a previous landlord, pay it off completely or set up a monthly payment plan. If you find it difficult to pay your rent on time, set up a budget to manage your income and expenses and keep track of your rent and other bill due dates.

Communicate respectfully with your landlords. Try to always part with your landlords on good terms so they don’t give a bad reference to your future landlords. Try to answer questions when they ask and communicate any maintenance issues when they happen so that your landlord can leave a positive recommendation on your rental history report. If your rental history report has a negative reference, negotiate with your previous landlord to give you a simple reference letter stating that you paid your rent on time. You can also gather documents that explain a landlord’s bad reference, like evidence of medical or financial problems that caused you to skip rent payments.

Take care of the properties you rent. Report any damages or major maintenance issues directly to your landlord, clean your rental regularly, and take care of what you’re responsible for (like replacing smoke detector batteries, changing the HVAC filter, or mowing or landscaping). When you move out, try to leave your unit in the same or better condition as when you moved in. Make sure the unit is completely clean and fix any damages before you leave. Taking care of (or even improving) the property might improve the chances that your landlord will recommend you to another property manager.

Explain any bad history reports to new landlords before submitting your application. If you have a rental history report that describes late payments, outstanding debts, damages to the unit, or lease violations, do your best to explain your circumstances to your potential landlord before they get your rental report. For example, if you were evicted because you lost your job, explain what happened, what’s different in your life now, and why paying rent at this location will not be a problem. Ask past landlords to write you a positive recommendation that includes the dates of tenancy, your rental rate, and a brief description of your tenancy, and include this with your application. Your transparency and any extra documentation you provide (like income statements, history of on-time utility or phone payments, or a good credit score) may give them a more accurate picture of who you are as a renter. You can also ask to apply with a cosigner or put down a larger security deposit to show a potential landlord that you’re less of a financial risk than the rental history report shows.

Other Factors Landlords Consider Besides Rental History

Income and employment Prospective landlords verify your employment status and income to make sure you have enough money to afford rent each month. They might ask for your bank account numbers, copies of your pay stubs, and/or your current employer’s phone number. If you’re not comfortable providing your bank account number, you might be able to submit a copy of your bank statement with your name and account history with the numbers blacked out. Depending on the state or the landlord, a potential landlord might ask that you earn double or triple the amount of rent each month.

Credit history Your credit report can reflect how financially responsible you are. Before submitting a rental application, let your prospective landlord know about any bad marks on your credit report and explain what you’re doing to clean up the problem. Some landlords might be more willing to work with you if you’ve created a payment plan to pay off past debts. To request a copy of your credit report for free, visit AnnualCreditReport.com. You can request a copy of your credit report from Experian, Equifax, or TransUnion. If you have no rental history but you have a good credit history, consider including it in your application even if it’s not required. You might be able to rent a property with bad credit if you have a great rental history with positive recommendations from past landlords.

Criminal background Potential landlords usually run a background check on potential tenants, and any cases, past misdemeanors, or felonies that come up may raise a red flag. Ask potential landlords if they will rent to someone with a criminal record before submitting your application to avoid paying unnecessary screening costs. Arrests can remain on your report for 7 years from the date of entry unless it has a longer statute of limitation. Depending on the conviction, the state the crime was committed in, and the amount of time that has passed, you might be eligible to expunge your criminal record. If you find outdated or inaccurate information on your criminal background check, file a dispute with the consumer reporting company.

Past evictions If a landlord ever filed a lawsuit to evict you, it’s best to be upfront about it with a potential landlord. Make sure any judgments against you have been paid off, explain your circumstances to the potential landlord, and ask them if they’re willing to rent to tenants with past evictions on their record. If you were evicted illegally or won in eviction court, give your landlord a written explanation or letter from the court stating that you won the case or confirming that the eviction was illegal. Even if you won, the eviction might still be on your record and be used against you in the tenant screening process. If you provide a letter from the court, the new landlord may be willing to consider the extenuating circumstances. If you find outdated or inaccurate information on your rental background check, file a dispute with the consumer reporting company.

Self-Reporting Your Rental Payments

Use a rent reporting service if you need to build your credit quickly. You can use a rent reporting service to include on-time rental payments on your credit report, which can improve your credit score for future applications. Many of these services charge you $2 to $10 each month, which might be worth it if you need to buy a home or make a major purchase quickly. These services typically contact your landlord each month to verify that you paid your rent on time, which they then report to the credit bureaus. Most services also charge you a one-time fee when you sign up—this can range anywhere from $10 to $95. Ask your current landlord to see if they use a service—they might have a landlord-initiated program that’s free for tenants.

Choose a service that reports your information to 2 or 3 major credit bureaus. Some services only report to 1 of the 3 credit bureaus (Experian, Equifax, and Transunion), which can be an issue if a prospective landlord looks at a service your credit boost doesn’t appear on. There are a ton of rent reporting services out there, so here are a few reputable renter-initiated ones: Self Rent Reporting: Enter your email and follow the instructions onscreen. Costs $0 a month and reports to all 3 bureaus. Boom Pay: Install the app to sign up. Costs $3 a month and reports to all 3 bureaus. Rental Kharma: Sign up online or call 720-307-1466. Costs $8.99 per month with a one-time $75 setup fee and reports to TransUnion and Equifax. Rent Reporters: Choose your plan and follow the instructions on screen. Costs $9.95 (billed per month) or $7.95 (billed annually) with a one-time fee of $94.95 and reports to TransUnion and Equifax. Rock the Score: Enter your name, email, and phone number and follow the instructions on the screen. Costs $6.95 a month with a one-time fee of $48 and reports to TransUnion and Equifax. Landlords can request a demo to enroll their tenants in services like Bilt Rewards, ClearNow, Esusu, Jetty Credit, PayYourRent, or RentDynamics.

Comments

0 comment