views

Preparing to Start the Business

Choose a company name. The first step is to choose a company name and then choose a corporate address. Make sure to get a phone and fax number. You should search your state’s business filing office to find out if a name has already been taken.

Draft your business plan. By writing a business plan, you will force yourself to think about the current likelihood of success as well as future growth opportunities. A comprehensive business plan will help steer you toward your goals. At a minimum, the plan should include the following: Executive summary. You will need to briefly describe the nature of your business and why you think it will be successful. The executive summary should contain your mission statement as well as company information. As a startup, you should focus on explaining how your experience and background will contribute to the business’s success. Company description. Explain the nature of the business, your intended market, and the market needs your lending business will satisfy. For example, you might want to meet the small loan needs of your community, which are underserved. Market analysis. You should explain the size and distinguishing characteristics of your target market. For example, you may want to make small loans to new immigrants in your community seeking to start a business. You would then explain how few lenders have tapped into that market. Also identify your competitors and describe their strength or weakness in the market. Product line. Describe the loans you want to make. You should explain the advantages of your loans over those of competitor’s. Marketing and sales. Discuss your overall sales strategy, including your plans for growth. For example, you may hope to grow geographically, offering your loans to a larger community. Or you might hope to grow by offering additional types of loans to your current market. Financial projections. Based on your market analysis, you should forecast your projected finances for five-years out.

Settle on financing. Another component of a business plan is funding. However, this element is so critical to a money lending business that you should spend extra time considering how you will fund the loans that you extend to borrowers. Some money lenders have dipped into their retirement accounts, such as their IRAs and 401(k) accounts, to fund their loans. Experts encourage money lenders who do this to understand the risks that they are taking. For example, loans might not be repaid, in which case you could lose a large percentage of the loan amount. If you seek funding from investors, then you will need to work closely with a lawyer to draft a prospectus to share with investors. State and federal laws tightly regulate how you advertise securities to potential investors. Your lawyer will need to be experienced in securities regulation.

Draft underwriting criteria. A successful money lending business does not lend to anyone who walks in the door. You need to evaluate each applicant according to a set of criteria. This is called underwriting. You will need to draft your criteria before you begin making loans. Generally, you will assess risk by gathering information about the loan applicant’s financial history. For example, you would want to look at their income, FICO score, and other debt load.

Attend seminars. You will need coaching and advice from people who have started successful money lending businesses themselves. Accordingly, you should find seminars and national conferences to attend where you can network and rub shoulders with experts in the business.

Meet with a lawyer. A lawyer will be an invaluable asset, so you should certainly hire one. He or she will research and answer any questions you have. Also, an attorney can help you incorporate and fill out other required paperwork. To find an experienced business lawyer, you can visit your state’s bar association website, which should run a referral program. You can research any attorney by visiting his or her website. Look for experience with business formation, as well as banking or lending experience. If you are starting a lending business for real estate, then look for an attorney who has real estate experience as well.

Buy your domain name. The amount of marketing you want to engage in will be determined by the scope of your market. However, a website is a must nowadays for any business, regardless of the business’s size. You can purchase your domain name from various registrars. Search the internet for “where to purchase domain name” and look at the different companies that provide this service.

Registering Your Business

Incorporate. The first order of business is to incorporate. There are many corporate forms: corporations, sole proprietorships, limited liability companies, etc. You should talk over each form with your attorney, who can advise you as to which corporate form is most appropriate for your money lending business. To incorporate, you will have to file articles of incorporation with your state. Your attorney should be able to get them, or you can get them yourself from your Secretary of State.

Apply for necessary licenses. You will also need permission from your state in order to legally start a money lending business. You will get that permission by obtaining a license for money lending. Your attorney can get the form for you. Alternately, you can check your state’s Secretary of State website to see if an application is available for download. In addition to state licenses, you may need municipal or local licenses. You must contact your state business licenses office and search for applicable licenses or permits. The Small Business Administration has links to each state’s office at https://www.sba.gov/content/what-state-licenses-and-permits-does-your-business-need.

Register your business name. If you choose as a business name anything other than your own personal name, you will need to register it with the necessary authorities. This is called your DBA, or “doing business as” name. You will need to register with either your local government or a state agency—or both. Not every state requires that you register a “doing business as” name. You can check registration requirements with your Secretary of State office as well as with your county clerk’s office.

Register with the Securities and Exchange Commission (SEC). If your money lending business has investors, then you may need to file with the appropriate securities commission. If you make a public offering of the securities, then your lawyer will have to register you with the SEC. You should check with your attorney whether or not you need to register the securities and which agency you need to register with.

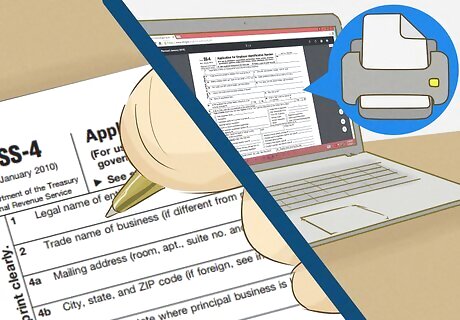

Get a business tax identification number. Unless your money lending business is a sole proprietorship, you will need a tax identification number, also called an EIN. You can get an EIN from the IRS in the following ways: You can apply for an EIN online. This is the preferred method. To start the application, visit the EIN Assistant at https://sa.www4.irs.gov/modiein/individual/index.jsp. You can also apply by mail or fax by printing off Form SS-4 available at http://www.irs.gov/pub/irs-pdf/fss4.pdf. To find out where to mail or fax your form, you should visit the IRS website at https://www.irs.gov/filing/where-to-file-your-taxes-for-form-ss-4.

Know debt collection laws. Lending businesses most often get into trouble when they are trying to collect money from their customers. Before going into the lending business, be sure you understand what you can and cannot do to collect money owed to you. Under federal law, specifically the Fair Debt Collection Practices Act, you are prohibited from harassing or abusing the customer that owes you money. Also, you cannot use false, deceptive, or misleading means to collect any debt. If you fail to obey federal law, you and your business could face stiff civil penalties. Each state will also have laws prohibiting certain debt collection activities. For example, in Iowa, you are prohibited from making illegal threats or from coercing or attempting to coerce a customer into paying a debt.

Hire a compliance professional. You will want to retain someone who can review your practices and make sure that you are in compliance with local, state, and federal laws. To find a compliance professional, you can ask your lawyer for recommendations. Alternately, if you met anyone at a national conference or panel, you could contact them for a recommendation.

Launching Your Business

Rent office space. Unless you are an entirely online business, you will need an office. Indeed, having a physical office can make your money lending business look more professional. If you decide to rent commercial space, then keep the following in mind: Rent is often one of the largest expenses for a new business. Accordingly, you should budget and not spend more than you can afford. Try to negotiate a one- to two-year lease with an option to renew. Because you don’t know if your business will be successful or not, you shouldn’t sign an initial lease for longer than that. Find out what other expenses you might incur in addition to the rent. For example, you could have to pay for maintenance and repair, upkeep, and utilities. Negotiate some add-on clauses, such as a right to sublease or an exclusivity clause (which prevents a landlord from leasing to a direct competitor at the same location).

Open a bank account. You will need to open a bank account for your money lending business. You will deposit funds into the account and then draw the funds out when you make a loan. The information you need to open an account will vary depending on your corporate form, but generally you will need: Business tax identification number (or Social Security Number if sole proprietor) Business license Business name filing document Articles of incorporation with corporate officers listed (for a corporation)

Create contracts. Before extending a loan, you should have the borrower sign a loan agreement. You can have your attorney draft loan agreement contracts, or you can look for samples on the Internet. If you are lending money for real estate, you will need not only the promissory note but also the mortgage note. Lenders working in the real estate field also typically use other documents, such as Letters of Intent (LOI) and preliminary title reports. You should ask your attorney or compliance professional about what other contracts are necessary. For more information on loan agreements, see Write a Loan Agreement.

Advertise. In addition to your website, you will need to advertise so that the public can find you. The extent of your advertising will depend on your budget and your immediate business goals. If you want to make a few loans to acquaintances or people in your neighborhood, you could rely on word of mouth. However, if you want to reach a larger market or grow more quickly, then you should consider advertising in newspapers or online. You should also consider advertising in the form of imprinting your company name on pens, paper, calendars, and other giveaway items.

Comments

0 comment