views

Union Budget 2023 has amended income tax slabs for the new tax regime and has increased rebate under Section 87A for the new regime for income up to Rs7 lakh. While these amendments have been made in the new tax regime, all tax slabs and rebates under Section 87A for income tax assesses opting for the old tax regime remain the same. This article endeavours to compare the impact of the Budget on assessees opting for the new and old tax regimes.

This year’s Budget has amended the tax slabs for assessees (taxpayers) opting for a new tax regime. At the same time, the tax slabs for assessees opting for the old tax regime remain unchanged. Along with that, Finance Minister Nirmala Sitharaman has given an additional sop to the assessees opting for the new tax regime. This SOP is in the form of a higher rebate under Section 87A.

Before going further, it is imperative for everyone to understand what Section 87A is and how it operates. A rebate under Section 87A is a reduction of tax liability. This was limited to Rs 12,500 for all taxpayers who had an income of not more than Rs 5 lakh. As per the old tax regime, if any taxpayer had an income of Rs 5 lakh, after claiming all deductions under Chapter VIA, then the tax liability that arose was Rs 12,500. This rebate amount is deducted from the tax liability. Against that the taxpayer got a rebate of Rs 12,500. Effectively, the net tax liability became zero and the taxpayer did not have to pay any tax on his income up to Rs 5 lakh.

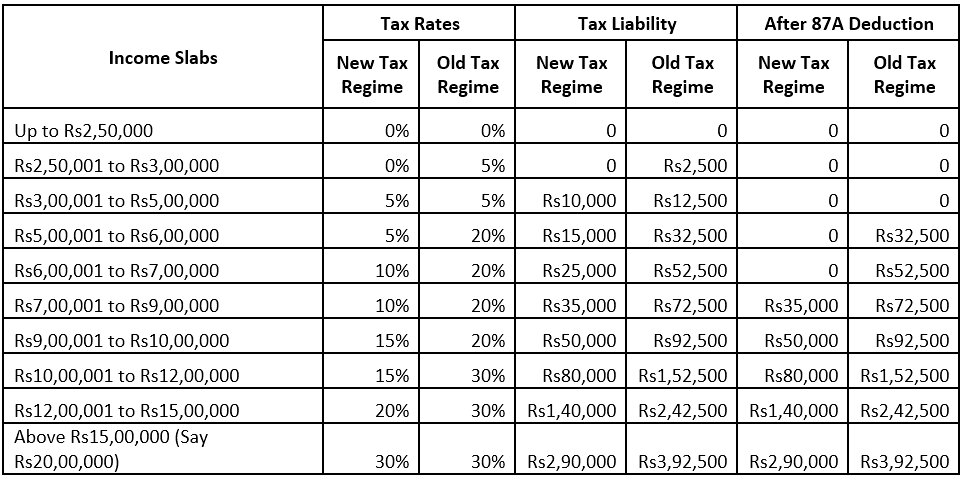

Now as per this year’s budget, the rebate for taxpayers opting for the new tax regime is increased to Rs 25,000 and on a taxable income of Rs 7 lakh. This means that as per this year’s budget, any taxpayer who earns Rs 7 lakh and has to pay a tax of Rs 25,000 (see table 1) will be able to avail the rebate of Rs 25,000 and in turn, he will not have to pay any tax.

Table 1: Net Tax Liability

This table is made without factoring benefits of Chapter VIA (Section 80C, 80CCC, 80CCD, 80D, etc). The benefits of Chapter VIA are available in the form of a deduction from gross total income and that is available only under the old tax regime. The new tax regime was introduced to simplify tax calculation and get freedom from complexities arising from computation of deductions on account of investments in LIC policies, PPF, mediclaim etc. Maximum tax benefits arising from deductions under Chapter VIA for a normal young person is Rs. 2,50,000. If that is factored in the calculations above, then the benefits table will look like this. (See Table 2).

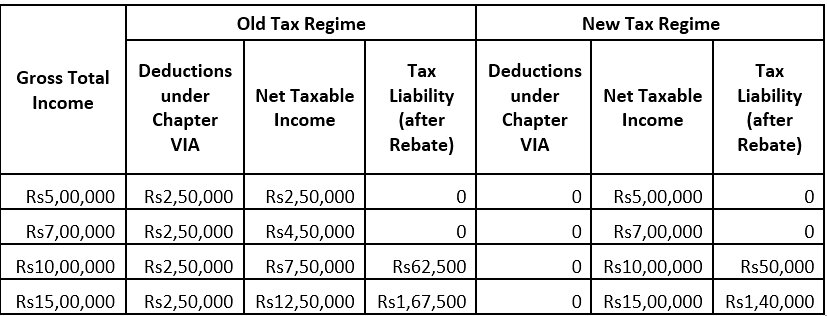

Table 2: Comparison of tax liabilities after availing deductions under Chapter VIA

This table makes it evident that people opting for the new tax regime and foregoing deductions under Chapter VIA is beneficial for taxpayers. As per this table, a person with a gross total income of Rs 7 lakh and availing all deductions under Sec 80C, 80CCC, 80CCD, and 80D will not have to pay any tax under the old tax regime. However, the same person will not have to pay any tax under the new tax regime even if he doesn’t make investments that are eligible for deductions under Chapter VIA.

This makes it evident that the intent of the government is to make the new tax regime more attractive to salaried and small taxpayers. The intent of the government is also to relieve small taxpayers from all hassles of tax planning using investment schemes in order to reduce tax liability.

This is a welcome move and helps in simplification of tax compliance.

Sumeet Mehta is a Chartered Accountant by qualification and a corporate finance professional. He is author of the book, ‘Diagnosing GST for Doctors’. published by CNBC Books18. He tweets from @sumeetnmehta. Views expressed are personal.

Read all the Latest Opinions here

Comments

0 comment