views

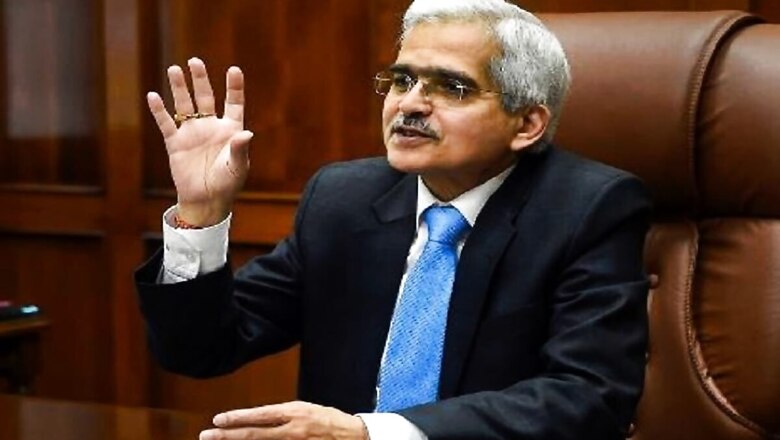

The Reserve Bank of India's Monetary Policy Committee has left the key lending rates - repo rate and reverse repo rate - unchanged, RBI Governor Shaktikanta Das announced on Thursday as the central bank predicted real GDP growth to remain negative for financial year 2020-21.

However, he said that any positive news on the COVID-19 containment efforts would change this scenario.

Continuing with the accommodative stance, Das said that the monetary policy committee decided to keep policy repo rate at 4 per cent and reverse repo rate at 3.35 per cent. "Early signs of revival in May/June were subdued in July due to renewed surge in COVID-19 cases," he said.

Repo rate is the rate at which RBI lends funds to commercial banks when needed. In 2020, the RBI has already cut the policy rate by 115 basis points.

Unanimously voting to maintain the status quo, the MPC said it expects the headline inflation to remain elevated in the second quarter of 2021.

Das said domestic food inflation remains elevated across most economies since the novel coronavirus outbreak. Inflation pressures were evident across all sub-groups in June and more favourable food inflation outlook could emerge on good farm produce, Das said.

He added that agriculture sector prospects have improved with the good monsoons and rise in Kharif sowing area. Das further said that the rural economy is expected to be robust.

Global economic activity has remained fragile, said Das. But he said that global financial markets have been buoyant. The merchandise exports contracted for fourth consecutive month though the pace of contraction has moderated, said the RBI governor.

The MPC had convened for this three-day meeting on August 4.

Das added that on revival in the economy post the easing of the lockdown will also be closely watched by the market participants. While from May 2020 there has been an easing, revival has been slow.

In the recent past, there have been massive liquidity infusions by the central bank to the system in multiple rounds and government offering a guarantee to various schemes. None of these has helped to encourage borrowers in borrowing more. The credit growth, at 6 percent, is still lowest in around six decades.

It was widely expected that the central bank will cut the key rates further due to India's worsening economic outlook as coronavirus cases soar despite inflationary pressures.

Around two-thirds of economists in a Reuters poll had expected the Reserve Bank of India (RBI) to cut the repo rate by another 25 basis points (bps) and once more next quarter to a record low of 3.50 per cent.

Annual retail inflation rose in June to 6.09 per cent from 5.84 per cent in March, remaining above the RBI's medium-term target range of 2 per cent to 6 per cent.

The RBI's recent policies have focused on financial stability and the need to support growth despite the price target. The country was placed under one of the strictest lockdowns in the world in late March for over two months to halt the spread of the coronavirus. The government gradually eased restrictions in June although infections continue to rise.

Most analysts expect the economy to contract 20 per cent in the June quarter versus the April forecast of a 5.2 per cent fall and remain in negative terrain until the December quarter.

For the full year 2020/21, the economy is likely to shrink 5.1 per cent which would be its weakest performance since 1979, a sharp contrast to the 1.5 per cent expansion forecast in April.

Comments

0 comment