views

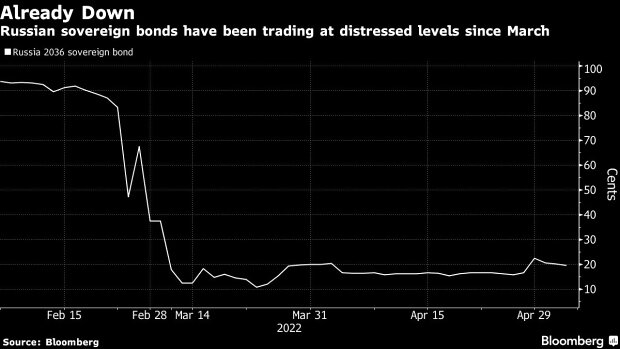

The sanctions placed on Russia by the United States, Europe and the rest of the west pushed the nation into its first foreign default. Russia disputes the designation and says it’s not a default because it has enough funds but the grace period on about $100 million of missed bond payments ended on Sunday night.

The payments were blocked because of the wide ranging sanctions and according to a Bloomberg report if investors did not have their money by the deadline, the bond documents say there shall be an ‘event of default’ in the morning.

There will be no official declaration that Russia defaulted. This will be the first time in more than a hundred years Russia will mark its foreign default.

In 1918, the Bolsheviks questioned the validity of the Czarist-era debts, marking the first time Russia committed its first foreign default. Earlier in 2022, Russia faced a similar situation but evaded the status by switching payment methods.

The US in May closed a sanctions loophole which allowed American investors to receive sovereign bond payments shutting off the alternative avenue – days before the $100 million was due.

Markets now face a unique situation as the defaulted borrower wills and has the resources to pay but cannot. Ratings agencies will issue a default declaration but due to sanctions they are barred from Russia businesses.

Bondholders collectively could release their own statement, but the Bloomberg report says they may prefer to wait to watch what the situation is in Ukraine and the level of sanctions while they figure out the chances of getting at least some of their money back.

“The Russian government already lost the opportunity to issue dollar-denominated debt. Already, as of now, Russia can’t borrow from most foreign countries. A declaration of default is a symbolic event,” Takahide Kiuchi, an economist at Nomura Research Institute in Tokyo was quoted as saying by news agency Bloomberg.

Payment routes were severed since penalties on Russian authorities, banks and individuals have increasingly cut off payment routes. Russia argues it met its obligations to creditors as it transferred the May payments to a local paying agent despite investors not having the funds on their own accounts, Bloomberg said.

The bonds in question do not allow payment in rubles but earlier this week Russia made the transfers in its own currency.

Finance minister Anton Siluanov justified the currency switch as a force majeure and called the situation farce. Lawyers speaking to Bloomberg said the legal argument of force majeure did not encompass sanctions historically.

Siluanov said Russia is being artificially barred from servicing its foreign sovereign debt with the goal of applying the label of default. “Anyone can declare whatever they like and can try to apply such a label. But anyone who understands the situation knows that this is in no way a default,” Siluanov was quoted as saying by news agency Bloomberg.

Read all the Latest News , Breaking News , watch Top Videos and Live TV here.

Comments

0 comment