views

Shares of Britannia Industries surged nearly 10 per cent to Rs 5,199.60, its sharpest intra-day rally in past 18 months, on the BSE in Monday’s intra-day trade on expectations of improvement in outlook.

Britannia on May 3 reported a consolidated net profit at Rs 536.61 crore for the March quarter, registering a decline of 3.76 percent on-year.

The total revenue of the company stood at Rs 4,069.36 crore, rising 1.14 percent from Rs 4,023.18 crore in the year-ago quarter. The brokerages estimated the topline would see growth of around 2.4 percent YoY.

The company’s board has recommended a final dividend of Rs 73.5 per share for the financial year ended March 31, 2024.

For the quarter ended March, Britannia’s market share saw some revival, as a result of the pricing action taken to remain competitive and higher investments in brands supported by distribution expansion.

Britannia Industries’ e-commerce and modern trade segments registered double-digit growth. The firm’s focus states surpassed other regions in terms of growth, even when faced with muted rural demand.

Commenting on the results Varun Berry, vice-chairman & managing director called the company’s performance as resilience and competitive in a tepid consumption scenario.

“Over the past 24 months, we have achieved a strong 19% growth in revenue, accompanied by a notable 43% increase in operating profit. Our market share rebounded as the year progressed as a result of strategic pricing actions to maintain competitiveness and intensified investments in brands, supported by distribution expansion,” Berry said.

On cost and profitability fronts, Berry said the company would stay vigilant of the commodity prices and evolving geopolitical landscape.

“Our Cost Efficiency Program continues to yield operational savings of 2% of revenues, ensuring healthy operating margins,” the VC & MD said.

Should You Buy?

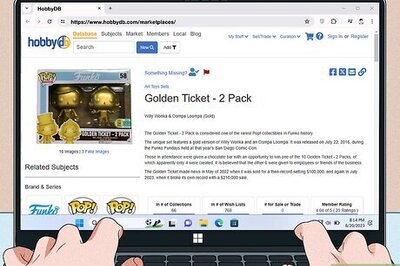

Following the Q4 results, global brokerage firm JPMorgan maintained a ‘Neutral’ rating on Britannia Industries with a target price of Rs 5,260. The Q4 numbers were in line with estimates, it said.

“The company delivered subdued revenue growth weighed down by pricing actions. However, the key positive was progressively improving market share,” the brokerage firm said.

The global investment bank sees downside risk to its earnings estimates post the Q4 print.

Meanwhile, Nuvama maintained its Hold rating on Britannia with a target price of Rs 5,395.

Nuvama said, “Rural demand which has been a laggard for the FMCG industry is expected to revive in FY25 on the onset of a likely strong monsoon. We expect Britannia to be a beneficiary of this revival. Further, a good wheat crop output will aid margins.”

Comments

0 comment