views

LONDON/BEIJING An upsurge in Chinese demand and imports of minor metal molybdenum have revitalised prices of the stainless steel ingredient, but a reversal is expected as local production ramps up after disruptions.

Molybdenum oxide prices are up nearly 10% to around $7.8 a lb since July’s 3-1/2 year low at $7.1 a lb.

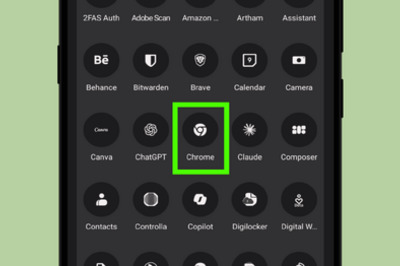

Moly consumption by industry https://fingfx.thomsonreuters.com/gfx/ce/ygdvzdzonvw/Moly%20consumption%20by%20industry.PNG

Disruptions in China include Yichun Luming Mining, producing around 30 million lbs a year, which was ordered to suspend molybdenum output earlier this year because of a tailings dam that leaked and contaminated local rivers.

An official at the Yichun emergency management department said Luming was preparing to restart but was unable to give a date. Luming did not respond to an emailed request for comment.

Meanwhile, Jinduicheng (JDC) Molybdenum said on Aug. 7 that two concentrators accounting for almost 60% of its molybdenum concentrate capacity had been shut down after heavy rain.

“When JDC and Luming eventually come back, there will be a massive influx of molybdenum returning to the market,” said CRU analyst James Jeary. CRU expects a molybdenum market surplus of at least 15 million lbs this year.

“JDC changed sentiment rather than significantly altering fundamentals and if Luming had been producing since late March, the surplus could have been as large as 30 million lbs.”

Molybdenum prices https://fingfx.thomsonreuters.com/gfx/ce/azgpokqgypd/Moly%20prices.PNG

Molybdenum supply is estimated at around 550 million lbs this year. Molybdenum’s anti-corrosive properties are vital for the stainless steels used in oil & gas, auto and petrochemicals industries.

These industries are casualties of the COVID-19 lockdowns and their demand for stainless containing molybdenum has tumbled. Stainless steel mills, mostly in China, account for about 25% of global molybdenum consumption.

China moly imports https://fingfx.thomsonreuters.com/gfx/ce/jbyvrkzydpe/China%20moly%20imports.PNG

“China appears to have been a significant buyer into recent price weakness — as it was in 2008/9 during the Great Financial Crash,” said Macquarie analyst Jim Lennon.

“Some rise in Chinese imports would have been expected. However, the extent to which net imports — imports minus exports — have risen is truly astounding.”

Lennon estimates China’s net imports of molybdenum concentrates at 37.3 million lbs in the first half of this year compared with 1.1 million lbs in the same period last year.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Comments

0 comment