views

Understanding Capital Leases

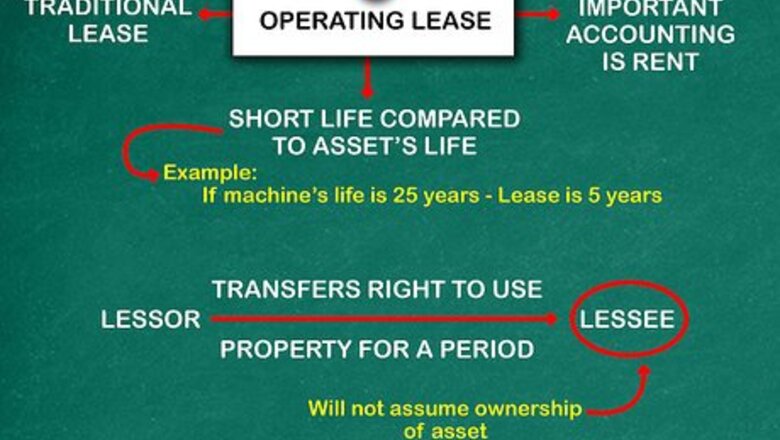

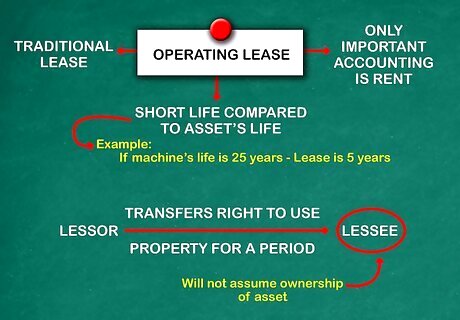

Learn about operating leases. In order to understand a capital lease, you must first understand an operating lease, as these are the two main kinds of leases. An operating lease is a traditional lease whereby lessor (or owner of a property) transfers the right to use the property to a borrower (or lessee) for a particular period, after which it is returned. With an operating lease, the borrower assumes no risk of ownership. An operating lease involves no ownership of the asset, and therefore, the asset does not appear on the company's balance sheet in any way. The only important accounting for an operating lease is the rent, or lease payment, which appears on the income statement as an expense. Operating leases are typically short compared to the life of the asset. For example, if a piece of machinery is being leased, and the life of the machine is 25 years, an operating lease may be for five years.

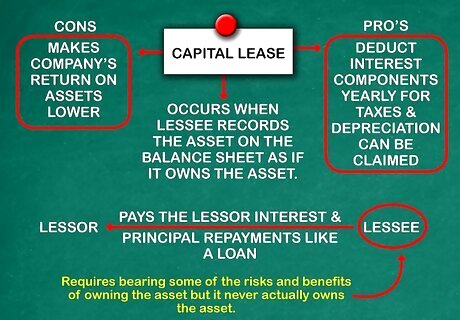

Contrast an operating lease with a capital lease. A capital lease is the other type of lease, and unlike an operating lease, a capital lease requires the lessee to bear some of the risks and benefits of owning the asset, even though it never actually owns the asset. A capital lease occurs when the lessee records the asset on the balance sheet as if it owns the asset. The lessee would then make lease payments to the lessor, and these payments consist of interest and principal repayments, just like a loan. There are several pro's to capital leases. Just like if the business actually owned the asset, they can choose to deduct the interest component of the lease payment each year for taxes, and can also claim depreciation each year on the asset. That is to say, as the asset decreases in value each year, the business can benefit from this, whereas this would not be possible with an operating lease. There are cons as well. For example, since the asset is listed on the balance sheet, this would make the company's return on assets lower. This is because since return on assets is income as a percentage of total assets, if assets increase, the return falls (assuming income stays the same).

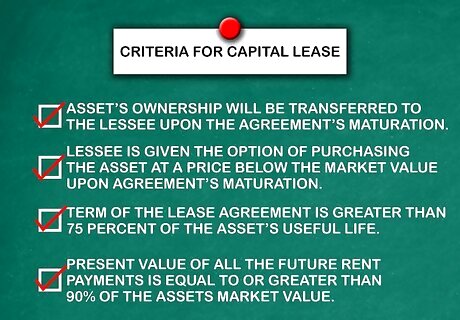

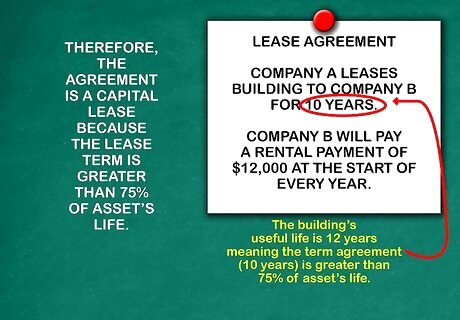

Consider the criteria for a capital lease. Under a capital lease, the lessee is essentially buying the asset from the lessor, with the lease payments functioning as a financing arrangement. If the lease meets one of these four criteria, it must be accounted for as a capital lease: The asset's ownership will be transferred to the lessee upon the agreement's maturation. The lessee is given the option of purchasing the asset at a price below the market value upon the agreement's maturation. The term of the lease agreement is greater than 75 percent of the asset's useful life. The present value of all the future rent payments is equal to or greater than 90% of the assets market value

Accounting for Capital Leases

Evaluate the terms of the lease. Before making any journal entries, make sure you understand the lease agreement's terms. For example, consider a lease agreement whereby Company A leases a building to Company B for 10 years. Company B will pay a rental payment of $12,000 at the beginning of each year. The building's useful life is 12 years; therefore, this is a capital lease because the lease term is greater than 75 percent of the asset's life.

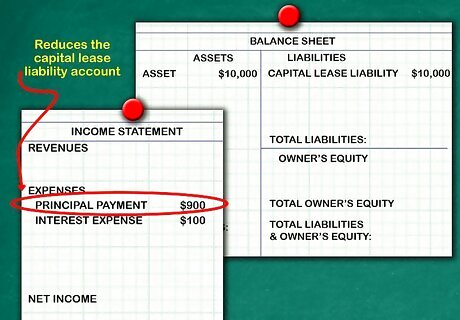

Review the basic accounting process for recognizing a capital lease. Before learning the journal entries it is important to understand the basic accounting process. From an accounting perspective, when you enter into a capital lease, you are basically purchasing the asset, and then financing it using a loan. Therefore the accounting would be very similar to if you simply bought and financed an asset. This means you would first need to add the asset to the balance sheet as a fixed asset, and also add the value of the asset to the balance sheet as a capital lease liability (since you do not own the asset). Over the term of the lease, regular payments consisting of interest and principal would be made. The interest portion of the payment would be recorded as an interest expense on the income statement, and the principal would reduce the balance of the capital lease liability. For example, assume you were leasing an asset worth $10,000. This means $10,000 would be listed as an asset on the balance sheet, and $10,000 would be listed as a capital lease liability. If you had a $1,000 yearly payment, and $100 was interest, $900 would go towards reducing the capital lease liability account. Over time, this means the capital lease liability account would eventually reach zero.. Finally, you would need account for depreciation. Since assets depreciate over their useful life, you would need to account for the declining value of the asset each year.

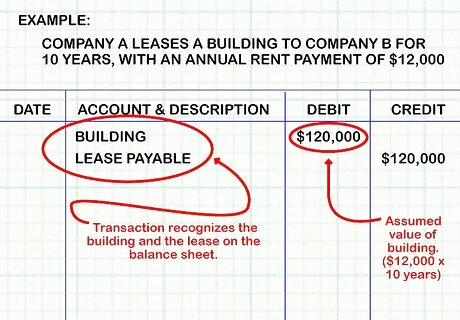

Start by recording the journal entries to recognize the start of the lease. The journal entries will reflect the fact that the lease is essentially a sale. For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000. Assume the value of the building is $120,000. Note that the value of the asset is supposed to be equal to the present value of all future rent payments. In this example, we are assuming the value of the building is equal to the sum of all future rent payments ($12,000 times 10 years). In reality, this would be less, since those future rent payments must be discounted to account for the fact that money received in the future is worth less than money received now. To begin, open whatever accounting software you are using, debit the "Building" asset account for $120,000, and credit the Lease Payable liability account for $120,000. If these accounts aren't available in your accounting program, you must create them. This transaction recognizes the building and the lease on the balance sheet.

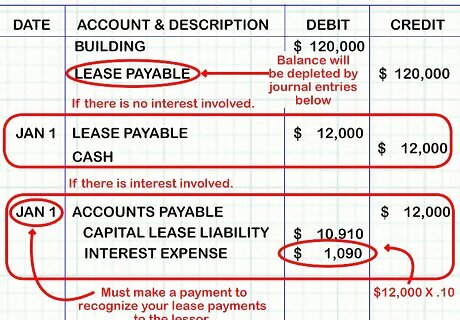

Record the journal entry to recognize each rental payment. Now that the lease is recognized on the balance sheet, you must account for the rental payments. On January 1 each year, you must make a payment to recognize your lease payments to the lessor. To do this, you would debit Lease Payable for $12,000 and credit Cash for $12,000. Doing this reduces the value of the Lease payable liability account, to reflect the fact that the principle on the "loan" is being paid down. This transaction also reduces cash as you are paying the lessee. Note that this assumes there is no interest involved. If part of that $12,000 annual payment is interest, you must debit that portion to the Interest Expense account. For example, suppose that the $12,000 payment included 10 percent interest. This means that $1,090 of that payment was interest expense. Therefore, you would record a debit of $10,910 to the capital lease liability account, a debit of $1,090 to the interest expense account and a credit of $12,000 to the accounts payable account. These journal entries will continue to deplete the balance of the Lease Payable account until they reach 0 at the agreement's end. You may also make monthly payments. Account for it in the same way, but repeat the process twelve times--once for each month.

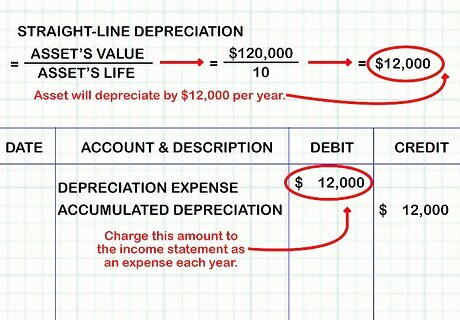

Record any necessary depreciation expenses. Because a capital lease is treated like a purchase agreement, the lessee will need to record depreciation on the asset in question. In the example above, you would need to depreciate the $120,000 balance in the Building account over its life. The required journal entries would vary depending on the company's depreciation schedule. Depreciation involves taking the value of the asset ($120,000), and reducing its value over the course of its life (10 years). For example, using straight-line depreciation, the asset would depreciate by $12,000 per year ( $ 120 , 000 / 10 = $ 12 , 000 {\displaystyle \$120,000/10=\$12,000} \$120,000/10=\$12,000). To account for this, you must charge that amount to the income statement as an expense each year. The basic procedure is to debit the depreciation expense account by $12,000, and then credit the accumulated depreciation account for $12,000.

Comments

0 comment