views

X

Research source

Preventing Red Flags

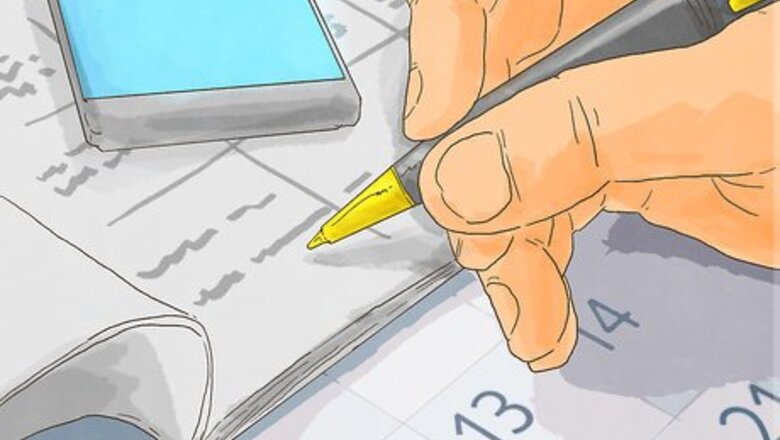

Wait several months before you file. Ideally, wait at least three to four months after you decide you want to file for bankruptcy to actually file. You can control your financial behavior and avoid questionable transactions that might cause problems with your bankruptcy case. In some situations, such as if you're trying to prevent an imminent wage garnishment, you may not have this luxury. If you're getting behind on your bills and experiencing significant financial stress, speak to a financial professional or credit counselor as soon as possible. They can help you decide if bankruptcy is for you. This way, you can plan accordingly, rather than getting yourself in a situation where you can't spend several months preparing to file. When you file for bankruptcy, the trustee – an officer of the court who oversees your bankruptcy – will look back over your expenditures for several months before you filed. The best way to avoid having any questionable transactions that happen a few months before you file is to make the decision to file for bankruptcy and then wait several months before you actually file.

Leave your assets where they are. Any transactions in the months immediately preceding your bankruptcy filing will be highly scrutinized by the court. Transferring assets to a friend or family member, or moving large sums of money from one account to another, looks suspect. For example, if you're filing Chapter 7, you typically can exempt one vehicle from liquidation in bankruptcy. If you own two cars, it may be tempting to transfer the title of that second car to the name of a friend or family member. That way you could avoid losing that car when you file for bankruptcy. However, this defeats the purpose of bankruptcy, which is to pay as many of your creditors as possible and give you a second start by discharging all of your other debts. The trustee and the court will look back for many months, if not years, to ensure you haven't been transferring assets in anticipation of filing for bankruptcy. If the trustee suspects various transfers are intended to defraud, you'll wind up in court to defend or explain those transactions.

Choose payments wisely. You may want to pay off certain debts once you've decided to file for bankruptcy, but preferential transfers are a big no-no. While paying your regular bills is fine, you may end up having to go to court to explain or defend any extraordinary payments. If you want to avoid going to court, you also must avoid paying off some debts and ignoring others. While you may think you're simply doing that creditor a favor because they're been nice to you, the bankruptcy court looks at this as fraud. This also means you can't pay off loans made by friends or family members, despite your relationship. These are considered legal debts and the bankruptcy court considers preferential treatment to be fraud. After you file, you can choose to pay back debts – such as a loan from a friend or family member – even after it's been discharged. If you plan to do this, let the creditor know. You also typically can choose to leave out secured debts (such as your mortgage or car loan) so that you don't lose your house or car as a result of your bankruptcy.

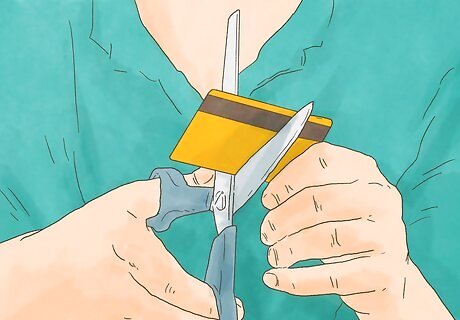

Resist adding to your debt. In the months leading up to a bankruptcy, be extremely conservative with your spending and do everything you can to avoid racking up more debt. The same concept applies to seeking credit-line increases or opening new accounts. For example, suppose you're planning to file for bankruptcy next month, and you get a credit card pre-approval in the mail. It may be tempting to treat this offer like free money. If the credit card company approves you with a $10,000 limit, you think you could simply max out this card and then add it to your bankruptcy. Not so fast – if you open a new account just before you file for bankruptcy, the bankruptcy court may consider this fraud. The same logic applies if you get a credit-line increase on an existing card and then run up the balance.

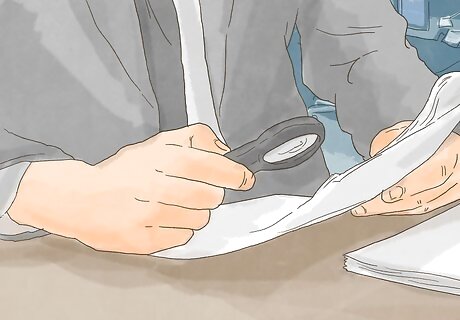

Get your records in order. If you file a sloppy petition that you have to amend several times, you could find yourself in court having to answer questions about the quality of your paperwork. Worse, significant mistakes could result in your case getting dismissed in its entirety. When you speak with an attorney, he or she typically will have a checklist of documents you must have to complete the bankruptcy petition. Make sure you get copies of your credit report from each of the three major bureaus and check each entry on your report carefully. It's important to include every debt on your petition, even if you haven't heard from the creditor in several years. Incomplete petitions and schedules are a sure-fire way to end up in court.

Hiring an Attorney

Ask for recommendations. Sometimes recommendations from friends or family members can be your best options when you're looking for an attorney. These are people who understand you and the specifics of your case. If you know anyone near you who has recently filed for bankruptcy, ask them which attorney they used and whether they would recommend them. Ask questions about their experience to get a better idea of whether that attorney might work for you. You also might want to ask any attorneys or accountants you know for recommendations. Even attorneys who don't practice bankruptcy may know good bankruptcy attorneys, particularly if they regularly have clients who have filed for bankruptcy. For example, bankruptcy and divorce unfortunately often go hand-in-hand, so a family law attorney probably knows bankruptcy attorneys they can recommend. Because accountants may frequently interact with bankruptcy attorneys, they also may have recommendations for you – or at least be able to tell you who you should stay away from.

Browse internet directories. Even if you've managed to score a good recommendation or two, you still should look for possible attorneys yourself. Hit your state or local bar association's website to start and use their searchable directory. Many bar associations have a bankruptcy section which includes attorneys licensed to practice in your area who specialize in bankruptcy. Typically attorneys must complete additional tests and submit professional references to be able to say they specialize in a particular area of law. These will be the strongest bankruptcy attorneys who practice in your area. Check each attorney's professional website as well as doing a general internet search for reviews from clients. There are multiple websites that allow current and former clients to provide reviews and ratings of attorneys. You should value client reviews more highly than any awards or "best of" lists, as these typically are voted on by fellow attorneys who may agree to vote for each other as a professional courtesy.

Schedule several consultations. Bankruptcy attorneys typically offer a free initial consultation. Take advantage of this to talk to at least three or four attorneys. This way you can get a feel for each attorney's background and practice style and choose your best fit. Call the office of each attorney in whom you're interested and try to schedule the initial consultation within the next week or two. If an attorney is too busy to see you within this time, it may be that he or she is too busy to represent you effectively or pay enough attention to your case. If you want to avoid going to court, you need an attorney who has sufficient time and energy to devote to your case. If you're scheduling more than one consultation on the same day, make sure to leave several hours between appointments. For example, you might schedule one in the morning and one in the afternoon.

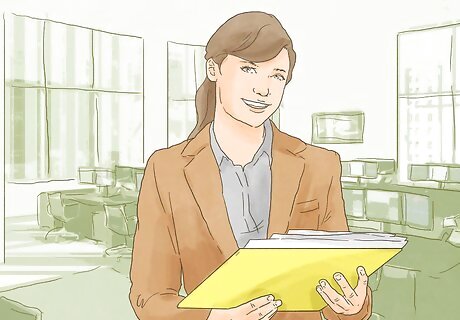

Provide information in advance. The attorneys you interview won't be able to provide you much direct advice on your case unless they have a good breakdown of your financial situation. The more detail you're able to provide each attorney to evaluate before your initial consultation, the more you'll get out of the meeting. The attorney may have forms to fill out before your consultation, or a checklist of documents or information you need to bring with you. Find out how far in advance of your consultation you need to provide this information. But don't wait until the last minute. Send the information as soon as possible to give the attorney plenty of time to look over it. If you're mailing documents to the attorney's office, clearly mark each page with your name and the date and time of your initial consultation. Include any reference or confirmation number the attorney's office has given you.

Ask each attorney lots of questions. Attorneys often have a basic script of information they provide to prospective clients during a free initial consultation – but that may not include information that's important to you. Specifically, you need to find out how much experience each attorney has handling bankruptcies similar to yours. Since it's important to you not to go to court, ask each attorney if you will be required to attend any court hearings, or what ways there are to avoid having to go to court. Make sure the attorneys understand that this is a priority for you. You also want to find out about the attorney's practice style. Ask what ways are best to communicate with the attorney – for example, whether the attorney prefers an email or a phone call – and how quickly they return messages. If the attorney is part of a larger firm, find out how much of the work on your case that attorney will personally do. If someone else will be doing the lion's share of the work on your case, ask if you can meet them too. There is no "right" answer to any of the questions you ask, particularly those that evaluate the attorney's practice style. Different attorneys have different styles and methods and can be equally effective – the true question is how the attorney's work style will work for you.

Compare and contrast the attorneys you interviewed. After you've completed your scheduled consultations, take a look at each attorney's characteristics. Pit them against each other to decide which can best represent you in your bankruptcy proceeding. Since you're filing for bankruptcy, you have limited funds and may consider an attorney's fees paramount. However, attorneys who handle bankruptcy cases know this, and typically are willing to work with you on fees. For this reason, don't allow fees to be the only – or even primary – reason you choose one attorney over another. Instead, concentrate on each attorney's experience and their ability to help you achieve the goals you have in filing for bankruptcy. Above all, it's important that you feel comfortable and at ease with the attorney you choose. One attorney you interviewed may have had far more experience and lower fees than the others. However, if he or she intimidated you or made you feel like a loser for filing for bankruptcy, do not choose that attorney.

Get a written retainer agreement. When you hire an attorney, make sure you get a detailed contract that outlines the terms of the representation. Have the attorney explain it to you, and question anything you don't understand or with which you don't agree. Even though it may not seem this way when the attorney hands you the retainer to sign, this agreement is negotiable. It won't hurt you to ask for something – the worst the attorney can do is say "no." However, keep in mind that most attorneys are willing to negotiate various terms of their retainer agreement. Likewise, if something you talked about in the initial consultation is not covered in the retainer agreement, ask the attorney to include it. Typically the attorney will be willing to give you time to look over the retainer agreement before you sign it. You may want to have a trusted friend or family member look it over as well.

Handling Your Creditors' Meeting

Go over your bankruptcy paperwork carefully. The trustee will ask you questions about your paperwork at your creditors' meeting. Make sure you are comfortably familiar with the contents of the documents you filed. Particularly if you're filing bankruptcy under Chapter 7, you won't have to go to court at all if all issues are resolved to the trustee's satisfaction at the creditors' meeting. For this reason, it's important that you know the information on the documents filed with the court in your bankruptcy case. This may require a bit of study if you have an attorney, since you didn't fill out the petition and schedules yourself.

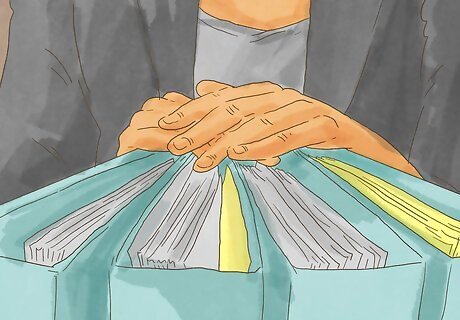

Make any amendments before your creditors' meeting. In going over your petition, you may come across an item that has changed since you initially completed the paperwork. File an amendment to set the record straight. This also applies if you find something, such as a missing account, that you want to add to your petition. Keep in mind that if you add a creditor fewer than 14 days before your meeting, you must have those new creditors served with your petition and notice of the meeting. The trustee may propose or require you to amend your petition to reflect the information provided in the creditors' meeting. However, you want your documents to be as accurate as possible before the meeting to avoid going to court.

Organize your documents and information. The impression you make is important at your creditors' meeting. One important way to make a good impression is to appear organized and in control. Having to stop and shuffle through a loose stack of papers will not endear you to the trustee. You should receive a checklist of documents you're required to bring to the creditors' meeting. Use this checklist to organize your documents. Your attorney also may have a checklist or other methods to help you organize your documents before the meeting. Consider using a binder with tabs to keep your documents together and easy to find.

Answer the trustee's questions completely and honestly. Even though you're not in court, you are under oath during your creditors' meeting. You could end up needing to go to court if you provide incomplete or inaccurate information. Even though this meeting is called a "creditors' meeting," your creditors typically will not attend. Usually it will just be you and the attorney in a meeting room in an office building. The trustee will ask you some general questions to confirm that you've been accurate and honest in the court documents you've filed. He or she also may ask specific questions about accounts or transactions that seem suspicious. Stick to the facts, and answer all questions as completely and honestly as you can. If you don't know the answer to a question, say "I don't know" or ask the trustee for clarification. If you filed for Chapter 7 bankruptcy, you'll be on your way to a discharge once the trustee concludes the creditors' meeting. You just have to wait the 60 days provided to creditors to object to your discharge. Generally, if no creditors object to your discharge, you can complete a Chapter 7 bankruptcy without having to go to court. If you filed a Chapter 13 bankruptcy, you will have to attend at least one court hearing for the judge to approve your repayment plan.

Comments

0 comment