views

X

Research source

Goodwill thrift stores accept donations of clothes, furniture, computers and much more provided they are in serviceable condition. If you itemize your deductions on your tax return, you can deduct these donations to Goodwill, making this a great way to support a good cause while decreasing your tax liability.

Making Your Donation

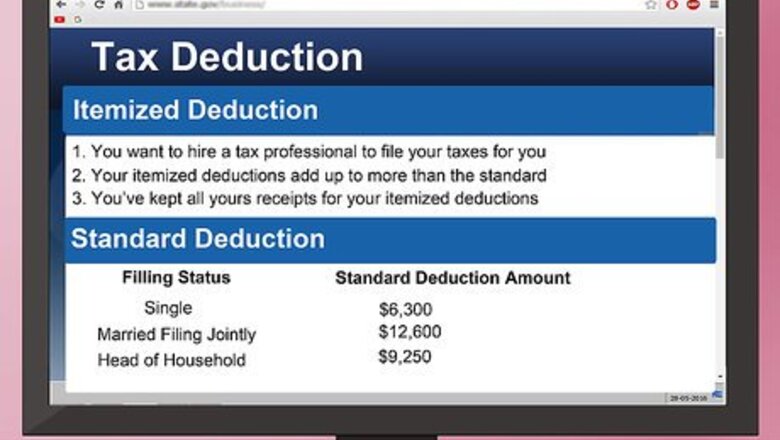

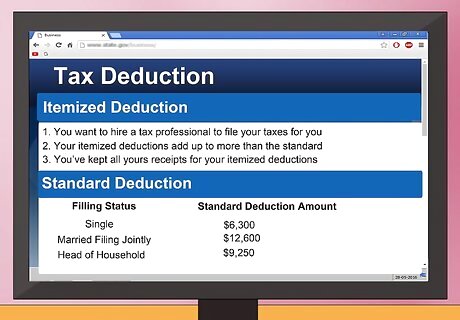

Learn about the difference between itemized and standard deductions for Goodwill donations. Goodwill donations can only get you a deduction on your Federal income taxes if you itemize them. When you file your taxes, you can choose to either take a standard deduction, which is based on your age, marital status, and income, or an itemized deduction, which takes all of your deductible activity into account. If you take the standard deduction, you can skip all the record keeping and just donate your goods. If your itemized deductions will be bigger than your standard deduction, then it is generally in your best interest to take the itemized deduction. For example, you may benefit from itemizing deductions if you donated lots of money or goods to charity or if you had major uninsured medical expenses. See the online IRS tax guide (http://www.irs.gov/taxtopics/tc501.html) for more information. Some states may offer a charitable contribution deduction even if you don't itemize your federal deduction.

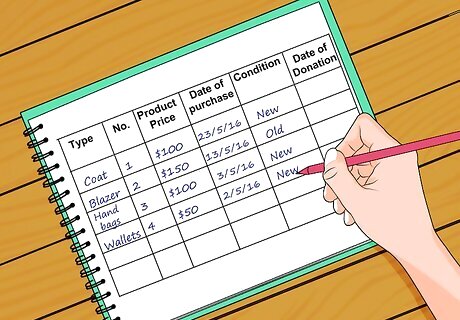

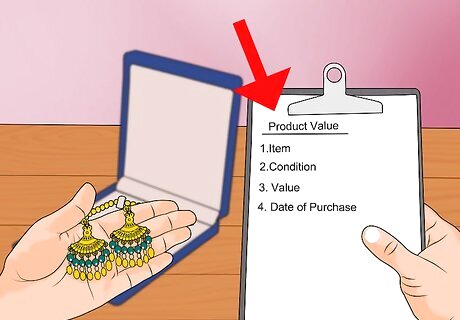

Record your donation items before donating them. Good record-keeping is important for maximizing your deduction. If you simply throw an assortment of goods to be donated in a bag, it will be almost impossible remember exactly what you have given. If you can’t remember what you have given, it will be hard to provide documentation to the IRS to support your deduction claim. There are also apps that can help you keep track of your donations, such as TurboTax's "Its Deductible." Keep track of your donations, by making a spreadsheet that includes: type of item or clothing number of each item you are donating purchase price (or, if you don't have receipts, a conservative estimate) approximate date of purchase condition donation date fair market value of each item

Donate items that are in good condition. Both Goodwill and the IRS require that you donate clothes or items that are in good condition or better. Damaged, dirty, or worn-out goods may be refused by Goodwill and will not earn you a tax deduction. In fact, it can actually be against the law to try to donate items that you know to be in bad condition. Check Goodwill's official donor guidelines for specific information about what is and isn't acceptable here: http://www.amazinggoodwill.com/donating/donor-guidelines/. Note that certain items, like socks and underwear, may not be accepted unless they are in "like-new" condition. However, some locations may still accept these items for resale to scrap/recycling facilities.

Take photographs of anything of high value that you are donating. It's a wise idea to take extra care to document any high-value donations you make to Goodwill. The better you are able to prove that you made your donation, the less risk you expose your deduction to. In addition, photographs can help you prove that your items were in good condition when you donated them. Items that you may want to seriously consider taking a picture of include: Computers Electronics Televisions Furniture There are special rules for items like cars or other vehicles, jewelry, fine clothing, artwork, or antiques, so refer to IRS Publication 526 to learn more about donating these types of things.

Have valuable items appraised. If you expect the goods you donate to total more than $5,000, you will need to have their value appraised by a qualified appraiser to be able to claim your deduction at the end of the year. When you fill out your tax return, you will need to be able to get your appraiser to sign on your tax Form 8283 for your high-value donation to be eligible for deduction. This means you must have your items appraised no more than 60 days before you donate them. The IRS's definition of a "qualified appraiser" is surprisingly vague. For instance, one of the criteria is that the appraiser must "[have] earned an appraisal designation from a recognized professional appraiser organization for demonstrated competency in valuing the type of property being appraised." To see the IRS's official guide on this subject, go to http://www.irs.gov/instructions/i8283/ch02.html.

Call ahead to make sure you will get a receipt. It's smart to check ahead of time to make sure that your local Goodwill store will have someone available to give you a receipt on your donations. Most Goodwill locations will only be able to provide a receipt during normal business hours. If you arrive unannounced with your donation outside these hours, you may have to leave your donation in a collection box or simply leave — either way, you won't get a receipt. In addition, if you're making an exceptionally large donation, it's usually helpful to the staff if you give them some warning so that they can prepare for you.

Deliver the goods to the Goodwill donation center. At the Goodwill, a staff member should be available to help you unload your goods if needed. The staffer may or may not go through your goods with you — if the location is busy, your goods may be set aside for later inspection. Not sure where the nearest Goodwill location is? Try using the Goodwill locator at the top of the official Goodwill Industries International website (http://www.goodwill.org/) — just check the "Donation site" box and input your city and state to see a map of nearby Goodwills. In some areas, Goodwill operates donation pickup services. Call your local Goodwill to see if this option is open to you.

Keep your receipt. The Goodwill staff member you meet with should ask you if you want a receipt when you make your donation. Be sure to say "yes." This receipt allows you to prove that you made a donation in the future. The IRS requires different types of documentation for different types of donations. See below: Donated goods of less than $250 in total value require a receipt with the organization's name, the date of the donation, and a brief description of the goods, unless it is impractical to get a receipt. Donated goods of more than $250 in total value require a receipt with all of the above, plus documentation of whether or not any goods or services were given to you in exchange. If they were, there must also be an estimate of their value. Note that these receipts can be very general. For example, a receipt might read "1 box of clothing," rather than "5 shirts, 7 pairs of pants," and so on. This is why it is good to keep your own records before you make your donation.

Completing Your Tax Paperwork

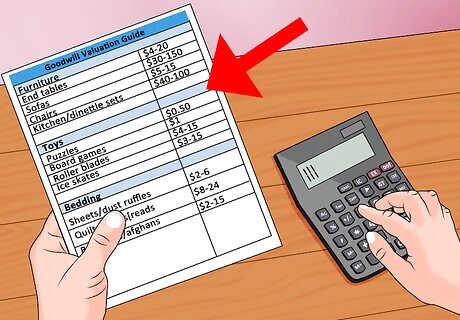

Add up the value of your donations. When it comes time to file your taxes, use the receipts you received for your donations to determine the total value of cash and goods you donated to Goodwill. You can also use the official Goodwill valuation guide (available here: http://www.goodwill.org/wp-content/uploads/2010/12/Donation_Valuation_Guide.pdf) to figure out the value of your donations if you kept good records of what you donated. This guide provides the fair market value for a wide variety of goods which Goodwill accepts. Fair market value is the estimated price that the item would get if there was a willing seller and buyer for the used item. For instance, the price the item would fetch on eBay or at a flea market is usually close to its fair market value. This is almost always less than the retail price these items might be sold for new.

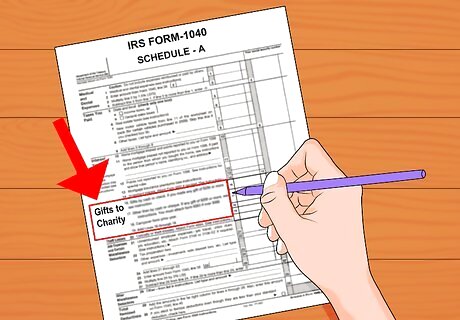

Record your donations on the Schedule A of IRS Form 1040. This form is used for itemized deductions and includes all charitable donations throughout the year. Enter your totals into the section labeled "Gifts to Charity." A copy of Schedule A for Form 1040 is available at http://www.irs.gov/pub/irs-pdf/f1040sa.pdf. Note that this is not the same as the basic 1040 form. You cannot donate more than 50 percent of your adjusted gross income in a year and claim it on your tax return. If you have donated more than 50 percent, it can be carried over to the next year's tax return, however.

Complete Section A of Form 8283 if your goods totaled more than $500. In this case, you must fill out this separate form titled "Non Cash Charitable Contributions." Here, you will need to provide information on the items you donated, the organizations you donated to, the dates of your donation, and so on. Your personal records and receipts will be helpful here. A copy of this form is located at http://www.irs.gov/pub/irs-pdf/f8283.pdf. You only need to fill out the first page (Section A) unless your donations exceeded $5,000.

Fill out Form 8283 on Section B if your donations exceeded $5,000. Large donations require additional work on the second page of the 8283 form. Here, you will need to provide more detailed information about the items you donated, including a description of the items, an explanation of how you got them, and more. You will also need to get your donations appraised (see below.) A copy of this form is located at http://www.irs.gov/pub/irs-pdf/f8283.pdf (Section B is on the second page).

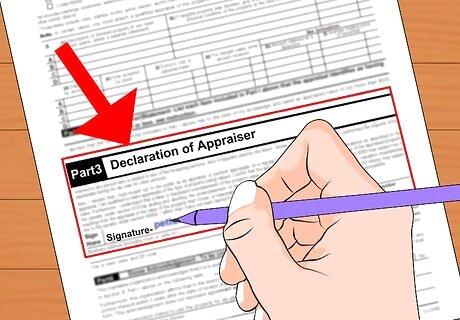

Get your appraiser's signature if your donation was more than $5,000. On Section B of Form 8283, you must have a qualified appraiser sign your form. The appraiser should fill out Part III, "Declaration of Appraiser," providing his or her signature, address, and so on. Use the same appraiser that originally appraised your high-value items. See the step regarding appraisers in Part 1 for more information. If you used multiple appraisers, all of them must sign the 8283.

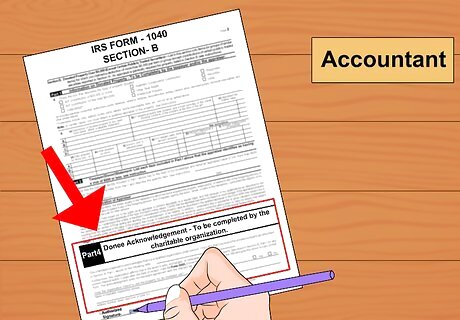

Get Goodwill's signature if your donation was more than $5,000. Finally, for donations in excess of $5,000, you must have the donee (the person or organization that received your donation) sign Part IV, "Donee Acknowledgement" at the bottom of the 8283. The organization will need to include their EIN (Employer Identification Number.) The person who signs the Donor Acknowledgement must be, according to the IRS, "an official authorized to sign the tax returns of the organization, or a person specifically designated to sign Form 8283" — generally, the organization's accountant. You must also provide a copy of Section B of the 8283 to the doner (Goodwill) when you get the signature.

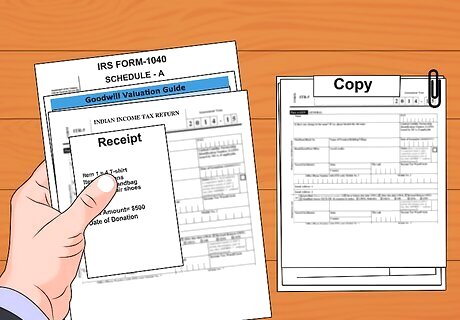

Include all of your documents with the year's tax return. Complete your tax return after you fill out your deductible information. Include all of your extra forms and documents with your return when you file it. This includes Form 1040, Schedule A, Form 8283, copies of your receipts, and a copy of your personal spreadsheet. Congratulations! You have completed your tax return and claimed your deduction. It's a very wise idea to make copies of your supporting documentation and to keep these in the event that you are audited.

Comments

0 comment