views

The Basics: Making Smart Decisions

Determine exactly what a young age is. Young may be 40 or 50, or even in your 30s. In determining this age you'll want to be reasonable. If you're already 27 with no net worth, it is going to be very difficult to retire at 30, so the first step is setting the age you want to stop working.

Learn to manage finances. Before you start bringing in the money necessary to retire young you'll want to know how to manage your money. There are countless amounts of stories of people who win the lottery, and end up miserable and penniless. No matter how much money you make it is important to manage it well. Start and stick with a budget. A budget will help you control everything from how much money gets saved to how much money gets spent each month. If you haven't started budgeting already, do it. It's amazing how many people don't know how much money is coming in and going out each month. You can't be responsible like that.

Get a college education. The studies are concrete: People with college degrees on average will make more over the course of their lifetimes than those without. These days a Bachelors Degree is what a High-School Diploma was 20 years ago. Find your passion, and get a degree (and subsequently a job) in that field. Think of a college degree as an investment in your future.

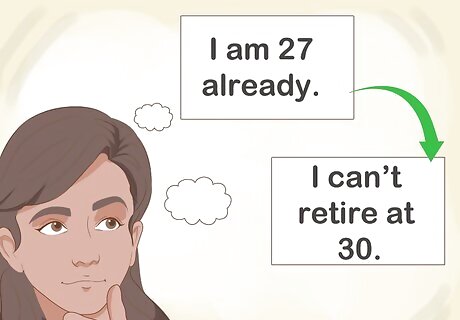

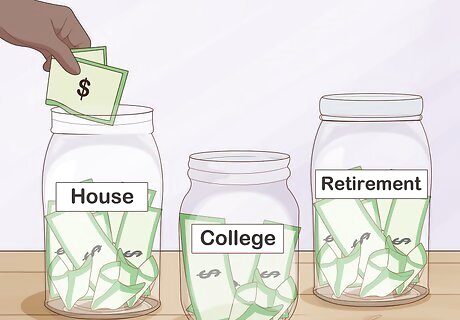

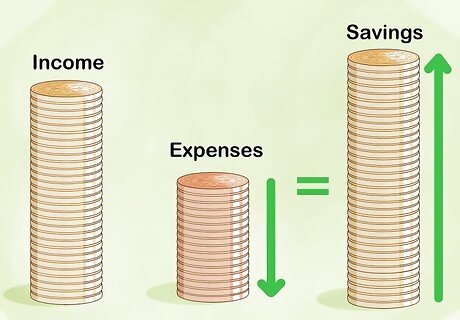

Save early, save often. The earlier you start saving, the quicker you'll retire. It's a devilishly simple idea, but it's hard to execute, and this is why: we humans value the tangibility and utility of the present over the far-off possibilities of the future. But you're not one of the unthinking masses, are you? You like the idea of saving early and saving often, because you know early retirement is sweet and attainable. In your twenties, experts say that you should at the very least put away 10% of your income straight into savings. This much should be easy to do in your twenties, even if it means you have to skimp a little bit. If you can, save any and all disposable money that isn't used to pay expenses, minus a bit of money for discretionary spending. If you earn $3,000 a month and have $1,500 in bills, squirrel away $1,250 each month and give yourself an extra $250 to do as you please.

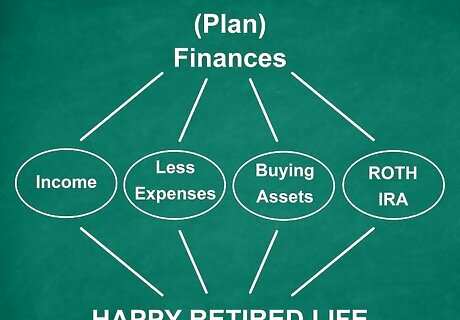

Reduce your expenses. As in, big time. Increasing your earning potential won't do much good if you increase how much you spend the same amount. To put it simply: If you make $20,000 more per year, but increase your cost of living by $20,000 per year you haven't traveled very far on your road to retiring. Rent instead of buy. Go to the library and rent books instead of buying them and then letting them attract dust forever. Watch movies online instead of buying DVDs. Renting may not make you feel powerful, but it will sure help you feel prudent. Take advantage of free stuff. There are whole websites devoted to people who believe in freecycling. Sign up for a (free) conference and partake in their buffet luncheon. When you travel, try couch-surfing. The world is full of wonderful opportunities to get free stuff; just make sure you're respectful and courteous doing it. Carpool if you can. With the rising cost of gasoline, you can potentially save $200-$300 a month on gasoline alone. This works out to a savings of $2,400-$3,600 per year. Wash your laundry in cold water. Detergent manufacturers sell specially formulated detergents meant for washing clothes in cold water. With cell phones being commonplace, consider whether you really need a land line in your home. If you do need one, some companies offer phone services using the internet, which is cheaper than regular land lines. Use LED or fluorescent bulbs in your home. Not only are they just as bright, but use much less electricity. Buy necessities in bulk. While the initial cost may be higher, you will save money in the long run. This includes water, toiletries, and food.

The Nitty-Gritty: Saving (Lots and Lots) of Money

Don't get fooled by get-rich-quick scams. They're out there almost everywhere you look: scams that promise easy money with very little effort. The problem is, with them being so widespread, why aren't more people rolling in free money? The painful truth is that it's extremely, extremely hard to get rich, and it's extremely likely that giving your hard-earned money to one of these schemes is a lot like flushing it down the drain. If it's too good to be true, it probably is.

Get a Roth IRA. The Roth IRA is a special savings account that lets you bypass taxes provided that you keep your money in it for a certain time (usually after you're 59½ years old). You don't have to keep all your retirement savings in your Roth IRA, but it's a good idea to make tax free dollars for when you're older than 60. There are several big advantages of Roth IRAs: You choose an investment plan for your money. Your money gets invested in a portfolio instead of just sitting there, meaning that it can grow much larger than if you put it in regular old savings and get a measly 1% interest rate. Compound interest. Roth IRAs generate interest on your interest, which is called compound interest in the industry. You need to let your money sit for a while in a Roth IRA, but once you do, your money will start generating huge amounts of interest, which only then get bigger.

Get a certificate of deposit (CD). Investing your money in a CD is a good way to put money to use that you know you won't lose to be missing for a while. When you put your money in a 1-year term CD, you can't withdraw it for a year (because the bank lends it out). After that period, you get your money back, plus interest. The longer the term of the CD (you could give some of your money away for 20 years), the higher the interest rate. Note: This is a way to beat inflation, and shouldn't be a large part of an investment strategy. Inflation happens when the government prints more currency, and the value of the total currency goes down. Do this if you're worried about inflation, not as a way to get rich.

Purchase appreciating assets. Everyone knows that when you buy a car it loses much of its value as soon as you drive it off the lot. Assets like these are called depreciating assets. Make as few of these purchases as possible. Instead, buy things that increase in value over time. Examples of appreciating assets include: Houses (usually, although the housing crisis of 2008 proved that wrong) Stocks (usually, adjusted for inflation, the stock market has steadily climbed since 1900). Small business (usually, but not always)

Outsource your work, if possible. The beauty of the global economy is that you can work with people across the globe in real time, in an engagement that is hopefully mutually beneficial for both parties. If you are self-employed, definitely consider outsourcing some of the work to cheaper markets. If your job is very clerical, consider outsourcing parts of it so that you can find time investing your energy into other profitable pursuits.

Create an automatic income source. It doesn't have to be a 401K, but you should set yourself up to receive funds even while you're not working. You could start a blog with advertisements on each page, or write articles for a revenue sharing site. Whatever you decide needs to generate income on its own; that way when you stop working, you can still pay your bills. Other automatic income sources include: Affiliate marketing programs Drop-shipping retail store Many more

Avoid bad debt. A certain amount of debt is fine to have, as long as you have a plan to pay it off and you're using it for something that's valuable. But too much debt can get you into a vicious cycle. Bad debt looks like this: Heavy debt on your credit card for purchases that have long since lost their value. You're only paying the minimum payments and your interest rate is at a whopping 20%, before tax. Good debt looks like this: A mortgage on a nice home that's less than what you would pay to rent the home. The down payment on your home was over 20%, and the home is in a neighborhood that's gradually increasing over time.

Enlist the services of a financial planner or advisor. Sure, a financial advisor will cost you some money, especially if they're a good one. But a good financial planner will also make you a ton of money; they understand the stock market, how to diversify accounts to spread out risk, and have financial savvy to see when the headwinds are changing. A good financial planner is someone who always has your back and who always forgives your mistakes while offering you the best financial advice in the world.

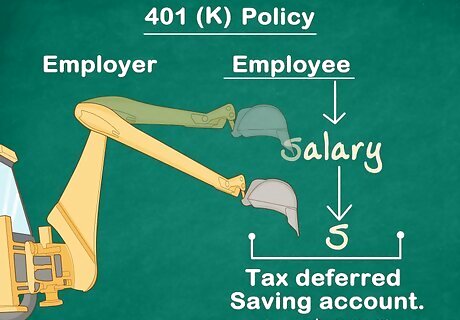

Take advantage of a 401(k) policy if your company offers it. A 401(k) policy is where your company funnels a small portion of your paycheck into a separate, tax-deferred savings account. The maximum current yearly contribution to 401(k) is $18,000. The great part of about 401(k)s is that your out-of-pocket contributions may be matched by your employer, depending on their policy. This means that whatever amount you decide to put into your 401(k), you employer will put in the same amount. If your employer does match contributions, definitely take advantage of that policy. It's the closest thing to free money you may ever get.

Plan finances according to time. Now that you know how much time you have until your youthful retirement age, plan what you need to do to get there. Don't be afraid if you need to make drastic adjustments. It will all be worth it once you're laying on a hammock enjoying your fruity beverage.

Comments

0 comment