views

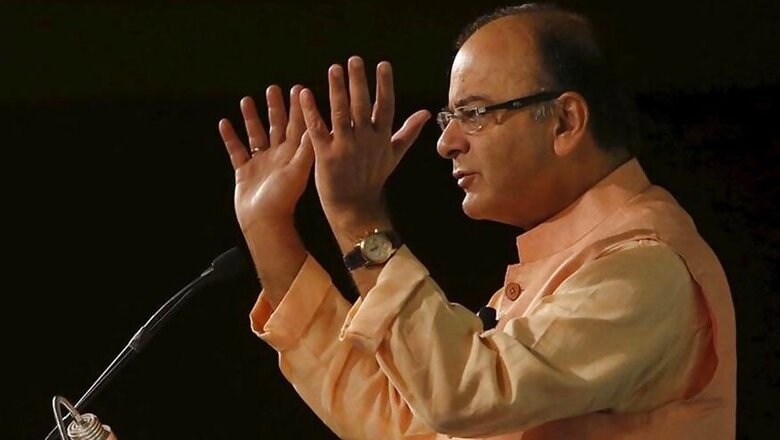

New Delhi: India can grow at an even faster pace in 2016 if predictions of good monsoon hold up, Finance Minister Arun Jaitley said on Thursday.

While the global outlook remains bleak, Jaitley said India remains the fastest growing major economy in the world. "But we recognise we have the potential to grow at an even faster pace," he said.

After two years of drought, if forecast of better monsoon rains this year holds good, it will improve agriculture and raise rural income, he said. "Economy which had been expanding on strength of public investment, highest foreign direct investment (FDI) and urban demand, can grow faster if rural demand is added," he said.

"Indian economy grew by 7.6% in 2015-16 and is projected to grow by 7.5% in the current year. Latest forecasts predict above-average rainfall in India after two years of drought. A good monsoon season will help farm output of the world's second-biggest producer of rice, wheat, sugar and cotton," Jaitley said.

Replying to a debate on the Finance Bill 2016 which was later passed in the Lok Sabha, Jaitley ruled out rollback of 1% excise on non-silver jewellery saying the levy was not applicable on small traders and artisans and only jewellers with more than Rs 12 crore turnover will attract the duty.

"I have not been able to understand the politics of hatred for 'suit' but love for gold," he said as he took potshots at Congress which is opposing the levy of excise duty on gold and other previous jewellery. If the Congress had objections to the levy, it can begin by removing the 5% VAT on bullion in Kerala where it rules, he said.

Jaitley, who moved some amendments to the Finance Bill introduced by him on February 28 along with demands for grants and appropriation bill, listed out measures taken by the BJP government in last two years to give relief to small tax payers and reduce tax litigation.

On black money, he said government efforts have brought to the books Rs 71,000 crore of undisclosed assets. He however ruled out bringing agriculture income under the tax net, saying large farm-based income was rare and people using agriculture as front to hide income from other sources would be dealt with tax authorities.

The Bill, which is the penultimate part of the budget exercise, was passed with the amendments by voice vote.

He said the government, had in 2015, brought a law for holders of undeclared foreign assets to come clean by paying tax along with interest and penalty.

While the HSBC list yielded Rs 6,500 crore of unassessed income, Rs 4000-4,250 crore has come to light from the foreign black money law, he said. Besides, direct and indirect measures have led to Rs 71,000 crore of black money in 2015, he said.

On the Panama paper leak, he said tax notices have gone to all the names of those holding offshore accounts that have been disclosed and action will be taken against those illegally parking money abroad.

Jaitley attacked the 1997 voluntary disclosure of income scheme (VDIS) as the "most ill-advised" as it allowed undeclared asset holders to pay just 30 per cent tax without any penalty or interest on 1987 value of gold and jewellery.

"It was an amnesty scheme," he said, adding no cash came into system and most declarants were women and minor.

The scheme saw declarations of Rs 33,000 crore and about Rs 9,700 crore of tax paid but it was "unfair" on honest tax payers as it allowed dishonest ones to pay tax at rupee value of 1987, he said.

VDIS was challenged in Supreme Court as tax evaders were being given the facility of paying tax at 1987 value in 1997. "If you honestly pay your taxes, you will pay at current value but if not, you will pay at 10 year old rupee value. This scheme could have been struck down as discrimination against honest tax payer but for the fact that the then government gave assurance to the Court that no future amnesty scheme would be brought," he said.

Jaitley said the Budget for 2016-17 has provided for a scheme to deal with domestic black money where undeclared assets can be brought to book by paying 30% tax and an equivalent amount of penalty.

To settle disputes, the Budget proposed 45% tax instead of regular 30% for income that may have escaped assessment. Also, to companies facing retrospective taxation, an option has been given to them to pay principal amount and interest and penalty would be foregone.

Comments

0 comment