views

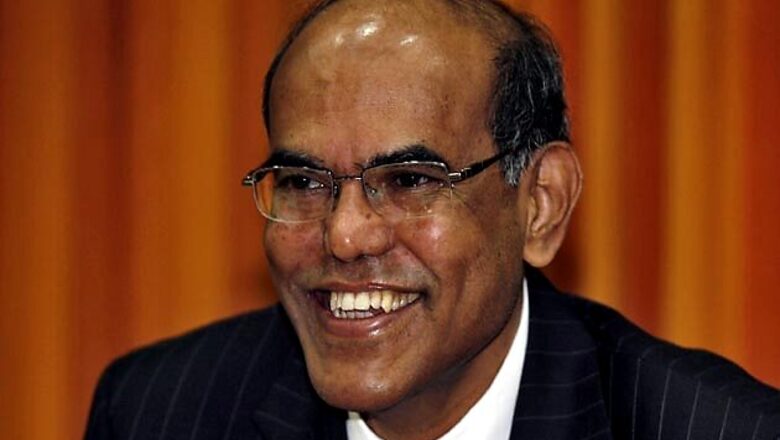

Has the outgoing RBI Governor's tenure been beneficial for India? There are allegations that he stifled growth in his zeal to contain inflation? Or was it the only way to address the widening Current Account Deficit? Business Standard's editor AK Bhattacharya joined IBNLive readers for an interaction on the issue.

Q. Was Subbarao too hasty in implementing liquidity tightening measures? Asked by: Chetak

A. We still do not know what role Duvvuri Subbarao played in the measures announced last month to tighten liquidity. With that qualifier in place, let me say that the measures did not help in achieving the primary goal of propping up the falling rupee. To the extent that measures need to be judged by their effectiveness, it was a poorly executed response. Worse, it led to a spike in the cost of money, an outcome that the central bank was not really bargaining for.

Q. Subbarao and Pratip Chaudhary of SBI had publicly expressed divergent views SLR /CRR and such issues. In retrospect RBI GUV could be said to have been overcautious? Asked by: sundar1950in

A. Why overcautious? He has been consistent in his approach, barring perhaps last month when he did something that surprised many. If the Union government has done precious little to revive investment and push growth, why should the RBI be expected to reduce interest rates even though inflationary pressure in the economy was high?

Q. Sir, who should you blame for the current economic situation, its Govt or the out going RBI Governor. Its Govt policy paralysis or RBI monitory policy is responsible for the current situation. Mr Subbarao's tried to stable the Inflation but does he succeed? Asked by: Alok

A. The government is clearly responsible for failing to remove hurdles to investment. The RBI was more focused on inflation for good reasons. Whether it succeeded or not is not easy to judge. What would have been the inflation rate had not the RBI stuck to its policy stance? Or what would have been the RBI response if the governemnt had spurred investment to achieve higher growth? Difficult questions.

Q. Has Subbarao's measures paved way for a challenging tenure for Raghuram Rajan? Or is it the macro-economic situation purely to blame? Asked by: Chetak

A. The latter is responsible.

Q. A possible extension for continuity did not come and Subbarao said he want to move. Was this to give way to FM to run the RBI suited to UPA 2 in an election tear? Asked by: sundar1950in

A. Not really if you see how the PM may have had his way in getting Raghuram Rajan in place to steer the monetary policy.

Q. Both Reddy and Rao faced bad times during their tenure. Who would you rate higher and why? Asked by: Chetan

A. Reddy faced a different set of challenges, arising out of a strengthening rupee, growing economy and rising foreign exchange reserves. And he handled those challenges very competently. He also had to deal with a more favourable political environment. In contrast, Subbarao's challenges were more difficult as a result of the economic downturn, falling reserves and a depreciating rupee. You could say that Subbarao made a valiant attempt to minimise the damage, but he also faced a much more hostile political environment, I think.

Q. How do you rate Subbarao's stint with RBI as governor when compared to Y V Reddy or Bimal Jalan? Asked by: Sudhakar

A. I have answered that question earlier. Not fair to compare governors who had to necessarily face different sets of challenges. Reddy and Jalan did very well as Governor. Can that be said of Subbarao. I doubt it. But then there are good reasons why Subbarao would be perceived that way.

Q. His actions on growth and containing inflation can be argued as something which is out of his control. But, what about his actions on firms which followed the fraudulent means of banking like Margadarsi financiers and the recent one discovered in West Bengal. These fraudelent means have actually shaken the banking operations of cooperative banks in states like Andhra Pradesh and village economy has shaken. What was his contribution towards improving village economy? Asked by: Kumar

A. Supervision and ensuring compliance by financial entities have continued to suffer from weaknesses for several years. Subbarao could be as guilty as several of his predecessors.

Q. Subba rao and his predecessor did not go aggressive on Housing finance much to dislike of Finance min. Has Subbarao's actions of conservative nature helped burst of Financial institutions in India? Asked by: sundar1950in

A. On what basis are you making these assertions?

Q. Was not on same page with PC the Fm on Interest matters. RBI GUV was rigid. has it proved to be a right way of tackling economy? Asked by: sundar1950in

A. You could argue that the FM was also rigid!!

Comments

0 comment