views

New Delhi: In the last one month, the Supreme Court has dismissed hundreds of cases in which the tax effects were less than Rs 1 crore.

A bench headed by Justice AK Sikri relied upon the July circular by the Central Board of Direct Taxes (CBDT) to put an end to scores of tax cases.

The CBDT circular fixed the threshold limit for filing appeal in the Supreme Court at over Rs 1 crore and stated that pending appeals or special leave petitions (SLPs) should be withdrawn "on priority" to enable the department to focus on high value litigation.

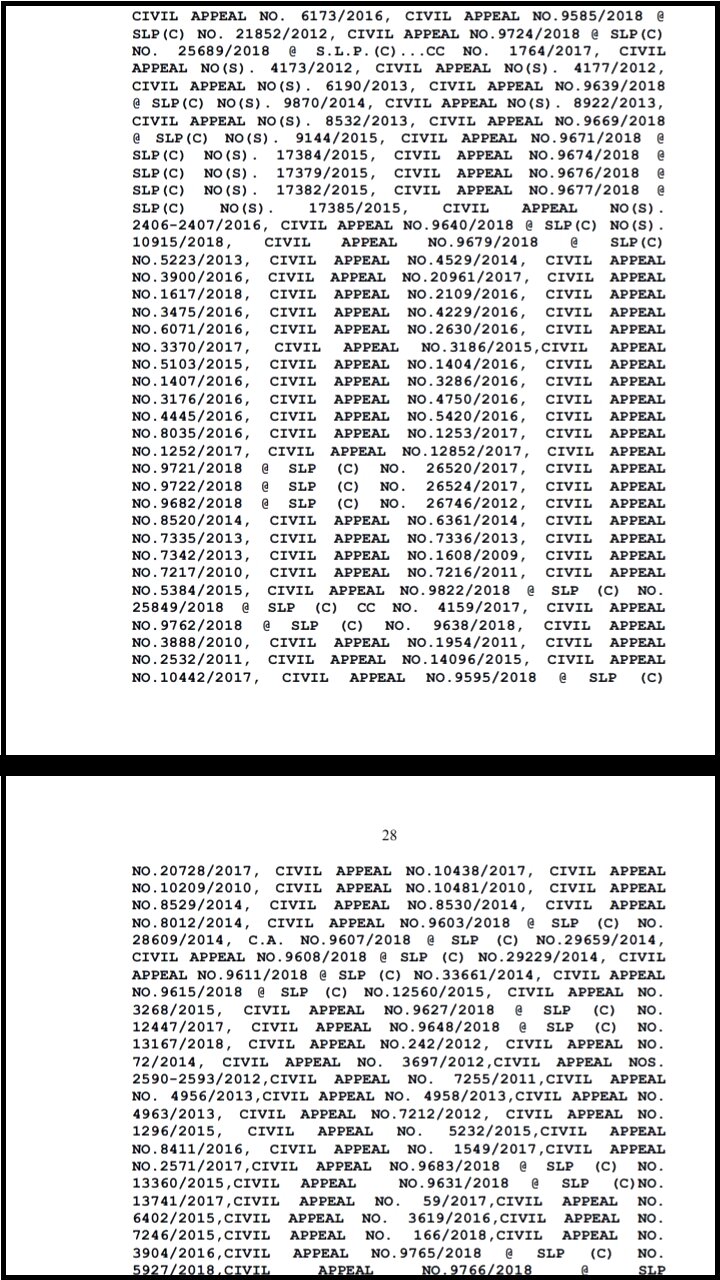

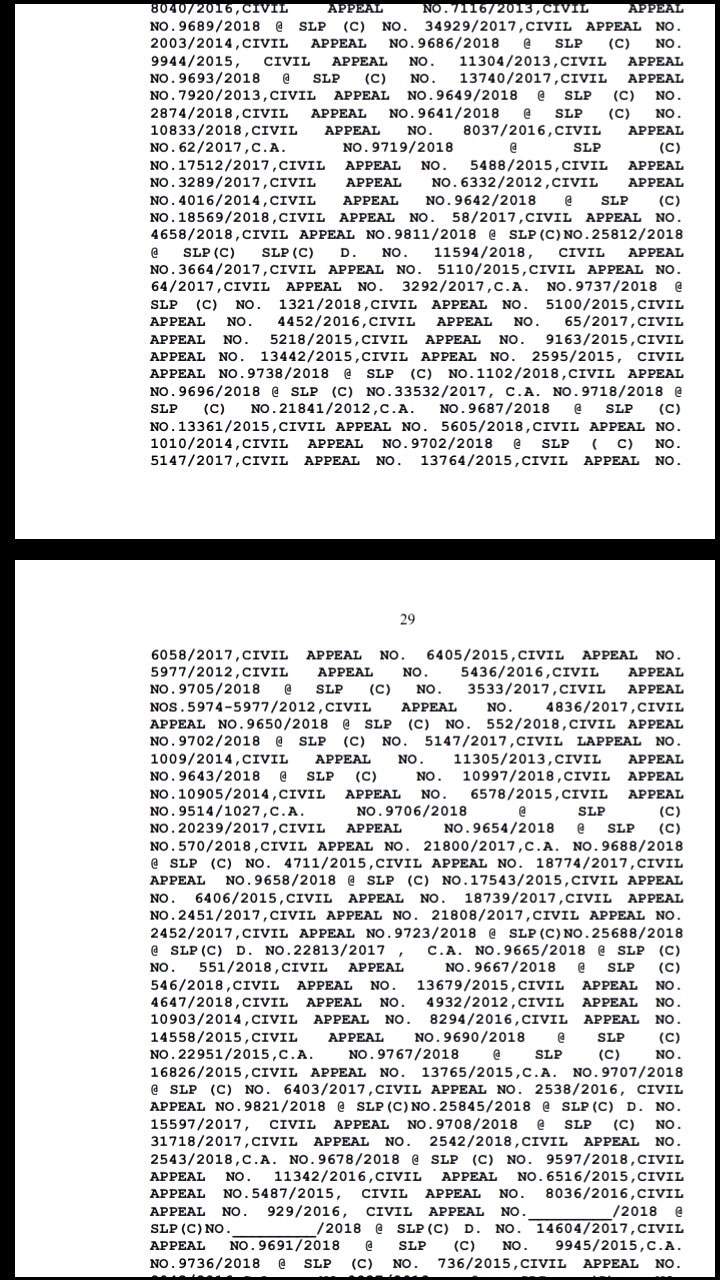

Taking into account this circular, the bench led by Justice Sikri decided to proactively cut down such appeals pending before the apex court. The court, by one such order recently, wrapped up more than 200 cases in one brush.

"The Registry has listed these matters on the ground that the tax effect is less than Rs 1 crore and, therefore, as per the Circular of the CBDT, these are not pressed by the Income Tax Department and are to be dismissed on the ground of low tax effect," noted the bench.

The order added: "In these appeals the tax effect is less than Rs 1 crore and are covered by the Circular of CBDT. These appeals are, accordingly, dismissed. However, it will be open to the Income-Tax Department to seek review in any of these matters, if it is pointed out that the tax effect is more than Rs 1 crore."

Similar orders have been passed in hundreds of cases to give a quietus to the tax cases.

The court has further directed the registry to maintain a separate list of cases where the assessees have moved in appeals and also another list where although the tax effect is less than Rs 1 crore, the cases said to be not covered by the CBDT circular.

Under the exception clause, notwithstanding the tax effect, taxmen can file appeals in cases that involve foreign black money or accounts, cases challenging constitutional validity of IT Act provisions, where rules issued by the tax department were held to be illegal, cases involving additions based on inputs received from other investigative agencies, or where the tax department has initiated prosecution.

Comments

0 comment