views

With rising income comes the burden of managing increasing taxes. But with a little time on hand and some early deposits, the tax pinch may not be as bad as 30% sounds.

A handsome inheritance may feature zero tax liability experience for some. But for most of us, it is a confusing world with information overload. Hundreds of plans and policies vie to grab eyeballs but do nothing to simplify choice for an investor.

Choose Wisely

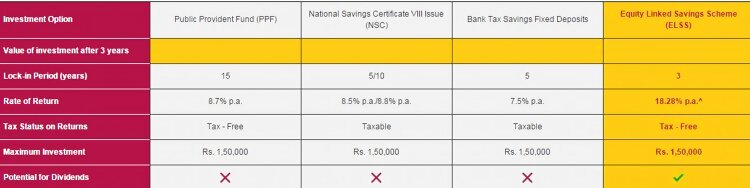

With January already gone, this is the time financial planning gathers full steam with the aim to minimise loses. However, it is surprising that so many investors blindly turn to FDs, PPFs and NPS as their first priority despite alternatives.

Let's look at one such plan, the Birla Sun Life Tax Relief 96. It is an open-ended Equity Linked Savings Scheme (ELSS) with a lock-in of 3 years from the date of allotment. With its inception dating back to March 1996, the scheme aims to generate long-term capital through a portfolio. It targets allocation of 80 percent equity and 20 percent debt and money market securities.

This product is suitable for investors who are seeking growth and investment in equity and equity-related securities with tax benefits under section 80C.

Meet Lifestyle Needs

ELSS is suitable for saving on tax outgo, creating wealth and meeting requirements of lifestyle needs. It is not suitable to fund your child’s education, marriage or retirement. Those who invest in this fund are qualified for tax benefits under section 80C ELSS. This means the investor can invest up to Rs.1 lakh a year and the amount will be deducted from their gross total income when income tax is being computed.

According to some experts, ELSS is a good option because the steep fall in crude prices may work as a boon for India. To see how returns of FD, PPF and ELSS differ, click here to analyse returns with a few easy clicks on the Birla Sun Life Tax Relief 96 customised calculator.

Diversified Portfolio

The Birla Sun Life Tax Relief '96 bring together the best of both worlds. Since investments are predominantly made in stocks of Indian companies, the value of your investment moves with the stock market in an Open-Ended Equity Linked Savings Scheme (ELSS). Although it comes with market-related risks, your money is diversified. It is spread out across stocks of multiple companies and monitored by an investment expert with an aim to minimize such risks.

While your money is locked-in for 3 years, you may opt for the dividend option and you can receive tax-free dividends during this time. This feature is unique to tax-saving solutions from mutual funds. When you withdraw your investment after 3 years, the returns (if any) are totally tax-free. You save taxes on both, your initial investment and on the returns (if any) too.

Overall Benefits

• Your money is locked-in for just 3 years, as against much longer lock-in periods in other options.

• You can also save up to Rs. 51,912 of income tax.

• When you withdraw your investment after 3 years, the returns (if any) are totally tax-free.

• Since investments are predominantly made in stocks of Indian companies, the value of your investment moves with the stock market.

• While your money is locked-in for 3 years, you may opt for the dividend option and you can receive tax-free dividends during this time.

This is a sponsored post for an investor awareness campaign.

Comments

0 comment