views

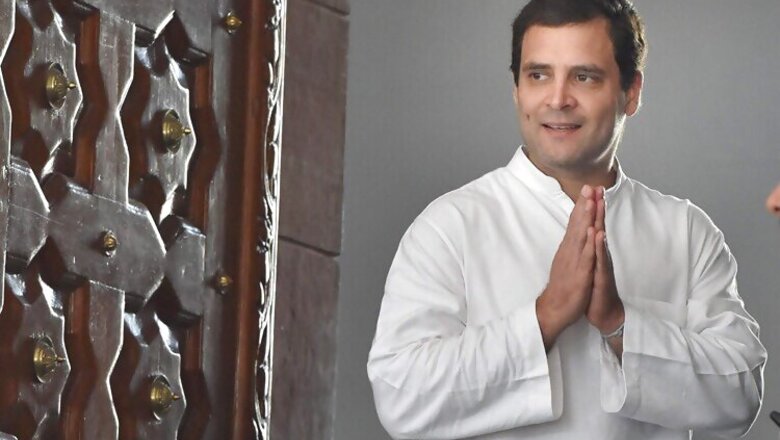

Soon after Finance Minister Arun Jaitley rolled back the proposal to tax 60% of Employee Provident Fund on withdrawal, Congress Vice President Rahul Gandhi took credit for the Centre's decision claiming that his intervention impacted the decision.

"When I feel someone is being oppressed or acted against wrongly or victimised, I try to help those people. I felt salaried people, middle class people were being hurt by the government and so I decided to put some pressure on the government and I am very happy that they've got some relief," he said.

Rahul Gandhi had urged Prime Minister Narendra Modi to roll back the proposal for taxing EPF withdrawals to instil confidence among employees. "EPF is the safety net of the employees and imposing a tax on this is wrong. I will urge the Prime Minister to announce... that the tax will be rolled back," Gandhi had said.

In a major relief for the salaried class, the Finance Minister rolled back the Budget proposal to tax 60% of EPF withdrawal on retirement. Making the announcement in the Lok Sabha on Tuesday, Jaitley said the proposal intended to encourage private sector employees to join the Nation Pension Scheme (NPS). He, however, retained the tax proposal for the NPS.

Reports suggested that Prime Minister Narendra Modi had also intervened in the matter urging Jaitley to withdraw the proposal. There had been a lot of hue and cry by the opposition parties as well as trade unions over the decision.

Jaitley announced in Lok Sabha that paragraphs 138 and 139 of budget speech related to tax on EPF have been withdrawn.

What paragraphs 138 and 139 of budget speech says:

138. In case of superannuation funds and recognized provident funds, including EPF, the same norm of 40% of corpus to be tax free will apply in respect of corpus created out of contributions made after 1.4.2016.

139. Further, the annuity fund which goes to the legal heir after the death of pensioner will not be taxable in all three cases. Also, we are proposing a monetary limit for contribution of employer in recognized Provident and Superannuation Fund of Rs 1.5 lakh per annum for taking tax benefit.

Finally the Govt was forced to listen to people and roll back the patently unfair tax on EPF (1/2)— Office of RG (@OfficeOfRG) March 8, 2016

But the attempt to tax the safety net of millions of hard working middle class ppl was morally wrong&shows this Govt's anti-ppl mindset(2/2)— Office of RG (@OfficeOfRG) March 8, 2016

Comments

0 comment