views

25 years ago, in 1995, if your home in India had internet connectivity, you would have been singled out as the lucky, elite few who not only had the financial means but also the knowhow to make the most of the World Wide Web. Today, close to half of India’s population use internet in some form or the other. Fixed line internet connectivity at home has journeyed full circle now, going from exclusive and expensive, to affordable and commonplace, to yet again being considerably more expensive if you want the best quality fiber networks at home. However, the truly transforming players, particularly over the past five years, have been two companies that practically set the tone for market competition – Chinese smartphone manufacturer Xiaomi, and Indian telecom operator Reliance Jio. Naturally, this story is two-fold.

Xiaomi and the rise of the affordable smartphone

In July 2014, Xiaomi entered the Indian smartphone market. Until then, budget and mid-range smartphones offered an evidently compromised usage experience. For a smooth Android smartphone experience, any prospective buyer had to splurge more than Rs 30,000 at the very least. With Xiaomi’s introduction in the market, India opened up to an influx on all areas.

On the budget smartphone front, Xiaomi pushed the price envelope even further down, bringing in smartphones that punched above their weight in terms of specifications. Devices priced at around Rs 5,000 to Rs 8,000 offered features and specifications that were previously available at around Rs 20,000. Xiaomi followed this up by offering its community approach, by creating an ecosystem of ‘Mi Fans’ – buyers of its smartphones who proclaimed themselves to be ‘fans’ of the brand itself.

The affordability front played a key role in the expansion of India’s smartphone ecosystem. In numerous ways, it brought to the fore the real potential of the Indian smartphone market, thereby attracting higher investments and active participation from Chinese OEMs. The likes of Oppo and Vivo started offering similarly configured, competitive devices in the country – but none had the kind of hype that Xiaomi succeeded in creating.

In effect, this led to the foundation of India’s budget smartphone market the way we know it today. It created buzz and hype around every device Xiaomi launched in India through the years, eventually leading to Xiaomi usurping Samsung, the once-infallible leader in the mobile phone and smartphone markets of India. Alongside taking over the top spot in the smartphone market, Xiaomi further made a push in the upper price ranges – therefore taking on the premium and flagship category devices as well.

At the time of Xiaomi's entry in the Indian smartphone market, a Q3 2014 market report from IDC stated that Samsung had a 24 percent market share in India, followed by Micromax at 20 percent and Lava at 8 percent. In its latest smartphone market report, IDC showed Xiaomi to continue its lead in India, with 29.4 percent market share. Samsung stands second with 26.3 percent, and fellow Chinese OEM Vivo stands at 17.5 percent. Now accounting for close to three years at the top of India's smartphone market, Xiaomi's feat came at the expense of Samsung, who previously led India's mobile phone market for six straight years.

It is this push that led to Xiaomi defining how today’s value-driven smartphone market works, thereby bringing large portions of Indians into the smartphone fold. Subsequently, in 2017, Xiaomi introduced its first offline store, hence appealing to the section of users who were not versed with the online smartphone buying experience.

All this, though, would not have been possible had India not seen a boom in the availability and affordability of mobile data. Enter, Reliance Jio.

Reliance Jio making 4G mainstream

In September 2016, about two years after Xiaomi’s affordably priced smartphone debut, Reliance Jio entered the mobile telecom market. At the time of its entry, the cost of mobile telephony in India was fairly high, with Vodafone being the dominant market player, and the likes of Bharti Airtel, Idea Cellular, BSNL, Tata Docomo, Aircel and more were all competing for gaining more subscribers.

To gain perspective on how the mobile telecom market was back then, a ‘competitive’ internet plan offered by Vodafone in August 2016 offered unlimited local calling, free incoming roaming calls, outgoing calls at Rs 0.5 per minute, 500 SMS messages per month and 6GB of 3G/4G data per month, for Rs 1,699. The average cost of data, hence, was over Rs 280 per GB of data.

Today, a sample monthly plan from Reliance Jio costs Rs 349 per month. At this price, users get 3GB of 4G data each day, along with fully unlimited calling and 100 SMS messages per day. Additionally, users also get access to premium content subscription plans, to stream movies and TV shows from these platforms. For such a plan, the average cost of data is Rs 4.15 per GB of data – over 67x lesser than what it was, just four days ago.

It is this prospect of cheap, affordable telephony that completely transformed the mobile internet market in India. Over the past four years, TRAI data shows the clear impact that Reliance Jio has had in the Indian telecom space – not only seeing a massive increase in the total subscriber count within its own umbrella, but also pulling the market through to grow in terms of the net user base. For reference, within the four year period between May 2016 and April 2020, TRAI data reveals interesting statistics regarding how the market has changed – from prior to Jio’s advent, till today.

In terms of the total subscriber base of mobile phone users in India, the market grew from 103.31 crore users to 114.95 crore users – with a total growth of 11.63 crore users within these four years. This signifies a growth of 11.26 percent in the time span, since Jio’s advent – marking a faster pace of growth even in a saturated mobile telephony market due to Jio’s disruptive pricing. The effect was even more evident in the rural circles.

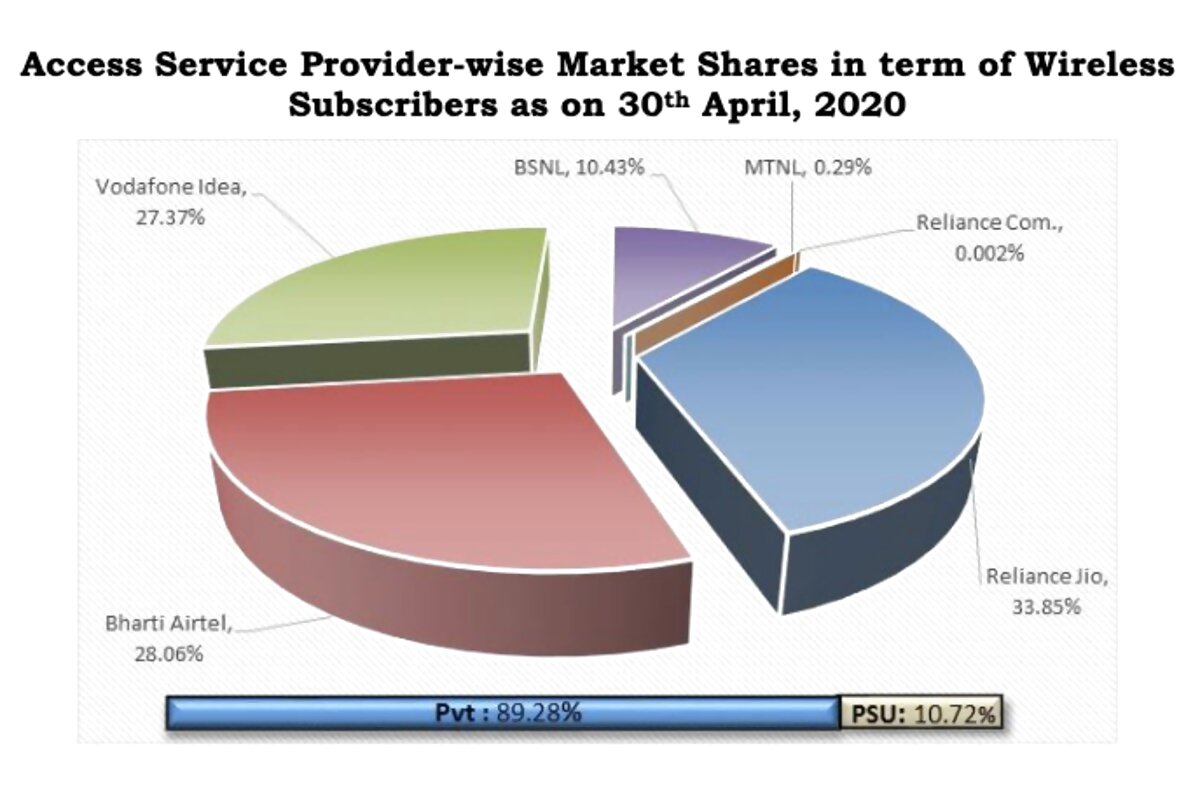

In rural areas, TRAI data shows users in rural circles growing at a faster pace – from 44.89 crore rural mobile users in May 2016, to 52.008 crore rural mobile users in April 2016, marking speed of growth of 15.86 percent in the past four years. The major contributing force behind this was the radical decrease in the average cost of owning a mobile phone, as documented above. Today, as per the last published TRAI report, Reliance Jio holds 33.85 percent of the Indian mobile telecom market, followed by Bharti Airtel at 28.06 percent and Vodafone-Idea at 27.37 percent.

Not only has Jio led the market over the past few years, but has recently promised affordable 5G connections to both users and businesses by 2021. After its tryst with JioPhone to fuel the growth of mobile users, Jio’s next phase is to cash in on the present anti-China sentiments, which right now has affected the market position of a company like Xiaomi. On this note, the operator has partnered with Google to bring activity back to the affordable smartphone space.

Looking back, the two moments in July 2014 and September 2016 can be safely regarded as two of the most pivotal junctures that catapulted the Indian smartphone usage ecosystem into making it what we know of it today. As we stand at the juncture of using 5G and buying more premium smartphones, it is these points in time that will be remembered as moments that positively changed the way Indians use internet.

Comments

0 comment