views

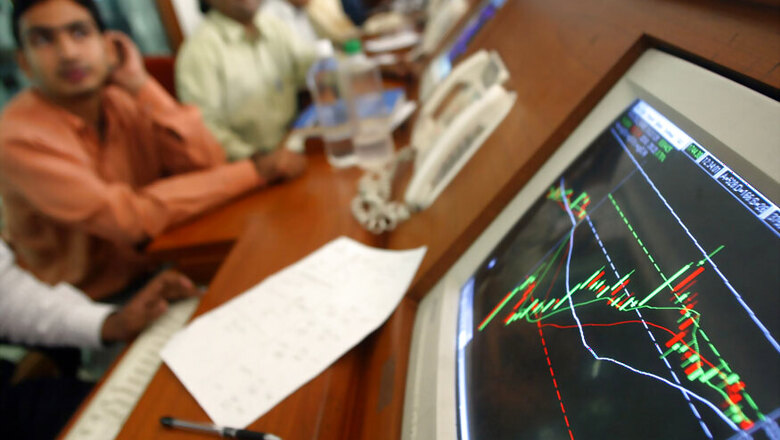

New Delhi: Global cues as well as industrial production and inflation numbers would dictate the stock market trend in a holiday-shortened week ahead, say experts.

Stock markets are closed on Tuesday for 'Mahashivratri'.

Over the last week, the BSE Sensex recorded a steep fall of 1,060.99 points or 3.02 per cent as sentiment was hit by the imposition of long-term capital gains tax on equities as well as the global markets turmoil.

"The current earnings season is providing strong signs of revival in corporate earnings underlining the long term growth prospects, which is providing relief for investors. However, the prevailing inflationary pressure and fiscal slippage may make RBI adopt a more hawkish stance in the near future," said Vinod Nair, Head of Research, Geojit Financial Services.

The Reserve Bank kept the policy rate unchanged at 6 per cent at its policy meet last week, saying that higher government spending would accelerate inflation, and warned of risks from wider fiscal deficit.

"Further, the volatility in global market is spooking the investor sentiments given the premium valuation. Week ahead, December IIP, January CPI and WPI inflation data are key triggers for the market," he added.

GAIL and NHPC are among the major companies scheduled to announce their earnings this week.

SBI and Coal India may also react to their earning numbers released on Friday and Saturday, respectively.

Markets are at present reacting to global cues and this may continue in the coming days, said an expert.

"How the US market recovers and bounces will be the key event to watch," said Jimeet Modi, Founder and CEO, SAMCO Securities.

"The shakedown in the Indian market reflects the market taking cognisance of the deterioration in India's macro- economic conditions over the past few months.

"The steep increase in domestic and global bond yields may have stirred the market out of its complacency and into recognising that the deterioration may be here to stay for longer than earlier believed.

"Nevertheless, we believe that the market is not fully pricing the risks of a prolonged macro weakness," Kotak Securities said in a report.

Comments

0 comment