views

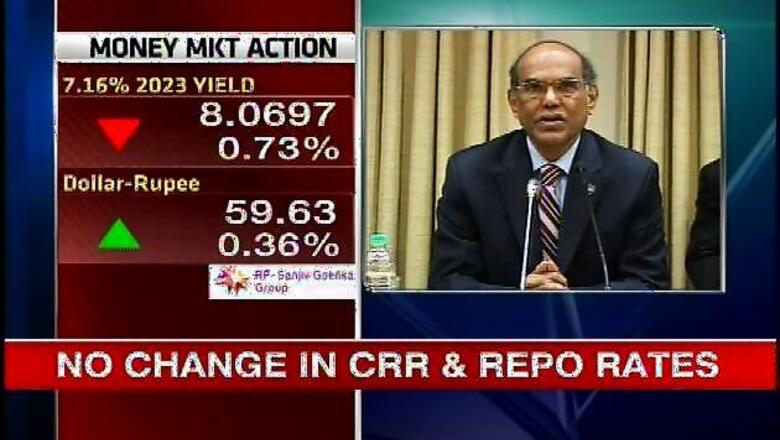

New Delhi: Key bank rates remain unchanged in the Reserve Bank of India's first quarter review of Monetary Policy 2013-14 announced on Tuesday. The RBI kept the cash reserve ratio and, repo rates and reverse repo rate are unchanged.

According to the RBI the forecast for the Indian economy's growth rate has been cut to 5.5 per cent from 5.7 per cent for the fiscal year 2013-14.

RBI Governor D Subbarao said that it has been decided to keep the repo rate under the liquidity adjustment facility (LAF) unchanged at 7.25 per cent. The reverse repo rate under the LAF, determined with a spread of 100 basis points below the repo rate, stands at 6.25 per cent.

The Marginal Standing Facility (MSF) rate remains unchanged at 300 basis points above the repo rate at 10.25 per cent.

The Bank lending rate stands at 10.25 per cent. The cash reserve ratio (CRR) of scheduled banks has been retained at 4 per cent of their net demand and time liabilities (NDTL).

The RBI has lowered inflation forecast and said it has been their endeavour to bring down inflation to 5 per cent by March 2014. The headline infaltion edged up in July due to food inflation but the fuel inflation declined in March.

The RBI said the investment climate still remains weak and the biggest threat to the macroeconomic stability stems from the external sector. But the credit growth to productive sectors has been higher than last year. It said the global growth has been slower than expected and will roll back recent steps once stability is restored in the foreign exchange market.

Subbarao said there is a need to focus on immediate structural steps to contain current account deficit as the external vulnerability indicators have deteoriated the current situation and it called for credible fiscal consolidation. He said the risk aversion continues to stall investment plans.

With no changes in rates, the banks are unlikely to give any relief to the customers on their EMIs.

The economic activity weakened in the first quarter of 2013-14. Lead indicators point to continuing headwinds facing manufacturing and services sector activity.

Industrial production remained muted at 0.1 per cent during April-May; in May, there was an absolute decline of 1.6 per cent spread across all constituent sub-sectors, barring electricity generation. Capital goods production continues to contract, reflecting deteriorating investment conditions.

Although the manufacturing purchasing managers' index (PMI) improved modestly in June, the pace of expansion was anaemic. With the decline in the services sector PMI in June, the composite PMI fell too, suggesting broad-based sluggishness in economic activity.

The global economic activity also remains subdued with still elevated downside risks. In the US, incoming data point to a slower recovery in domestic demand and weak export activity. In the UK, recovery is gradually gathering momentum on the back of consumer spending. The euro area continues to be in recession with high unemployment. Japan's economy is returning to positive growth with improved industrial production and retail sales.

Among the BRICS countries, although retail sales in China have maintained the impetus of recent months, the manufacturing purchasing managers' index (PMI) and industrial production declined in June. Growth has clearly lost momentum in Brazil, Russia and South Africa.

Inflation remains subdued in many developed countries, but in several emerging and developing economies upside pressures persist. In China, inflation quickened in June, although it is expected to stay benign due to weak demand conditions. Inflation dropped sharply in Russia in June due to softening food prices.

Non-fuel commodity prices have been easing, reflecting subdued global demand and comfortable supply levels. On the other hand, energy prices have firmed up due to a decline in US crude oil inventories and geo-political tensions in the Middle East.####

Comments

0 comment