views

X

Research source

SSS provides a number of benefits for its members, including salary and housing loans. These benefits are available for all members, including the more than 1.3 million Filipinos working overseas ("Overseas Filipino Workers," or OFWs). Salary loans are available for immediate emergency cash needs, while housing loans allow Filipinos to build or buy a new home.[2]

X

Research source

Getting a Salary Loan

Check if you are eligible for a salary loan. If you are currently employed and currently contributing to social security, you are generally eligible for a salary loan. You must be under the age of 65 at the time of your application. If you're applying for a loan equivalent to one month's salary, you must have at least 36 monthly contributions to social security. At least 6 of these contributions must be within the past 12 months. You must have at least 72 monthly contributions to social security to apply for a loan equivalent to 2 months' salary. At least 6 of those contributions must have been made within the past 12 months.

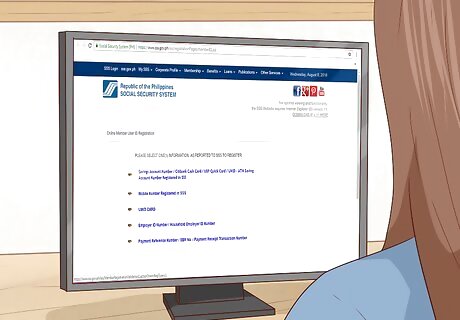

Register for an online account. Go to https://member.sss.gov.ph/members/registrationPages/memberE1.jsp and select an option to begin your registration. Complete the online form and submit it to complete your registration. If you have a smart phone, tablet, or computer that is connected to the internet, you can set up a my.SSS account to manage your SSS account and apply for a salary loan. You can also register for my.SSS if you are self-employed, or if you are an OFW.

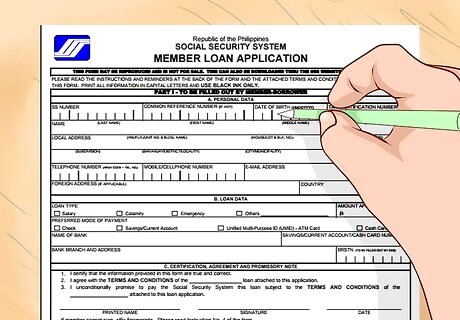

Complete the salary loan application. You can complete a salary loan application online through your my.SSS account, or you can get a paper application from any SSS branch or service office. The loan application requires you to enter identification and employment information. You must also state the amount of the loan you're applying for, and how you wish to receive your loan proceeds. There is also a section on the loan application for your employer to complete, if you are employed by a company or individual that reports to SSS.

Submit your application online. If you've registered for a my.SSS account, you can log in and complete an online form to apply for a salary loan. If you are employed, make sure your employer also has an online account to certify your employment. You can submit an application online if you are an OFW member, or if you are self-employed. Your income well be self-certified based on SSS records.

Take your application to an SSS branch if you can't submit it online. Search the SSS branch directory online at https://www.sss.gov.ph/sss/getBranchDir.action to find the most convenient branch for you. Salary loan applications are also accepted by SSS Foreign Representative Offices in some countries. If you live and work overseas, contact your nearest Philippine embassy or consulate for more information. If you are an OFW member and there is not an SSS branch in the country where you live and work, you can send your documents to a family member in the Philippines and authorize them to submit your application on your behalf.

Receive your funds. Provided you meet the eligibility requirements, your loan will be automatically approved. Proceeds will be disbursed to you according to the method you chose on your loan application. If you live in the Philippines, you can have the money deposited directly into your bank account. OFWs can choose to get either a check or a cash card in the mail.

Make payments as agreed. Your loan is generally payable in 24 monthly installments. Your due date each month varies depending on the applicable identification number, and whether you are employed or self-employed. A chart of payment deadlines is available at https://www.sss.gov.ph/sss/appmanager/pages.jsp?page=salarydetails. After half the term of the loan has passed and you've paid at least 50 percent of your loan, you can renew it for up to the original principal amount.

Applying for a Housing Loan

Review the types of housing loans. SSS offers 4 basic types of housing loans, each of which have their own eligibility requirements. The different types of housing loans also may have slightly different application processes. Generally, you must be an SSS member under the age of 60 who has made social security contributions for at least 36 months. That 36 months must include 24 continuous contributions for the 2-year period immediately before your application. If you're buying a new home or building a home on land you own, look at a direct housing loan. There are 2 types, one for those who are members of a registered workers' organization, and another for OFWs. If you already own your own home, you may be interested in either a loan for repairs and improvements, or for an assumption of mortgage loan. The assumption of mortgage essentially allows you to refinance an existing mortgage at a lower rate.

Gather documents to file with your application. The specific documents required depend on the type of housing loan you're applying for. You must submit originals of some documents. For others, you must submit both the original and a photocopy. A list of required documents for the workers' organization housing loan is available at https://www.sss.gov.ph/sss/appmanager/pages.jsp?page=dhwomapply. If you are an OFW and applying for a housing loan, use the list of required documents at https://www.sss.gov.ph/sss/appmanager/pages.jsp?page=dhofwapply.

Complete your application for a house repair or improvement loan. If you're applying for a loan to repair or improve a house you already own, your can download an application form from the SSS website. There are not forms available for other SSS housing loans. To access the complete list of downloadable forms, go to https://www.sss.gov.ph/sss/appmanager/sss_downloads.jsp?type=forms.

Apply in person for a direct housing loan. Take all of your documents and copies together with your application to an SSS branch in person to apply for a housing loan. You can also apply at the Housing and Business Loans Department at 5/F, SSS Building, East Avenue, Diliman, Quezon City. Search the online SSS branch directory at https://www.sss.gov.ph/sss/getBranchDir.action to find the branch or service office nearest you. If you're applying for a direct housing loan, you may need to fill out an application form at the SSS branch. Make sure you bring appropriate identification.

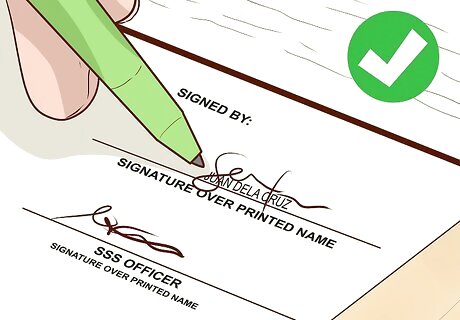

Sign your loan documents. Provided you meet the eligibility requirements, you'll be provided with documents to sign to finalize your loan. Read these documents carefully, and make sure you understand the payment terms. While your loan remains outstanding, you are responsible for maintaining appropriate fire, mortgage redemption, and home guaranty corporation insurance coverage on your home. The application fee of 1/2 of 1 percent of the loan amount, or P 500, whichever is higher, will be deducted from your loan proceeds when they are released.

Restructuring Overdue Loans

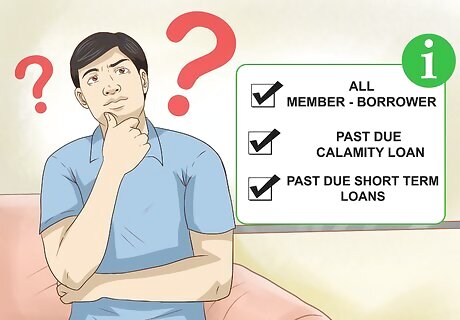

Confirm your eligibility. If you have overdue SSS loans, you may be able to restructure them so that the penalties are waived. However, this benefit is only available to member-borrowers who have been the victim of a calamity or natural disaster recognized by the national government. The restructuring program covers past-due short-term loans, such as salary loans. If a natural disaster meant you were unable to make payments on your short-term loan, you can restructure that loan and eliminate any penalties for late payments. To be eligible, you must be living or working in an area declared a national disaster area by the National Disaster Risk Reduction and Management Council. Loans must be at least 6 months past due to qualify. The Loan Restructuring Program (LRP) was first made available in 2017, and was extended into 2018. After October 2018, check with the SSS to find out if the LRP has been renewed or extended.

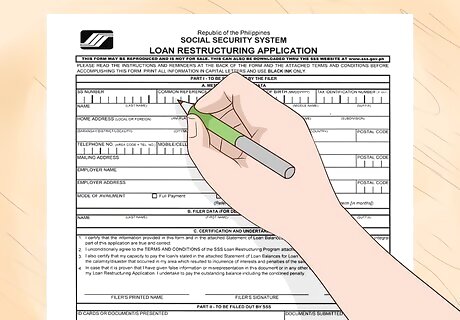

Fill out the loan restructuring application. You can download an application form from the SSS website, or pick up a paper application at an SSS branch or service office. The form requires basic information about you and your employer. You must also make a number of declarations to verify your eligibility for the program. Along with your application, you'll provide documents to support these declarations.

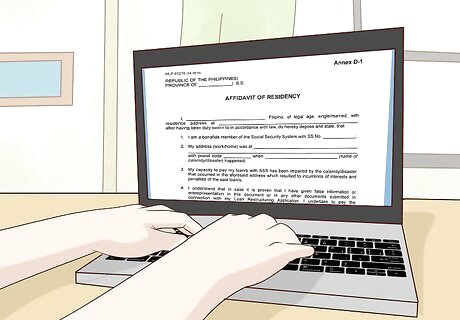

Complete an affidavit of residency. Your affidavit of residency certifies that you live or work in a national disaster area. You can download the form at https://www.sss.gov.ph/sss/DownloadContent?fileName=mlp_affidavit_of_residency.pdf, or pick one up at your nearest SSS branch or service office. Fill in the blanks on the form, but do not sign it. You must sign the affidavit in the presence of a notary. Make a copy of your signed and notarized affidavit for your own records.

Get a Statement of Loan Balance from an SSS branch. While you can view your outstanding balance online, your LRP application must be accompanied by an official statement issued by the SSS. You can get this statement from any nearby SSS branch. Locate the SSS branch nearest you by searching the SSS branch directory online at https://www.sss.gov.ph/sss/getBranchDir.action.

Submit your application to your nearest SSS branch or service office. All 256 SSS branches and service offices in the Philippines accept LRP applications during regular working hours. You must submit your LRP application in person – you can't apply for this program online. If you don't currently live in the Philippines, you can authorize a family member to submit your application and supporting documentation for you. Complete a Special Power of Attorney form to authorize them. You can download this form at https://www.sss.gov.ph/sss/DownloadContent?fileName=mlp_special_power_of_attorney.pdf.

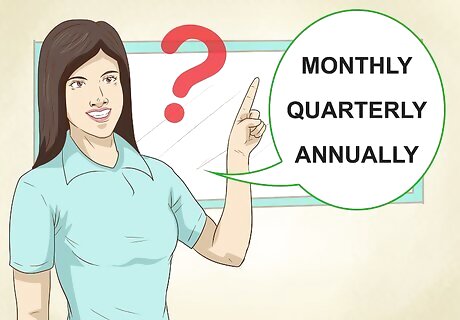

Select your payment terms. You can choose to make a full payment of your loan within 30 days of your application, or choose a monthly payment plan. You can generally select any monthly payment plan you want, but your monthly payments cannot extend beyond 5 years. If the amount you owe is less than P2,000.00, SSS prefers that you make payment in full. For amounts ranging from P2,000.00 to P18,000.00, the recommended term is 12 months. Generally, the more you owe, the longer you can extend the monthly payment term. However, SSS approves the term you choose based on the totality of your circumstances.

Complete your payments on your restructured loan. The restructuring program allows you either to settle the overdue principal by making a single payment in full, or by making installment payments. Your loan penalties will be waived when you've paid your restructured loan in full.

Comments

0 comment