views

The US Federal Reserve rate-setting committee is scheduled to begin later today. After taking a pause on rate hikes in June, the US Federal Reserve will most likely raise benchmark rates by 25 bps to the 5.25-5.50 per cent range later today.

A majority of the economists see the central bank leaving interest rates unchanged at the end of the meeting, even though inflation remains higher and above the targeted 2 per cent.

The consumer price index-based inflation in the US rose 3.7 per cent from a year ago in August, primarily due to the spike in gas prices. This was up from a 3.2 per cent annual increase in July.

During its previous policy meeting in July, the Fed committee had said that it will continue to assess incoming data and its implications for monetary policy.

In the minutes of the Fed’s previous meeting too, the central bank hinted at interest rates staying higher for longer amid inflation risks.

Experts pointed out that market participants across the globe will be closely watching Fed chief Jerome Powell’s comments about the disinflation process in the US and the likely trend in interest rates.

Fed is expected to remain data-dependent to decide on rate hike trajectory. Experts believe that a substantial part of the rate hike cycle is behind us. However, for rates to reduce, more evidence of a sustained reduction in the inflationary outlook is required.

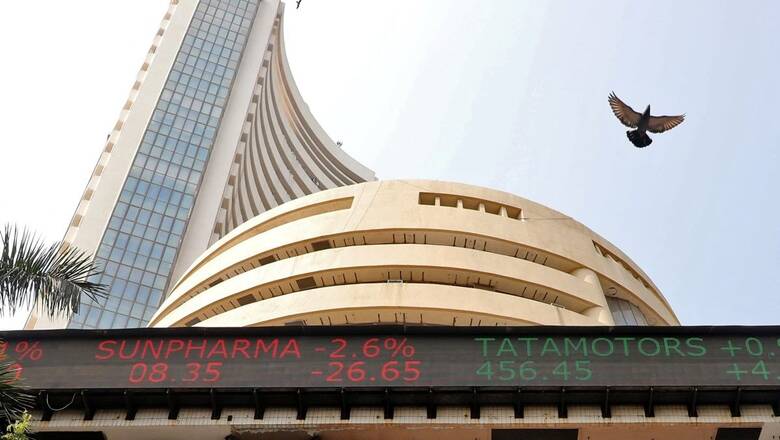

How Will the Fed’s Move Impact The Indian Market?

Experts expect a 25 bps rate hike today and do not see any significant impact of it on the mood of the market. However, if the Fed signals that it is ready to end the rate hike cycle now, the market may see sharp gains.

“The market’s reaction tomorrow will be driven by the Fed’s commentary rather than the 25 bps rate hike, which has already been priced in. Investors need to monitor the Fed’s outlook for insights into future monetary policies and their potential impact on various sectors and asset classes,” said Anita Gandhi, Whole Time Director, and Head of Institutional Business at Arihant Capital.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said that a 25 bp rate hike is already discounted by the market, and will not trigger any market move.

“If the Fed chief indicates that inflation is coming under control and, therefore, no further rate hikes are needed, that will be a big trigger for markets to move up. But such an outcome is highly unlikely since the Fed will play it safe even if inflation is coming under control,” said Vijayakumar.

Aamar Deo Singh, Head Advisory, Angel One said, “The US Fed will likely adjust its policies going ahead in light of new economic data, given the current inflation rate of 2.97 per cent is still much above the goal rate of 2 per cent. Global markets have been supported by investors’ expectations that this rate hike will be the final one, however, markets are likely to trade cautiously ahead of the Fed decision.”

Comments

0 comment